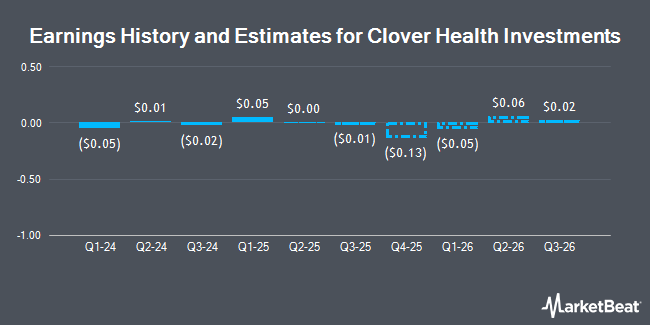

Clover Health Investments, Corp. (NASDAQ:CLOV - Free Report) - Leerink Partnrs lifted their Q2 2025 earnings per share estimates for shares of Clover Health Investments in a report issued on Wednesday, November 6th. Leerink Partnrs analyst W. Mayo now anticipates that the company will post earnings per share of $0.03 for the quarter, up from their previous forecast of $0.02. The consensus estimate for Clover Health Investments' current full-year earnings is ($0.13) per share.

Separately, UBS Group initiated coverage on shares of Clover Health Investments in a research report on Monday, October 7th. They issued a "neutral" rating and a $4.00 price target for the company.

Read Our Latest Research Report on Clover Health Investments

Clover Health Investments Stock Performance

Clover Health Investments stock traded down $0.26 during midday trading on Friday, hitting $3.41. 13,650,492 shares of the company's stock were exchanged, compared to its average volume of 8,098,257. The company has a market cap of $1.70 billion, a PE ratio of -12.89 and a beta of 2.03. The firm has a 50-day moving average of $3.45 and a two-hundred day moving average of $2.15. Clover Health Investments has a 12 month low of $0.61 and a 12 month high of $4.71.

Clover Health Investments (NASDAQ:CLOV - Get Free Report) last announced its quarterly earnings results on Monday, August 5th. The company reported $0.01 EPS for the quarter, beating the consensus estimate of ($0.04) by $0.05. Clover Health Investments had a negative return on equity of 36.55% and a negative net margin of 7.30%. The firm had revenue of $356.26 million for the quarter, compared to analyst estimates of $338.70 million. During the same quarter last year, the firm posted ($0.06) earnings per share.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently made changes to their positions in the stock. Connor Clark & Lunn Investment Management Ltd. lifted its stake in shares of Clover Health Investments by 75.7% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 1,128,171 shares of the company's stock worth $3,181,000 after purchasing an additional 485,987 shares during the last quarter. KBC Group NV purchased a new stake in shares of Clover Health Investments during the third quarter valued at about $53,000. Sigma Planning Corp purchased a new stake in shares of Clover Health Investments during the third quarter valued at about $29,000. Concurrent Investment Advisors LLC bought a new stake in shares of Clover Health Investments in the 3rd quarter valued at about $28,000. Finally, Forum Financial Management LP grew its position in shares of Clover Health Investments by 33.8% in the 3rd quarter. Forum Financial Management LP now owns 16,077 shares of the company's stock worth $45,000 after buying an additional 4,061 shares during the last quarter. 19.77% of the stock is currently owned by hedge funds and other institutional investors.

About Clover Health Investments

(

Get Free Report)

Clover Health Investments, Corp. provides medicare advantage plans in the United States. It operates through two segments: Insurance and Non-Insurance. It also offers Clover Assistant, a cloud-based software platform, that enables physicians to detect, identify, and manage chronic diseases earlier; and access to data-driven and personalized insights for the patients they treat.

Read More

Before you consider Clover Health Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clover Health Investments wasn't on the list.

While Clover Health Investments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.