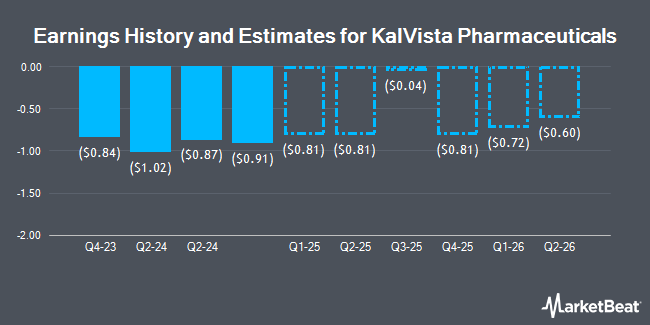

KalVista Pharmaceuticals, Inc. (NASDAQ:KALV - Free Report) - Equities researchers at Leerink Partnrs raised their Q3 2025 EPS estimates for shares of KalVista Pharmaceuticals in a research note issued to investors on Monday, November 4th. Leerink Partnrs analyst J. Schwartz now forecasts that the specialty pharmaceutical company will earn $0.81 per share for the quarter, up from their previous forecast of ($0.92). The consensus estimate for KalVista Pharmaceuticals' current full-year earnings is ($3.19) per share. Leerink Partnrs also issued estimates for KalVista Pharmaceuticals' Q4 2025 earnings at ($0.79) EPS, FY2025 earnings at ($1.66) EPS and FY2026 earnings at ($2.26) EPS.

Several other equities analysts also recently commented on the company. Needham & Company LLC restated a "buy" rating and issued a $32.00 price objective on shares of KalVista Pharmaceuticals in a research report on Friday, September 6th. HC Wainwright reissued a "buy" rating and issued a $20.00 price target on shares of KalVista Pharmaceuticals in a report on Monday, October 7th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating on shares of KalVista Pharmaceuticals in a report on Monday, September 9th.

Read Our Latest Stock Analysis on KalVista Pharmaceuticals

KalVista Pharmaceuticals Trading Down 2.0 %

Shares of KALV traded down $0.23 during trading hours on Thursday, reaching $11.18. 227,057 shares of the stock traded hands, compared to its average volume of 482,544. The company has a market cap of $483.20 million, a P/E ratio of -3.17 and a beta of 0.92. The company's 50-day moving average price is $11.48 and its two-hundred day moving average price is $12.08. KalVista Pharmaceuticals has a 52-week low of $7.21 and a 52-week high of $16.88.

KalVista Pharmaceuticals (NASDAQ:KALV - Get Free Report) last issued its quarterly earnings results on Thursday, September 5th. The specialty pharmaceutical company reported ($0.87) EPS for the quarter, topping analysts' consensus estimates of ($0.91) by $0.04.

Institutional Inflows and Outflows

A number of hedge funds have recently bought and sold shares of the company. BNP Paribas Financial Markets lifted its holdings in shares of KalVista Pharmaceuticals by 94.5% in the 1st quarter. BNP Paribas Financial Markets now owns 18,013 shares of the specialty pharmaceutical company's stock worth $214,000 after acquiring an additional 8,750 shares during the last quarter. ClariVest Asset Management LLC bought a new stake in KalVista Pharmaceuticals in the first quarter worth about $659,000. Susquehanna Fundamental Investments LLC purchased a new position in shares of KalVista Pharmaceuticals during the first quarter valued at approximately $192,000. Entropy Technologies LP bought a new position in shares of KalVista Pharmaceuticals during the first quarter valued at approximately $121,000. Finally, StemPoint Capital LP raised its holdings in shares of KalVista Pharmaceuticals by 174.4% in the first quarter. StemPoint Capital LP now owns 1,161,060 shares of the specialty pharmaceutical company's stock worth $13,770,000 after buying an additional 737,886 shares during the period.

Insider Buying and Selling at KalVista Pharmaceuticals

In other news, insider Christopher Yea sold 7,102 shares of KalVista Pharmaceuticals stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $12.01, for a total value of $85,295.02. Following the sale, the insider now directly owns 84,467 shares of the company's stock, valued at approximately $1,014,448.67. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other KalVista Pharmaceuticals news, insider Christopher Yea sold 7,102 shares of the company's stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $12.01, for a total transaction of $85,295.02. Following the sale, the insider now directly owns 84,467 shares in the company, valued at $1,014,448.67. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this link. Also, CEO Benjamin L. Palleiko sold 14,215 shares of KalVista Pharmaceuticals stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $12.01, for a total value of $170,722.15. Following the completion of the transaction, the chief executive officer now owns 242,527 shares of the company's stock, valued at approximately $2,912,749.27. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 30,804 shares of company stock valued at $372,112 in the last 90 days. Insiders own 10.50% of the company's stock.

About KalVista Pharmaceuticals

(

Get Free Report)

KalVista Pharmaceuticals, Inc, a clinical stage pharmaceutical company, engages in the discovery, development, and commercialization of drug therapies inhibitors for diseases with unmet needs. The company's product candidate is Sebetralstat, a small molecule plasma kallikrein inhibitor targeting the disease of hereditary angioedema (HAE).

Read More

Before you consider KalVista Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KalVista Pharmaceuticals wasn't on the list.

While KalVista Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.