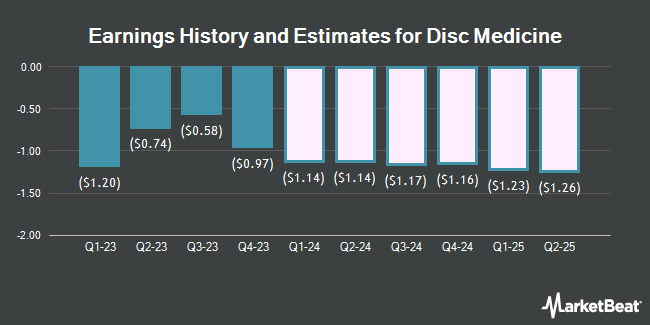

Disc Medicine, Inc. (NASDAQ:IRON - Free Report) - Leerink Partnrs reduced their FY2025 earnings estimates for Disc Medicine in a research note issued on Monday, November 4th. Leerink Partnrs analyst T. Smith now expects that the company will earn ($6.29) per share for the year, down from their previous forecast of ($5.15). The consensus estimate for Disc Medicine's current full-year earnings is ($4.09) per share. Leerink Partnrs also issued estimates for Disc Medicine's FY2026 earnings at ($8.72) EPS, FY2027 earnings at ($9.21) EPS and FY2028 earnings at ($8.12) EPS.

Disc Medicine (NASDAQ:IRON - Get Free Report) last issued its earnings results on Thursday, August 8th. The company reported ($1.03) EPS for the quarter, beating the consensus estimate of ($1.11) by $0.08.

A number of other analysts also recently weighed in on the stock. Wedbush reissued an "outperform" rating and set a $75.00 target price (up previously from $60.00) on shares of Disc Medicine in a research report on Monday. Wells Fargo & Company initiated coverage on shares of Disc Medicine in a research report on Thursday, August 22nd. They set an "overweight" rating and a $75.00 target price for the company. Raymond James raised shares of Disc Medicine from an "outperform" rating to a "strong-buy" rating and raised their price objective for the stock from $66.00 to $110.00 in a research report on Monday. Jefferies Financial Group initiated coverage on shares of Disc Medicine in a research report on Wednesday, October 23rd. They set a "buy" rating and a $89.00 price objective for the company. Finally, Morgan Stanley raised shares of Disc Medicine from an "equal weight" rating to an "overweight" rating and set a $85.00 price objective for the company in a research report on Tuesday. Nine investment analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, Disc Medicine has an average rating of "Buy" and a consensus target price of $80.20.

Check Out Our Latest Analysis on IRON

Disc Medicine Trading Down 1.2 %

NASDAQ IRON traded down $0.80 on Thursday, hitting $64.00. 132,758 shares of the company's stock were exchanged, compared to its average volume of 354,832. Disc Medicine has a 52 week low of $25.60 and a 52 week high of $77.60. The stock has a 50-day moving average of $49.37 and a 200-day moving average of $43.34. The stock has a market cap of $1.90 billion, a price-to-earnings ratio of -17.66 and a beta of 0.60.

Insider Buying and Selling

In other Disc Medicine news, Director William Richard White sold 7,136 shares of the firm's stock in a transaction on Monday, November 4th. The stock was sold at an average price of $58.61, for a total transaction of $418,240.96. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Insiders have sold a total of 7,538 shares of company stock worth $437,875 in the last ninety days. Corporate insiders own 4.24% of the company's stock.

Institutional Investors Weigh In On Disc Medicine

A number of hedge funds have recently made changes to their positions in the business. Amalgamated Bank raised its stake in shares of Disc Medicine by 76.9% during the 2nd quarter. Amalgamated Bank now owns 568 shares of the company's stock worth $26,000 after purchasing an additional 247 shares during the period. Mirae Asset Global Investments Co. Ltd. raised its stake in shares of Disc Medicine by 45.7% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,075 shares of the company's stock worth $54,000 after purchasing an additional 337 shares during the period. SG Americas Securities LLC raised its stake in shares of Disc Medicine by 19.5% during the 3rd quarter. SG Americas Securities LLC now owns 4,864 shares of the company's stock worth $239,000 after purchasing an additional 793 shares during the period. Bleakley Financial Group LLC increased its holdings in Disc Medicine by 23.0% in the 1st quarter. Bleakley Financial Group LLC now owns 4,572 shares of the company's stock worth $285,000 after acquiring an additional 856 shares during the last quarter. Finally, TD Asset Management Inc increased its holdings in Disc Medicine by 3.7% in the 2nd quarter. TD Asset Management Inc now owns 40,732 shares of the company's stock worth $1,836,000 after acquiring an additional 1,468 shares during the last quarter. 83.70% of the stock is currently owned by institutional investors.

About Disc Medicine

(

Get Free Report)

Disc Medicine, Inc, together with its subsidiaries, a clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States. The company has assembled a portfolio of clinical and preclinical product candidates that aim to modify fundamental biological pathways associated with the formation and function of red blood cells, primarily heme biosynthesis and iron homeostasis.

Featured Articles

Before you consider Disc Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Disc Medicine wasn't on the list.

While Disc Medicine currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.