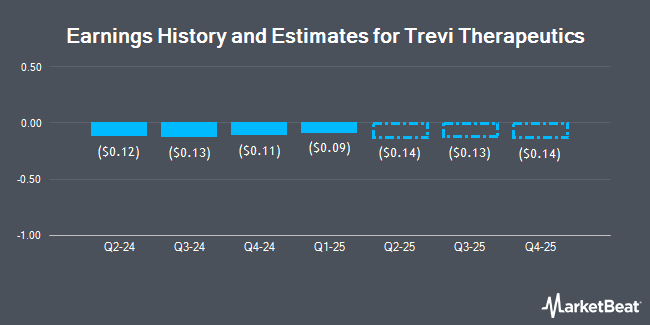

Trevi Therapeutics, Inc. (NASDAQ:TRVI - Free Report) - Investment analysts at Leerink Partnrs reduced their FY2024 EPS estimates for shares of Trevi Therapeutics in a note issued to investors on Wednesday, November 6th. Leerink Partnrs analyst F. Khurshid now expects that the company will post earnings of ($0.49) per share for the year, down from their previous estimate of ($0.48). Leerink Partnrs has a "Strong-Buy" rating on the stock. The consensus estimate for Trevi Therapeutics' current full-year earnings is ($0.47) per share. Leerink Partnrs also issued estimates for Trevi Therapeutics' Q4 2024 earnings at ($0.13) EPS, FY2025 earnings at ($0.47) EPS and FY2026 earnings at ($0.45) EPS.

Trevi Therapeutics (NASDAQ:TRVI - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported ($0.13) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.01). During the same quarter in the prior year, the business earned ($0.08) EPS.

TRVI has been the subject of several other research reports. EF Hutton Acquisition Co. I raised shares of Trevi Therapeutics to a "strong-buy" rating in a research note on Monday, August 19th. B. Riley reaffirmed a "buy" rating and issued a $6.00 price objective on shares of Trevi Therapeutics in a research note on Monday, October 7th. HC Wainwright reaffirmed a "buy" rating and issued a $6.00 price objective on shares of Trevi Therapeutics in a research note on Tuesday, October 22nd. Leerink Partners started coverage on shares of Trevi Therapeutics in a research note on Monday, September 9th. They issued an "outperform" rating and a $7.00 price objective for the company. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $8.00 price objective on shares of Trevi Therapeutics in a research note on Friday. Seven analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and an average price target of $7.43.

Get Our Latest Report on TRVI

Trevi Therapeutics Stock Up 5.5 %

Shares of NASDAQ:TRVI traded up $0.16 during trading on Monday, reaching $3.07. 1,666,913 shares of the company traded hands, compared to its average volume of 291,659. The firm has a fifty day simple moving average of $3.15 and a 200 day simple moving average of $2.91. The firm has a market cap of $235.98 million, a P/E ratio of -6.77 and a beta of 1.01. Trevi Therapeutics has a 1-year low of $0.97 and a 1-year high of $4.00.

Hedge Funds Weigh In On Trevi Therapeutics

Large investors have recently modified their holdings of the stock. Price T Rowe Associates Inc. MD bought a new stake in Trevi Therapeutics in the first quarter valued at approximately $47,000. Hsbc Holdings PLC bought a new stake in shares of Trevi Therapeutics during the second quarter worth $61,000. Intech Investment Management LLC bought a new stake in shares of Trevi Therapeutics during the third quarter worth $63,000. The Manufacturers Life Insurance Company increased its position in shares of Trevi Therapeutics by 87.6% during the second quarter. The Manufacturers Life Insurance Company now owns 24,524 shares of the company's stock worth $73,000 after acquiring an additional 11,450 shares in the last quarter. Finally, SG Americas Securities LLC bought a new stake in shares of Trevi Therapeutics during the third quarter worth $78,000. 95.76% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Trevi Therapeutics

In related news, insider Thomas Sciascia sold 18,660 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $2.76, for a total value of $51,501.60. Following the sale, the insider now owns 220,315 shares of the company's stock, valued at $608,069.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. In other Trevi Therapeutics news, insider Thomas Sciascia sold 18,660 shares of the business's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $2.76, for a total value of $51,501.60. Following the transaction, the insider now directly owns 220,315 shares in the company, valued at $608,069.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Jennifer L. Good sold 10,981 shares of the business's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $3.02, for a total transaction of $33,162.62. Following the completion of the transaction, the chief executive officer now owns 213,313 shares in the company, valued at approximately $644,205.26. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 40,355 shares of company stock worth $116,663. 24.37% of the stock is currently owned by company insiders.

About Trevi Therapeutics

(

Get Free Report)

Trevi Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapy Haduvio for the treatment of chronic cough in idiopathic pulmonary fibrosis (IPF) and refractory chronic cough (RCC) conditions targeting the central and peripheral nervous systems.

Further Reading

Before you consider Trevi Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trevi Therapeutics wasn't on the list.

While Trevi Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.