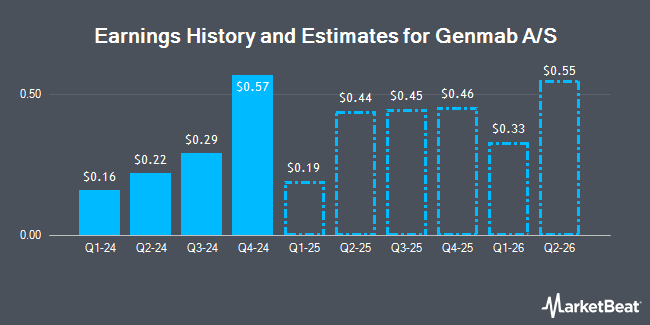

Genmab A/S (NASDAQ:GMAB - Free Report) - Research analysts at Leerink Partnrs lifted their FY2024 earnings estimates for shares of Genmab A/S in a research note issued to investors on Wednesday, November 6th. Leerink Partnrs analyst J. Chang now expects that the company will post earnings per share of $1.29 for the year, up from their prior forecast of $1.15. The consensus estimate for Genmab A/S's current full-year earnings is $1.31 per share. Leerink Partnrs also issued estimates for Genmab A/S's Q4 2024 earnings at $0.40 EPS and FY2025 earnings at $1.58 EPS.

A number of other research analysts have also issued reports on the stock. Redburn Atlantic initiated coverage on shares of Genmab A/S in a research note on Tuesday, October 8th. They set a "buy" rating on the stock. JPMorgan Chase & Co. reaffirmed a "neutral" rating on shares of Genmab A/S in a report on Tuesday, August 20th. Truist Financial lowered their price target on shares of Genmab A/S from $53.00 to $50.00 and set a "buy" rating on the stock in a report on Monday, September 9th. Royal Bank of Canada raised shares of Genmab A/S from a "sector perform" rating to an "outperform" rating in a report on Monday, July 15th. Finally, Morgan Stanley reissued an "equal weight" rating and set a $31.00 price target on shares of Genmab A/S in a report on Wednesday, September 11th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $45.20.

View Our Latest Research Report on Genmab A/S

Genmab A/S Stock Up 0.5 %

Shares of NASDAQ GMAB traded up $0.12 during trading hours on Monday, hitting $23.20. 1,535,601 shares of the stock were exchanged, compared to its average volume of 679,262. The company has a market cap of $15.35 billion, a PE ratio of 22.50, a PEG ratio of 0.68 and a beta of 0.99. The firm has a fifty day moving average price of $24.39 and a 200-day moving average price of $26.38. Genmab A/S has a 12 month low of $21.90 and a 12 month high of $32.89.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The company reported $0.22 EPS for the quarter, missing the consensus estimate of $0.29 by ($0.07). The business had revenue of $779.50 million during the quarter, compared to the consensus estimate of $734.60 million. Genmab A/S had a net margin of 23.49% and a return on equity of 14.64%.

Institutional Investors Weigh In On Genmab A/S

Several hedge funds and other institutional investors have recently bought and sold shares of the company. Russell Investments Group Ltd. boosted its stake in Genmab A/S by 137.7% during the first quarter. Russell Investments Group Ltd. now owns 939 shares of the company's stock worth $28,000 after buying an additional 544 shares during the period. Allspring Global Investments Holdings LLC acquired a new position in Genmab A/S during the 1st quarter worth approximately $43,000. Blue Trust Inc. grew its holdings in Genmab A/S by 892.0% during the 3rd quarter. Blue Trust Inc. now owns 4,315 shares of the company's stock worth $108,000 after acquiring an additional 3,880 shares in the last quarter. Headlands Technologies LLC grew its holdings in Genmab A/S by 1,702.8% during the 2nd quarter. Headlands Technologies LLC now owns 5,138 shares of the company's stock worth $129,000 after acquiring an additional 4,853 shares in the last quarter. Finally, Benjamin F. Edwards & Company Inc. grew its holdings in Genmab A/S by 7.1% during the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 7,227 shares of the company's stock worth $182,000 after acquiring an additional 478 shares in the last quarter. 7.07% of the stock is currently owned by institutional investors and hedge funds.

About Genmab A/S

(

Get Free Report)

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

Further Reading

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.