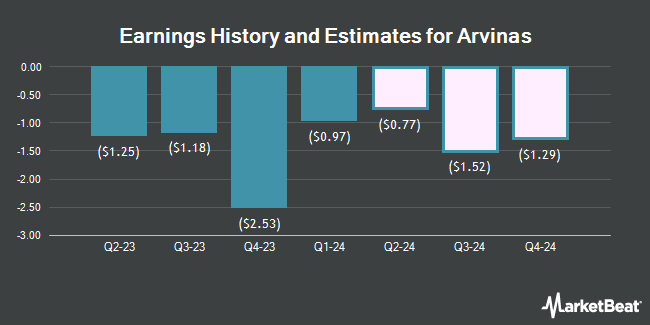

Arvinas, Inc. (NASDAQ:ARVN - Free Report) - Leerink Partnrs lowered their FY2025 earnings per share (EPS) estimates for shares of Arvinas in a research report issued on Tuesday, November 19th. Leerink Partnrs analyst A. Berens now anticipates that the company will post earnings per share of ($2.98) for the year, down from their previous forecast of ($2.85). The consensus estimate for Arvinas' current full-year earnings is ($3.32) per share. Leerink Partnrs also issued estimates for Arvinas' FY2026 earnings at ($3.64) EPS and FY2027 earnings at $1.38 EPS.

A number of other research firms have also recently commented on ARVN. Cantor Fitzgerald reiterated an "overweight" rating on shares of Arvinas in a research report on Monday, September 9th. BMO Capital Markets cut their price objective on shares of Arvinas from $90.00 to $88.00 and set an "outperform" rating for the company in a research report on Wednesday. Stephens assumed coverage on shares of Arvinas in a research note on Monday. They set an "overweight" rating and a $55.00 price objective on the stock. Wedbush reaffirmed an "outperform" rating and issued a $57.00 target price on shares of Arvinas in a research note on Tuesday, July 30th. Finally, Barclays reduced their price target on Arvinas from $60.00 to $48.00 and set an "overweight" rating on the stock in a research note on Wednesday, July 31st. One investment analyst has rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $61.08.

Get Our Latest Research Report on Arvinas

Arvinas Stock Performance

ARVN stock traded up $0.75 on Friday, reaching $25.86. The company had a trading volume of 1,060,227 shares, compared to its average volume of 720,106. Arvinas has a 1 year low of $21.17 and a 1 year high of $53.08. The company's fifty day moving average is $25.63 and its 200 day moving average is $27.05. The company has a market cap of $1.78 billion, a P/E ratio of -5.48 and a beta of 1.96.

Arvinas (NASDAQ:ARVN - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported ($0.68) EPS for the quarter, beating analysts' consensus estimates of ($0.88) by $0.20. The business had revenue of $102.40 million during the quarter, compared to analyst estimates of $60.56 million. Arvinas's revenue was up 196.0% on a year-over-year basis. During the same period in the previous year, the company posted ($1.18) earnings per share.

Institutional Investors Weigh In On Arvinas

Several institutional investors and hedge funds have recently modified their holdings of the stock. M&T Bank Corp boosted its stake in shares of Arvinas by 53.5% during the 3rd quarter. M&T Bank Corp now owns 27,137 shares of the company's stock valued at $669,000 after buying an additional 9,462 shares during the last quarter. Barclays PLC raised its stake in Arvinas by 198.9% during the third quarter. Barclays PLC now owns 121,699 shares of the company's stock worth $2,998,000 after acquiring an additional 80,984 shares during the period. Nomura Asset Management Co. Ltd. lifted its holdings in shares of Arvinas by 36.3% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 90,870 shares of the company's stock worth $2,238,000 after purchasing an additional 24,223 shares during the last quarter. XTX Topco Ltd bought a new position in Arvinas during the 3rd quarter worth $453,000. Finally, Zacks Investment Management increased its position in Arvinas by 9.8% in the third quarter. Zacks Investment Management now owns 89,827 shares of the company's stock worth $2,212,000 after buying an additional 8,029 shares during the period. Hedge funds and other institutional investors own 95.19% of the company's stock.

About Arvinas

(

Get Free Report)

Arvinas, Inc, a clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins. The company engineers proteolysis targeting chimeras (PROTAC) targeted protein degraders that are designed to harness the body's own natural protein disposal system to degrade and remove disease-causing proteins.

Further Reading

Before you consider Arvinas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arvinas wasn't on the list.

While Arvinas currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.