Lazard Freres Gestion S.A.S. cut its stake in Otis Worldwide Co. (NYSE:OTIS - Free Report) by 1.8% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 1,020,098 shares of the company's stock after selling 18,721 shares during the quarter. Otis Worldwide makes up approximately 2.2% of Lazard Freres Gestion S.A.S.'s investment portfolio, making the stock its 15th largest position. Lazard Freres Gestion S.A.S. owned approximately 0.26% of Otis Worldwide worth $106,028,000 at the end of the most recent reporting period.

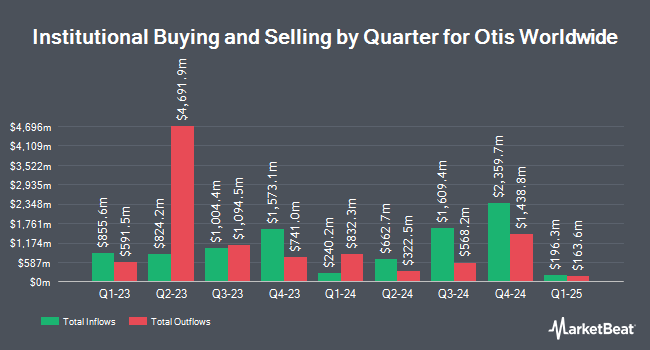

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Appian Way Asset Management LP acquired a new position in shares of Otis Worldwide in the 2nd quarter valued at $991,000. Cetera Investment Advisers boosted its stake in shares of Otis Worldwide by 259.1% in the first quarter. Cetera Investment Advisers now owns 46,371 shares of the company's stock valued at $4,603,000 after buying an additional 33,457 shares in the last quarter. Blair William & Co. IL grew its holdings in shares of Otis Worldwide by 64.7% in the 2nd quarter. Blair William & Co. IL now owns 24,544 shares of the company's stock worth $2,363,000 after acquiring an additional 9,643 shares during the period. Public Sector Pension Investment Board increased its stake in shares of Otis Worldwide by 3.2% during the 2nd quarter. Public Sector Pension Investment Board now owns 198,871 shares of the company's stock worth $19,143,000 after purchasing an additional 6,259 shares in the last quarter. Finally, Tidal Investments LLC raised its position in shares of Otis Worldwide by 49.5% in the first quarter. Tidal Investments LLC now owns 25,252 shares of the company's stock valued at $2,509,000 after buying an additional 8,356 shares during the last quarter. Institutional investors and hedge funds own 88.03% of the company's stock.

Otis Worldwide Stock Down 0.5 %

Otis Worldwide stock traded down $0.50 during mid-day trading on Tuesday, hitting $101.96. The company's stock had a trading volume of 1,179,802 shares, compared to its average volume of 2,108,490. The stock has a market capitalization of $40.73 billion, a P/E ratio of 25.43 and a beta of 1.04. The stock's fifty day moving average price is $101.46 and its two-hundred day moving average price is $97.69. Otis Worldwide Co. has a twelve month low of $83.99 and a twelve month high of $106.33.

Otis Worldwide (NYSE:OTIS - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $0.96 earnings per share for the quarter, missing the consensus estimate of $0.97 by ($0.01). The firm had revenue of $3.55 billion during the quarter, compared to analysts' expectations of $3.59 billion. Otis Worldwide had a negative return on equity of 31.28% and a net margin of 11.48%. The business's revenue was up .7% on a year-over-year basis. During the same period last year, the business earned $0.95 earnings per share. Equities analysts expect that Otis Worldwide Co. will post 3.85 earnings per share for the current year.

Otis Worldwide Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Friday, November 15th will be given a dividend of $0.39 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.56 annualized dividend and a dividend yield of 1.53%. Otis Worldwide's dividend payout ratio is presently 38.90%.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on the company. UBS Group started coverage on Otis Worldwide in a report on Wednesday, November 13th. They issued a "neutral" rating and a $113.00 price objective on the stock. Royal Bank of Canada reissued an "outperform" rating and issued a $110.00 target price on shares of Otis Worldwide in a research report on Thursday, September 19th. Wolfe Research cut Otis Worldwide from an "outperform" rating to a "peer perform" rating in a research note on Tuesday, October 8th. Wells Fargo & Company lowered their target price on Otis Worldwide from $108.00 to $105.00 and set an "equal weight" rating for the company in a report on Thursday, October 31st. Finally, Morgan Stanley assumed coverage on Otis Worldwide in a research report on Friday, September 6th. They issued an "equal weight" rating and a $97.00 target price on the stock. Eight analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $104.57.

Get Our Latest Stock Analysis on Otis Worldwide

Insider Buying and Selling at Otis Worldwide

In other Otis Worldwide news, EVP Abbe Luersman sold 9,000 shares of the stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $101.02, for a total value of $909,180.00. Following the transaction, the executive vice president now directly owns 9,992 shares in the company, valued at approximately $1,009,391.84. This trade represents a 47.39 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.23% of the company's stock.

Otis Worldwide Company Profile

(

Free Report)

Otis Worldwide Corporation engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally. The company operates in two segments, New Equipment and Service. The New Equipment segment designs, manufactures, sells, and installs a range of passenger and freight elevators, as well as escalators and moving walkways for residential and commercial buildings, and infrastructure projects.

Recommended Stories

Before you consider Otis Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Otis Worldwide wasn't on the list.

While Otis Worldwide currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.