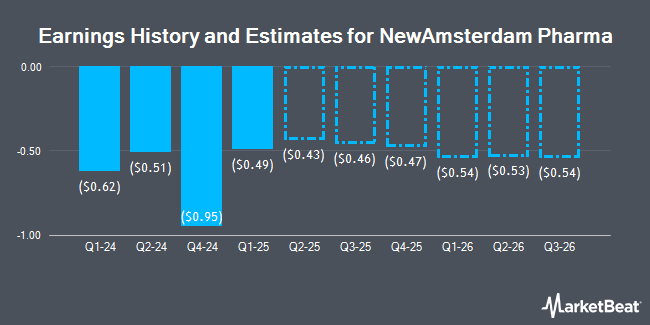

NewAmsterdam Pharma (NASDAQ:NAMS - Free Report) - Stock analysts at Leerink Partnrs upped their FY2028 EPS estimates for NewAmsterdam Pharma in a research note issued on Wednesday, November 6th. Leerink Partnrs analyst R. Ruiz now forecasts that the company will post earnings of $0.44 per share for the year, up from their prior estimate of $0.39. The consensus estimate for NewAmsterdam Pharma's current full-year earnings is ($2.06) per share.

NAMS has been the topic of several other reports. Needham & Company LLC restated a "buy" rating and set a $36.00 price objective on shares of NewAmsterdam Pharma in a research note on Thursday. Piper Sandler reaffirmed an "overweight" rating and issued a $37.00 price objective on shares of NewAmsterdam Pharma in a research report on Monday, September 23rd. Finally, Royal Bank of Canada reiterated an "outperform" rating and issued a $31.00 price objective on shares of NewAmsterdam Pharma in a research note on Thursday, September 5th. Seven equities research analysts have rated the stock with a buy rating, According to MarketBeat, the stock has a consensus rating of "Buy" and an average target price of $33.80.

Get Our Latest Research Report on NewAmsterdam Pharma

NewAmsterdam Pharma Stock Performance

NAMS traded up $0.86 during midday trading on Friday, reaching $23.50. 420,221 shares of the company were exchanged, compared to its average volume of 260,185. NewAmsterdam Pharma has a one year low of $8.64 and a one year high of $26.35. The company's fifty day moving average price is $17.51 and its 200 day moving average price is $18.49.

NewAmsterdam Pharma (NASDAQ:NAMS - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported ($0.18) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.48) by $0.30. The firm had revenue of $29.11 million for the quarter, compared to the consensus estimate of $5.35 million.

Hedge Funds Weigh In On NewAmsterdam Pharma

Large investors have recently modified their holdings of the business. Banque Cantonale Vaudoise bought a new position in NewAmsterdam Pharma in the 2nd quarter worth approximately $38,000. Rosalind Advisors Inc. purchased a new position in shares of NewAmsterdam Pharma in the second quarter valued at $194,000. Wolverine Asset Management LLC raised its stake in shares of NewAmsterdam Pharma by 117.7% during the 2nd quarter. Wolverine Asset Management LLC now owns 15,524 shares of the company's stock valued at $298,000 after purchasing an additional 8,394 shares during the period. Sei Investments Co. lifted its holdings in NewAmsterdam Pharma by 49.1% during the 2nd quarter. Sei Investments Co. now owns 24,561 shares of the company's stock worth $472,000 after purchasing an additional 8,087 shares in the last quarter. Finally, Lisanti Capital Growth LLC bought a new position in NewAmsterdam Pharma in the 3rd quarter worth about $700,000. Hedge funds and other institutional investors own 89.89% of the company's stock.

Insider Activity

In related news, CAO Louise Frederika Kooij sold 45,000 shares of NewAmsterdam Pharma stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $15.72, for a total value of $707,400.00. The transaction was disclosed in a legal filing with the SEC, which is available at the SEC website. Insiders own 19.50% of the company's stock.

NewAmsterdam Pharma Company Profile

(

Get Free Report)

NewAmsterdam Pharma Company N.V., a late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease. It is developing obicetrapib, an oral low-dose cholesteryl ester transfer protein (CETP) inhibitor, that is in various clinical trials as a monotherapy and a combination therapy with ezetimibe for lowering LDL-C for cardiovascular diseases.

Read More

Before you consider NewAmsterdam Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewAmsterdam Pharma wasn't on the list.

While NewAmsterdam Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.