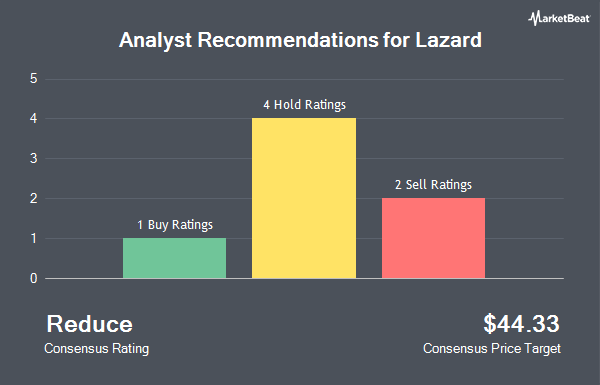

Shares of Lazard, Inc. (NYSE:LAZ - Get Free Report) have been given a consensus recommendation of "Hold" by the seven brokerages that are covering the company, Marketbeat.com reports. One analyst has rated the stock with a sell recommendation, five have assigned a hold recommendation and one has issued a buy recommendation on the company. The average 1-year price objective among analysts that have covered the stock in the last year is $55.33.

A number of equities research analysts have commented on the stock. Wells Fargo & Company increased their price objective on shares of Lazard from $51.00 to $55.00 and gave the stock an "equal weight" rating in a report on Friday, January 31st. UBS Group increased their price target on shares of Lazard from $50.00 to $54.00 and gave the company a "neutral" rating in a research note on Monday, February 3rd. Wolfe Research cut shares of Lazard from an "outperform" rating to a "peer perform" rating in a research report on Friday, January 3rd. StockNews.com upgraded Lazard from a "hold" rating to a "buy" rating in a research report on Friday, January 31st. Finally, Keefe, Bruyette & Woods boosted their target price on Lazard from $52.00 to $57.00 and gave the stock a "market perform" rating in a research report on Friday, January 31st.

Get Our Latest Research Report on Lazard

Lazard Stock Performance

NYSE:LAZ opened at $45.83 on Thursday. The stock has a market capitalization of $5.17 billion, a P/E ratio of 17.23 and a beta of 1.41. Lazard has a 1 year low of $35.56 and a 1 year high of $61.14. The firm has a 50 day moving average of $50.95 and a 200-day moving average of $51.83. The company has a current ratio of 2.24, a quick ratio of 2.24 and a debt-to-equity ratio of 2.72.

Lazard (NYSE:LAZ - Get Free Report) last issued its quarterly earnings data on Thursday, January 30th. The asset manager reported $0.78 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.69 by $0.09. Lazard had a return on equity of 44.58% and a net margin of 8.98%. As a group, sell-side analysts anticipate that Lazard will post 4.24 EPS for the current fiscal year.

Lazard Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, February 21st. Shareholders of record on Monday, February 10th were paid a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 4.36%. The ex-dividend date of this dividend was Monday, February 10th. Lazard's payout ratio is presently 75.19%.

Insiders Place Their Bets

In other Lazard news, CEO Evan L. Russo sold 25,000 shares of the stock in a transaction dated Friday, February 14th. The stock was sold at an average price of $55.32, for a total value of $1,383,000.00. Following the completion of the sale, the chief executive officer now directly owns 163,448 shares in the company, valued at $9,041,943.36. This represents a 13.27 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 3.14% of the company's stock.

Hedge Funds Weigh In On Lazard

Institutional investors and hedge funds have recently modified their holdings of the business. State Street Corp lifted its stake in Lazard by 2.9% in the third quarter. State Street Corp now owns 1,948,167 shares of the asset manager's stock valued at $98,149,000 after buying an additional 55,469 shares in the last quarter. Bank of New York Mellon Corp raised its holdings in shares of Lazard by 128.4% during the fourth quarter. Bank of New York Mellon Corp now owns 678,617 shares of the asset manager's stock worth $34,935,000 after acquiring an additional 381,546 shares during the period. Fisher Asset Management LLC lifted its position in Lazard by 2.2% in the 3rd quarter. Fisher Asset Management LLC now owns 1,772,237 shares of the asset manager's stock valued at $89,285,000 after acquiring an additional 37,681 shares in the last quarter. Monument Capital Management acquired a new position in Lazard in the 4th quarter worth $2,809,000. Finally, Victory Capital Management Inc. increased its holdings in Lazard by 5,770.1% during the 3rd quarter. Victory Capital Management Inc. now owns 1,064,431 shares of the asset manager's stock worth $53,626,000 after purchasing an additional 1,046,298 shares in the last quarter. 54.80% of the stock is currently owned by institutional investors and hedge funds.

About Lazard

(

Get Free ReportLazard, Inc, together with its subsidiaries, operates as a financial advisory and asset management firm in North and South America, Europe, the Middle East, Asia, and Australia. It operates in two segments, Financial Advisory and Asset Management. The Financial Advisory segment offers financial advisory services, such as mergers and acquisitions, capital markets, shareholder, sovereign, geopolitical advisory, and other strategic advisory services, as well as restructuring and liability management, and capital raising and placement services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lazard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lazard wasn't on the list.

While Lazard currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.