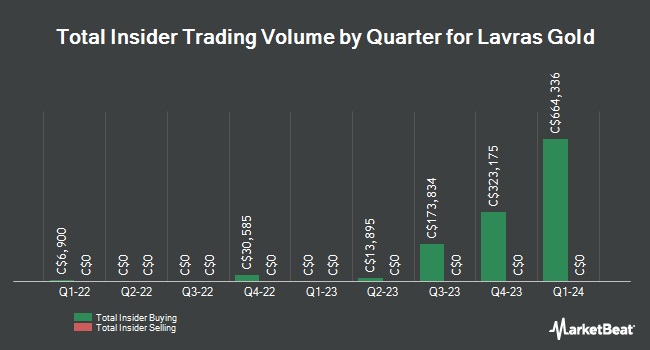

Lavras Gold Corp. (CVE:LGC - Get Free Report) Director Rostislav Christov Raykov acquired 37,000 shares of the company's stock in a transaction on Wednesday, March 19th. The shares were purchased at an average cost of C$2.06 per share, for a total transaction of C$76,220.00.

Rostislav Christov Raykov also recently made the following trade(s):

- On Thursday, March 13th, Rostislav Christov Raykov purchased 50,000 shares of Lavras Gold stock. The shares were bought at an average cost of C$1.96 per share, for a total transaction of C$98,000.00.

- On Tuesday, February 18th, Rostislav Christov Raykov purchased 183,000 shares of Lavras Gold stock. The shares were bought at an average cost of C$2.35 per share, for a total transaction of C$430,050.00.

- On Tuesday, February 11th, Rostislav Christov Raykov purchased 40,000 shares of Lavras Gold stock. The shares were bought at an average cost of C$2.35 per share, for a total transaction of C$94,000.00.

- On Tuesday, January 28th, Rostislav Christov Raykov purchased 2,000 shares of Lavras Gold stock. The shares were bought at an average cost of C$2.47 per share, for a total transaction of C$4,940.00.

- On Tuesday, January 21st, Rostislav Christov Raykov purchased 4,000 shares of Lavras Gold stock. The shares were bought at an average cost of C$2.26 per share, for a total transaction of C$9,040.00.

- On Tuesday, January 14th, Rostislav Christov Raykov purchased 19,200 shares of Lavras Gold stock. The shares were bought at an average cost of C$2.17 per share, for a total transaction of C$41,664.00.

- On Tuesday, December 31st, Rostislav Christov Raykov acquired 900 shares of Lavras Gold stock. The stock was acquired at an average cost of C$2.30 per share, for a total transaction of C$2,070.00.

Lavras Gold Stock Performance

LGC remained flat at C$2.17 during trading on Friday. The company's stock had a trading volume of 3,438 shares, compared to its average volume of 58,332. Lavras Gold Corp. has a 12 month low of C$1.21 and a 12 month high of C$2.89. The firm has a 50-day moving average of C$2.21 and a two-hundred day moving average of C$2.37. The company has a market capitalization of C$111.46 million, a P/E ratio of -33.98 and a beta of -0.26. The company has a debt-to-equity ratio of 0.60, a current ratio of 4.11 and a quick ratio of 11.12.

Lavras Gold Company Profile

(

Get Free Report)

Lavras Gold Corp. engages in the exploration and development of mineral resource properties in Brazil. It holds interests in the Lavras do Sul, an advanced exploration gold project with 29 mineral rights covering approximately 22,000 hectares located in Rio Grande do Sul, Brazil. The company was incorporated in 2021 and is headquartered in Toronto, Canada.

Further Reading

Before you consider Lavras Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lavras Gold wasn't on the list.

While Lavras Gold currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.