Leeward Investments LLC MA grew its holdings in shares of Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 8.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,338,942 shares of the company's stock after purchasing an additional 107,035 shares during the period. Gates Industrial makes up about 1.1% of Leeward Investments LLC MA's portfolio, making the stock its 24th biggest holding. Leeward Investments LLC MA owned about 0.51% of Gates Industrial worth $23,498,000 at the end of the most recent quarter.

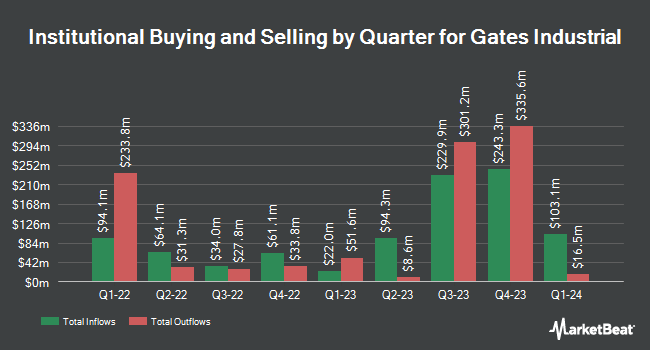

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. grew its position in shares of Gates Industrial by 17.5% during the 1st quarter. Vanguard Group Inc. now owns 18,008,743 shares of the company's stock valued at $318,935,000 after acquiring an additional 2,678,954 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in Gates Industrial by 2.1% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 14,929,377 shares of the company's stock valued at $262,011,000 after purchasing an additional 303,353 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in shares of Gates Industrial by 9.5% in the second quarter. Dimensional Fund Advisors LP now owns 11,921,356 shares of the company's stock worth $188,477,000 after acquiring an additional 1,037,741 shares in the last quarter. LSV Asset Management grew its stake in shares of Gates Industrial by 19.9% in the second quarter. LSV Asset Management now owns 4,137,951 shares of the company's stock worth $65,421,000 after acquiring an additional 686,080 shares in the last quarter. Finally, Fred Alger Management LLC grew its stake in shares of Gates Industrial by 156.8% during the second quarter. Fred Alger Management LLC now owns 2,665,632 shares of the company's stock worth $42,144,000 after purchasing an additional 1,627,482 shares in the last quarter. Hedge funds and other institutional investors own 98.50% of the company's stock.

Analysts Set New Price Targets

GTES has been the subject of a number of research reports. Robert W. Baird reduced their target price on shares of Gates Industrial from $26.00 to $22.00 and set an "outperform" rating for the company in a report on Thursday, August 1st. The Goldman Sachs Group increased their price target on shares of Gates Industrial from $18.00 to $20.00 and gave the stock a "neutral" rating in a research note on Thursday, August 1st. Morgan Stanley assumed coverage on shares of Gates Industrial in a research note on Friday, September 6th. They issued an "equal weight" rating and a $19.00 target price on the stock. Barclays lifted their price target on shares of Gates Industrial from $16.00 to $21.00 and gave the stock an "equal weight" rating in a research note on Tuesday. Finally, KeyCorp boosted their target price on shares of Gates Industrial from $21.00 to $22.00 and gave the stock an "overweight" rating in a research report on Thursday, October 31st. Four equities research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $20.30.

View Our Latest Stock Analysis on GTES

Gates Industrial Price Performance

GTES stock traded down $0.09 during trading on Thursday, hitting $21.26. 2,561,896 shares of the stock traded hands, compared to its average volume of 3,083,080. The stock has a market cap of $5.42 billion, a price-to-earnings ratio of 25.72 and a beta of 1.38. Gates Industrial Corp PLC has a one year low of $11.14 and a one year high of $21.54. The company has a 50 day simple moving average of $17.89 and a 200 day simple moving average of $17.21. The company has a current ratio of 3.02, a quick ratio of 2.11 and a debt-to-equity ratio of 0.70.

Gates Industrial announced that its Board of Directors has initiated a share repurchase program on Wednesday, July 31st that permits the company to buyback $250.00 million in outstanding shares. This buyback authorization permits the company to purchase up to 5.4% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's leadership believes its stock is undervalued.

Insiders Place Their Bets

In related news, Director Wilson S. Neely purchased 11,952 shares of Gates Industrial stock in a transaction dated Wednesday, August 21st. The stock was bought at an average price of $16.80 per share, for a total transaction of $200,793.60. Following the completion of the acquisition, the director now directly owns 6,000 shares of the company's stock, valued at $100,800. This represents a -200.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 2.30% of the company's stock.

Gates Industrial Company Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Read More

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.