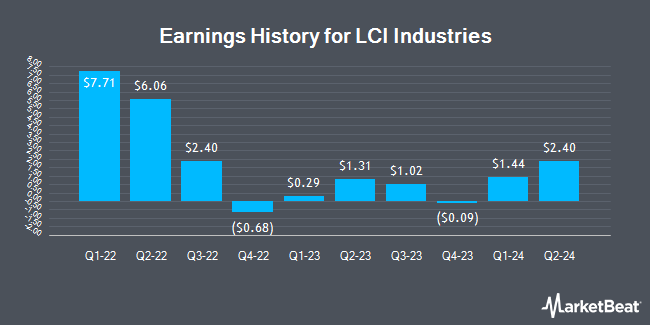

LCI Industries (NYSE:LCII - Get Free Report) issued its quarterly earnings data on Tuesday. The company reported $0.37 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.31 by $0.06, Zacks reports. LCI Industries had a return on equity of 9.48% and a net margin of 3.47%.

LCI Industries Stock Up 0.9 %

Shares of NYSE:LCII traded up $0.99 on Friday, reaching $110.46. The company had a trading volume of 137,052 shares, compared to its average volume of 263,575. LCI Industries has a twelve month low of $96.18 and a twelve month high of $129.38. The stock has a 50-day moving average price of $106.31 and a 200 day moving average price of $112.93. The stock has a market capitalization of $2.81 billion, a P/E ratio of 21.56 and a beta of 1.44. The company has a quick ratio of 1.25, a current ratio of 2.88 and a debt-to-equity ratio of 0.58.

Insiders Place Their Bets

In related news, CEO Jason Lippert sold 10,000 shares of the business's stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $126.00, for a total transaction of $1,260,000.00. Following the transaction, the chief executive officer now directly owns 373,145 shares in the company, valued at $47,016,270. The trade was a 2.61 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Insiders own 3.50% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on LCII. Truist Financial raised their price objective on LCI Industries from $102.00 to $108.00 and gave the stock a "hold" rating in a report on Monday. StockNews.com upgraded LCI Industries from a "hold" rating to a "buy" rating in a research note on Friday, February 7th. Finally, CJS Securities upgraded LCI Industries from a "market perform" rating to an "outperform" rating and set a $145.00 price objective for the company in a research note on Wednesday. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, LCI Industries presently has an average rating of "Moderate Buy" and an average target price of $121.20.

Read Our Latest Stock Report on LCI Industries

About LCI Industries

(

Get Free Report)

LCI Industries, together with its subsidiaries, manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally. It operates through two segments: Original Equipment Manufacturers (OEM) and Aftermarket.

Read More

Before you consider LCI Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LCI Industries wasn't on the list.

While LCI Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.