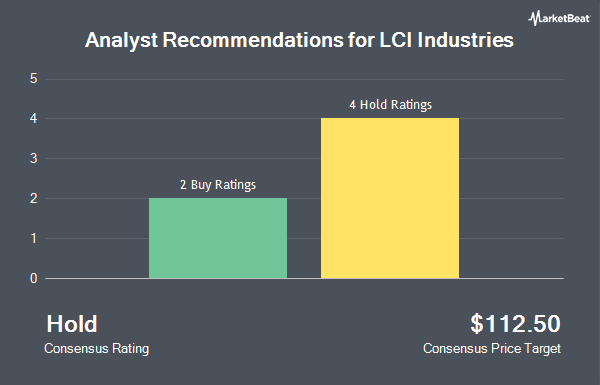

LCI Industries (NYSE:LCII - Get Free Report) was downgraded by analysts at StockNews.com from a "buy" rating to a "hold" rating in a note issued to investors on Monday.

Several other analysts have also recently commented on LCII. CJS Securities upgraded LCI Industries from a "market perform" rating to an "outperform" rating and set a $145.00 price target for the company in a report on Wednesday, February 12th. Truist Financial boosted their target price on shares of LCI Industries from $102.00 to $108.00 and gave the company a "hold" rating in a report on Monday, February 10th. Five investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $117.20.

Read Our Latest Stock Analysis on LCI Industries

LCI Industries Price Performance

LCI Industries stock traded down $1.58 during mid-day trading on Monday, reaching $79.42. The company had a trading volume of 281,240 shares, compared to its average volume of 261,408. The stock's 50-day simple moving average is $98.77 and its 200-day simple moving average is $108.57. The company has a market capitalization of $2.02 billion, a P/E ratio of 14.17 and a beta of 1.45. The company has a debt-to-equity ratio of 0.55, a current ratio of 2.82 and a quick ratio of 1.03. LCI Industries has a 1 year low of $75.68 and a 1 year high of $129.38.

LCI Industries (NYSE:LCII - Get Free Report) last issued its quarterly earnings data on Tuesday, February 11th. The company reported $0.37 EPS for the quarter, beating analysts' consensus estimates of $0.31 by $0.06. LCI Industries had a net margin of 3.82% and a return on equity of 10.28%. On average, equities analysts predict that LCI Industries will post 6.76 EPS for the current year.

Institutional Investors Weigh In On LCI Industries

Large investors have recently made changes to their positions in the company. Strategic Financial Concepts LLC bought a new position in shares of LCI Industries in the 4th quarter valued at approximately $28,000. Smartleaf Asset Management LLC raised its position in LCI Industries by 205.8% in the fourth quarter. Smartleaf Asset Management LLC now owns 367 shares of the company's stock worth $37,000 after purchasing an additional 247 shares in the last quarter. LRI Investments LLC lifted its position in shares of LCI Industries by 345.6% during the 4th quarter. LRI Investments LLC now owns 401 shares of the company's stock worth $41,000 after buying an additional 311 shares during the period. Wilmington Savings Fund Society FSB acquired a new stake in shares of LCI Industries during the 3rd quarter worth about $49,000. Finally, Headlands Technologies LLC bought a new position in shares of LCI Industries in the fourth quarter valued at approximately $59,000. Institutional investors and hedge funds own 99.71% of the company's stock.

LCI Industries Company Profile

(

Get Free Report)

LCI Industries, together with its subsidiaries, manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally. It operates through two segments: Original Equipment Manufacturers (OEM) and Aftermarket.

Further Reading

Before you consider LCI Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LCI Industries wasn't on the list.

While LCI Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.