LBP AM SA bought a new position in Invesco Ltd. (NYSE:IVZ - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 413,118 shares of the asset manager's stock, valued at approximately $7,221,000. LBP AM SA owned about 0.09% of Invesco as of its most recent filing with the Securities and Exchange Commission.

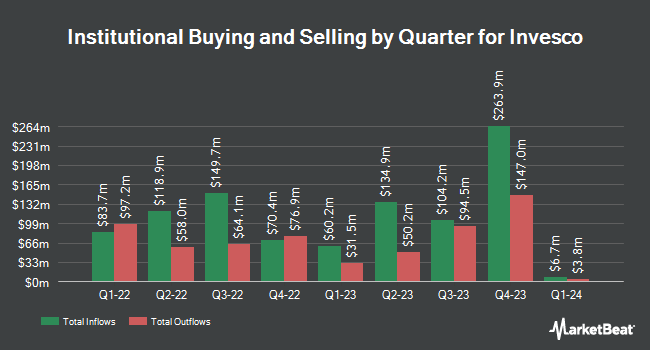

Several other large investors have also made changes to their positions in the company. Massachusetts Mutual Life Insurance Co. bought a new stake in shares of Invesco in the 3rd quarter worth about $1,428,196,000. State Street Corp grew its holdings in shares of Invesco by 0.7% in the 3rd quarter. State Street Corp now owns 21,060,533 shares of the asset manager's stock worth $369,823,000 after purchasing an additional 151,408 shares during the last quarter. Geode Capital Management LLC grew its holdings in shares of Invesco by 0.9% in the 3rd quarter. Geode Capital Management LLC now owns 10,248,480 shares of the asset manager's stock worth $179,666,000 after purchasing an additional 93,126 shares during the last quarter. Fisher Asset Management LLC grew its holdings in shares of Invesco by 2.0% in the 3rd quarter. Fisher Asset Management LLC now owns 4,540,913 shares of the asset manager's stock worth $79,738,000 after purchasing an additional 87,405 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its holdings in shares of Invesco by 2.6% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 4,423,332 shares of the asset manager's stock worth $77,320,000 after purchasing an additional 111,518 shares during the last quarter. Institutional investors own 66.09% of the company's stock.

Invesco Trading Up 1.6 %

Invesco stock traded up $0.25 during trading hours on Wednesday, reaching $15.58. 5,366,483 shares of the company's stock traded hands, compared to its average volume of 3,843,859. The company has a debt-to-equity ratio of 0.49, a quick ratio of 4.91 and a current ratio of 4.91. The firm has a market capitalization of $6.97 billion, a price-to-earnings ratio of 13.20, a PEG ratio of 0.98 and a beta of 1.43. The firm's 50 day moving average is $17.34 and its 200-day moving average is $17.47. Invesco Ltd. has a fifty-two week low of $14.16 and a fifty-two week high of $19.55.

Invesco (NYSE:IVZ - Get Free Report) last announced its quarterly earnings results on Tuesday, January 28th. The asset manager reported $0.52 EPS for the quarter, beating analysts' consensus estimates of $0.51 by $0.01. Invesco had a return on equity of 8.18% and a net margin of 12.77%. On average, analysts predict that Invesco Ltd. will post 1.87 earnings per share for the current year.

Invesco Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, March 4th. Stockholders of record on Friday, February 14th were paid a $0.205 dividend. The ex-dividend date was Friday, February 14th. This represents a $0.82 dividend on an annualized basis and a dividend yield of 5.26%. Invesco's dividend payout ratio (DPR) is presently 69.49%.

Wall Street Analysts Forecast Growth

IVZ has been the topic of several research reports. Royal Bank of Canada initiated coverage on shares of Invesco in a research report on Tuesday, January 28th. They set a "sector perform" rating and a $19.00 price target on the stock. TD Cowen reduced their price target on shares of Invesco from $20.00 to $19.00 and set a "buy" rating on the stock in a research report on Tuesday, January 28th. Barclays upped their price target on shares of Invesco from $18.00 to $20.00 and gave the stock an "equal weight" rating in a research report on Wednesday, January 29th. Keefe, Bruyette & Woods reiterated a "market perform" rating and set a $20.00 price target (up previously from $18.00) on shares of Invesco in a research report on Wednesday, January 29th. Finally, Morgan Stanley upped their price target on shares of Invesco from $18.00 to $19.00 and gave the stock an "equal weight" rating in a research report on Thursday, February 6th. One research analyst has rated the stock with a sell rating, eleven have issued a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $19.94.

Get Our Latest Analysis on Invesco

Invesco Company Profile

(

Free Report)

Invesco Ltd. is a publicly owned investment manager. The firm provides its services to retail clients, institutional clients, high-net worth clients, public entities, corporations, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions, and sovereign wealth funds.

Featured Articles

Before you consider Invesco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco wasn't on the list.

While Invesco currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.