Leeward Investments LLC MA reduced its position in shares of Ingredion Incorporated (NYSE:INGR - Free Report) by 9.4% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 227,452 shares of the company's stock after selling 23,511 shares during the quarter. Ingredion accounts for approximately 1.5% of Leeward Investments LLC MA's holdings, making the stock its 8th biggest position. Leeward Investments LLC MA owned about 0.35% of Ingredion worth $31,259,000 at the end of the most recent quarter.

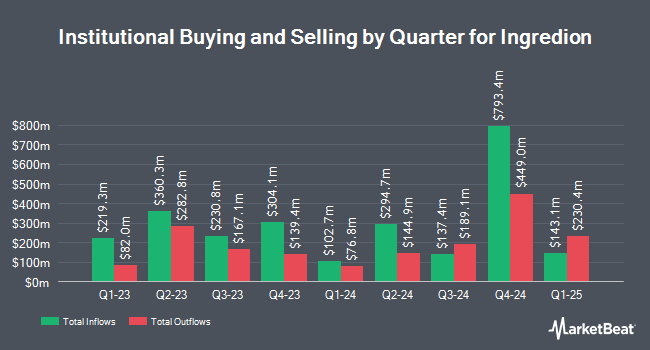

Other large investors have also recently made changes to their positions in the company. Pacer Advisors Inc. increased its position in shares of Ingredion by 92.4% during the 2nd quarter. Pacer Advisors Inc. now owns 1,764,012 shares of the company's stock valued at $202,332,000 after purchasing an additional 846,967 shares during the last quarter. Acadian Asset Management LLC raised its stake in Ingredion by 177.8% in the second quarter. Acadian Asset Management LLC now owns 396,743 shares of the company's stock valued at $45,491,000 after buying an additional 253,949 shares during the last quarter. International Assets Investment Management LLC increased its holdings in shares of Ingredion by 55,219.9% in the third quarter. International Assets Investment Management LLC now owns 174,811 shares of the company's stock valued at $240,240,000 after purchasing an additional 174,495 shares during the period. Dimensional Fund Advisors LP increased its holdings in shares of Ingredion by 4.9% in the second quarter. Dimensional Fund Advisors LP now owns 2,685,339 shares of the company's stock valued at $308,009,000 after purchasing an additional 125,543 shares during the period. Finally, DekaBank Deutsche Girozentrale grew its holdings in Ingredion by 43.8% during the first quarter. DekaBank Deutsche Girozentrale now owns 405,465 shares of the company's stock worth $47,303,000 after acquiring an additional 123,406 shares during the period. 85.27% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Ingredion news, SVP Larry Fernandes sold 4,700 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $153.41, for a total value of $721,027.00. Following the transaction, the senior vice president now owns 29,034 shares of the company's stock, valued at approximately $4,454,105.94. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, SVP Larry Fernandes sold 4,700 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $153.41, for a total value of $721,027.00. Following the completion of the sale, the senior vice president now directly owns 29,034 shares in the company, valued at approximately $4,454,105.94. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO James P. Zallie sold 1,300 shares of the company's stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $134.03, for a total transaction of $174,239.00. Following the completion of the sale, the chief executive officer now owns 52,530 shares of the company's stock, valued at $7,040,595.90. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 30,056 shares of company stock worth $4,121,736 over the last ninety days. Company insiders own 1.80% of the company's stock.

Ingredion Stock Down 0.3 %

NYSE:INGR traded down $0.52 during mid-day trading on Thursday, hitting $150.00. The company had a trading volume of 677,390 shares, compared to its average volume of 380,146. The business has a fifty day simple moving average of $135.87 and a 200-day simple moving average of $125.11. The company has a current ratio of 2.52, a quick ratio of 1.51 and a debt-to-equity ratio of 0.47. Ingredion Incorporated has a 1 year low of $100.01 and a 1 year high of $155.44. The firm has a market capitalization of $9.76 billion, a price-to-earnings ratio of 15.34, a PEG ratio of 1.21 and a beta of 0.73.

Ingredion (NYSE:INGR - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The company reported $3.05 earnings per share for the quarter, beating the consensus estimate of $2.58 by $0.47. The firm had revenue of $1.87 billion during the quarter, compared to analyst estimates of $1.94 billion. Ingredion had a return on equity of 17.18% and a net margin of 8.47%. Ingredion's quarterly revenue was down 8.0% on a year-over-year basis. During the same period in the previous year, the company earned $2.33 earnings per share. Equities analysts forecast that Ingredion Incorporated will post 10.05 earnings per share for the current fiscal year.

Ingredion Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, October 22nd. Stockholders of record on Tuesday, October 1st were given a dividend of $0.80 per share. The ex-dividend date was Tuesday, October 1st. This is an increase from Ingredion's previous quarterly dividend of $0.78. This represents a $3.20 annualized dividend and a dividend yield of 2.13%. Ingredion's payout ratio is currently 32.72%.

Analysts Set New Price Targets

A number of brokerages have issued reports on INGR. UBS Group increased their price target on Ingredion from $141.00 to $148.00 and gave the stock a "buy" rating in a research report on Thursday, August 15th. Oppenheimer raised their target price on Ingredion from $147.00 to $178.00 and gave the stock an "outperform" rating in a research note on Wednesday. StockNews.com cut Ingredion from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, August 7th. BMO Capital Markets lifted their price objective on Ingredion from $128.00 to $147.00 and gave the company a "market perform" rating in a research note on Wednesday. Finally, Barclays boosted their target price on Ingredion from $145.00 to $168.00 and gave the stock an "overweight" rating in a research note on Wednesday. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $151.00.

Get Our Latest Stock Analysis on Ingredion

Ingredion Profile

(

Free Report)

Ingredion Incorporated, together with its subsidiaries, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

Further Reading

Before you consider Ingredion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingredion wasn't on the list.

While Ingredion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report