Chevy Chase Trust Holdings LLC lowered its holdings in Las Vegas Sands Corp. (NYSE:LVS - Free Report) by 5.0% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 189,521 shares of the casino operator's stock after selling 10,021 shares during the period. Chevy Chase Trust Holdings LLC's holdings in Las Vegas Sands were worth $9,540,000 at the end of the most recent quarter.

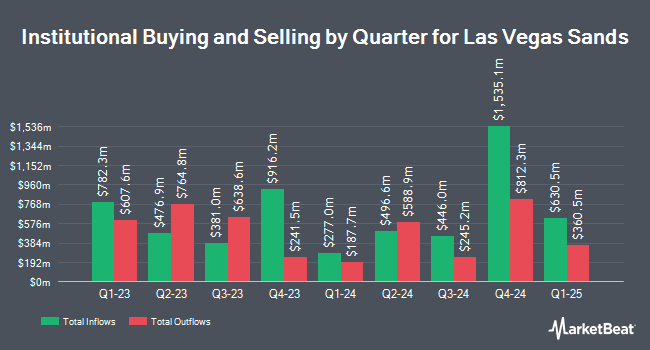

A number of other institutional investors also recently modified their holdings of LVS. Cetera Investment Advisers increased its position in shares of Las Vegas Sands by 148.3% during the first quarter. Cetera Investment Advisers now owns 32,443 shares of the casino operator's stock valued at $1,677,000 after buying an additional 19,376 shares during the period. Cetera Advisors LLC bought a new stake in Las Vegas Sands during the 1st quarter worth approximately $364,000. Mather Group LLC. lifted its stake in Las Vegas Sands by 28.1% in the 2nd quarter. Mather Group LLC. now owns 2,034 shares of the casino operator's stock worth $90,000 after purchasing an additional 446 shares in the last quarter. Park Avenue Securities LLC boosted its holdings in Las Vegas Sands by 7.6% in the 2nd quarter. Park Avenue Securities LLC now owns 18,684 shares of the casino operator's stock valued at $827,000 after purchasing an additional 1,324 shares during the period. Finally, Hexagon Capital Partners LLC grew its position in shares of Las Vegas Sands by 73.3% during the 2nd quarter. Hexagon Capital Partners LLC now owns 4,730 shares of the casino operator's stock valued at $209,000 after purchasing an additional 2,000 shares in the last quarter. 39.16% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently issued reports on LVS shares. UBS Group increased their price objective on Las Vegas Sands from $49.00 to $50.00 and gave the stock a "neutral" rating in a research report on Tuesday, November 5th. Barclays lifted their price target on Las Vegas Sands from $52.00 to $58.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. Wells Fargo & Company upped their price objective on shares of Las Vegas Sands from $53.00 to $60.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 1st. Argus downgraded shares of Las Vegas Sands from a "buy" rating to a "hold" rating in a research note on Thursday, August 15th. Finally, Susquehanna boosted their price target on shares of Las Vegas Sands from $51.00 to $59.00 and gave the stock a "positive" rating in a research note on Wednesday, October 16th. Four equities research analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to MarketBeat, Las Vegas Sands has an average rating of "Moderate Buy" and an average price target of $58.00.

View Our Latest Research Report on LVS

Las Vegas Sands Trading Up 0.3 %

Shares of NYSE LVS traded up $0.15 during midday trading on Friday, reaching $53.99. The company had a trading volume of 3,058,843 shares, compared to its average volume of 5,719,347. The stock has a market cap of $39.14 billion, a PE ratio of 26.73, a price-to-earnings-growth ratio of 1.42 and a beta of 1.10. Las Vegas Sands Corp. has a one year low of $36.62 and a one year high of $55.65. The firm's fifty day moving average price is $51.52 and its 200-day moving average price is $45.25. The company has a quick ratio of 0.89, a current ratio of 0.90 and a debt-to-equity ratio of 3.09.

Las Vegas Sands (NYSE:LVS - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The casino operator reported $0.44 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.53 by ($0.09). The business had revenue of $2.68 billion during the quarter, compared to the consensus estimate of $2.79 billion. Las Vegas Sands had a return on equity of 44.26% and a net margin of 13.29%. The firm's revenue for the quarter was down 4.0% compared to the same quarter last year. During the same period in the previous year, the business earned $0.55 earnings per share. On average, equities research analysts anticipate that Las Vegas Sands Corp. will post 2.33 earnings per share for the current year.

Las Vegas Sands Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, November 13th. Stockholders of record on Tuesday, November 5th were given a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 1.48%. The ex-dividend date of this dividend was Tuesday, November 5th. Las Vegas Sands's dividend payout ratio is presently 39.60%.

Insider Activity at Las Vegas Sands

In other news, CEO Robert G. Goldstein sold 119,221 shares of Las Vegas Sands stock in a transaction that occurred on Tuesday, October 29th. The shares were sold at an average price of $53.73, for a total transaction of $6,405,744.33. Following the completion of the transaction, the chief executive officer now directly owns 84,511 shares in the company, valued at approximately $4,540,776.03. This trade represents a 58.52 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Robert G. Goldstein sold 60,187 shares of the company's stock in a transaction that occurred on Friday, November 29th. The stock was sold at an average price of $53.02, for a total value of $3,191,114.74. The disclosure for this sale can be found here. Insiders sold a total of 203,732 shares of company stock valued at $10,861,707 in the last three months. Company insiders own 0.91% of the company's stock.

About Las Vegas Sands

(

Free Report)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Macao and Singapore. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Recommended Stories

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.