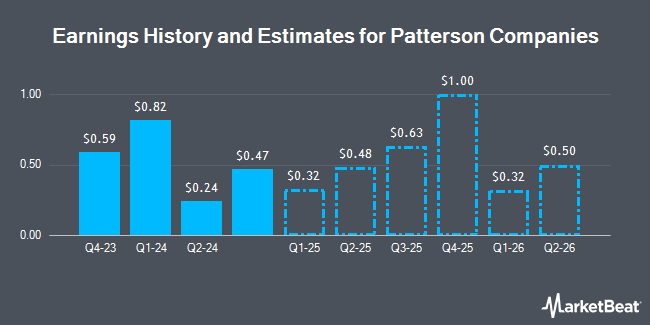

Patterson Companies, Inc. (NASDAQ:PDCO - Free Report) - Investment analysts at Leerink Partnrs decreased their Q3 2025 earnings per share estimates for shares of Patterson Companies in a research report issued on Thursday, December 5th. Leerink Partnrs analyst M. Cherny now forecasts that the company will post earnings of $0.62 per share for the quarter, down from their prior estimate of $0.69. The consensus estimate for Patterson Companies' current full-year earnings is $2.29 per share. Leerink Partnrs also issued estimates for Patterson Companies' Q4 2025 earnings at $0.94 EPS, FY2025 earnings at $2.27 EPS, FY2026 earnings at $2.48 EPS, FY2027 earnings at $2.76 EPS and FY2028 earnings at $3.04 EPS.

A number of other equities analysts have also recently weighed in on PDCO. Evercore ISI lowered their price objective on shares of Patterson Companies from $23.00 to $22.00 and set an "in-line" rating for the company in a research report on Tuesday, October 8th. Bank of America dropped their target price on shares of Patterson Companies from $31.00 to $29.00 and set a "buy" rating for the company in a report on Thursday, August 29th. JPMorgan Chase & Co. dropped their price objective on shares of Patterson Companies from $29.00 to $26.00 and set a "neutral" rating for the company in a research note on Thursday, August 29th. Mizuho initiated coverage on Patterson Companies in a research note on Wednesday, December 4th. They issued a "neutral" rating and a $23.00 target price for the company. Finally, Stifel Nicolaus reduced their price target on shares of Patterson Companies from $25.00 to $24.00 and set a "hold" rating on the stock in a research report on Thursday. Nine analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $26.10.

Read Our Latest Stock Report on PDCO

Patterson Companies Price Performance

PDCO traded up $0.01 on Monday, hitting $22.93. 566,846 shares of the company's stock were exchanged, compared to its average volume of 954,468. The firm has a 50-day moving average price of $21.02 and a 200-day moving average price of $22.78. The stock has a market cap of $2.03 billion, a price-to-earnings ratio of 13.40, a P/E/G ratio of 1.69 and a beta of 1.00. The company has a current ratio of 1.37, a quick ratio of 0.76 and a debt-to-equity ratio of 0.34. Patterson Companies has a fifty-two week low of $19.45 and a fifty-two week high of $30.68.

Patterson Companies (NASDAQ:PDCO - Get Free Report) last released its quarterly earnings data on Thursday, December 5th. The company reported $0.47 EPS for the quarter, missing the consensus estimate of $0.49 by ($0.02). The business had revenue of $1.67 billion during the quarter, compared to analysts' expectations of $1.65 billion. Patterson Companies had a net margin of 2.37% and a return on equity of 19.77%. The firm's revenue was up 1.0% on a year-over-year basis. During the same period last year, the company earned $0.50 earnings per share.

Hedge Funds Weigh In On Patterson Companies

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Dimensional Fund Advisors LP raised its holdings in shares of Patterson Companies by 0.6% in the second quarter. Dimensional Fund Advisors LP now owns 3,915,315 shares of the company's stock valued at $94,436,000 after purchasing an additional 23,344 shares during the last quarter. Allspring Global Investments Holdings LLC grew its position in Patterson Companies by 13.4% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 2,183,940 shares of the company's stock worth $47,697,000 after acquiring an additional 258,042 shares during the last quarter. River Road Asset Management LLC grew its position in shares of Patterson Companies by 3.6% in the 3rd quarter. River Road Asset Management LLC now owns 1,988,217 shares of the company's stock worth $43,423,000 after buying an additional 68,947 shares during the last quarter. Equity Investment Corp boosted its position in Patterson Companies by 10.6% during the 3rd quarter. Equity Investment Corp now owns 1,739,669 shares of the company's stock valued at $37,994,000 after acquiring an additional 166,899 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its holdings in shares of Patterson Companies by 5.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,554,566 shares of the company's stock valued at $33,952,000 after buying an additional 81,524 shares in the last quarter. 85.43% of the stock is owned by institutional investors and hedge funds.

Patterson Companies Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, November 1st. Shareholders of record on Wednesday, October 16th were given a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a yield of 4.54%. The ex-dividend date of this dividend was Friday, October 18th. Patterson Companies's dividend payout ratio (DPR) is presently 60.82%.

About Patterson Companies

(

Get Free Report)

Patterson Companies, Inc engages in the distribution of dental and animal health products in the United States, the United Kingdom, and Canada. The company operates through three segments: Dental, Animal Health, and Corporate segments. The Dental segment offers consumable products, including infection control, restorative materials, and instruments; basic and advanced technology and dental equipment; practice optimization solutions, such as practice management software, e-commerce, revenue cycle management, patient engagement solutions, and clinical and patient education systems.

Featured Articles

Before you consider Patterson Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patterson Companies wasn't on the list.

While Patterson Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.