Leeward Investments LLC MA decreased its holdings in Casey's General Stores, Inc. (NASDAQ:CASY - Free Report) by 20.5% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 19,809 shares of the company's stock after selling 5,123 shares during the quarter. Leeward Investments LLC MA owned approximately 0.05% of Casey's General Stores worth $7,443,000 at the end of the most recent reporting period.

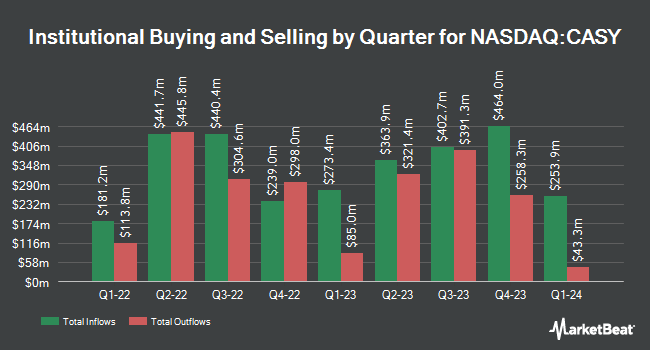

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Janus Henderson Group PLC boosted its stake in shares of Casey's General Stores by 1.4% in the 1st quarter. Janus Henderson Group PLC now owns 768,060 shares of the company's stock valued at $244,592,000 after purchasing an additional 10,841 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in Casey's General Stores by 3.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 468,650 shares of the company's stock worth $178,822,000 after acquiring an additional 14,750 shares during the period. Envestnet Asset Management Inc. lifted its stake in shares of Casey's General Stores by 20.4% in the 2nd quarter. Envestnet Asset Management Inc. now owns 458,044 shares of the company's stock valued at $174,771,000 after purchasing an additional 77,515 shares during the period. International Assets Investment Management LLC acquired a new position in shares of Casey's General Stores in the 3rd quarter valued at about $959,880,000. Finally, TD Asset Management Inc boosted its position in shares of Casey's General Stores by 2.5% during the 1st quarter. TD Asset Management Inc now owns 220,257 shares of the company's stock valued at $70,141,000 after purchasing an additional 5,296 shares in the last quarter. 85.63% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at Casey's General Stores

In other news, insider Thomas P. Brennan, Jr. sold 3,000 shares of the stock in a transaction on Friday, September 6th. The stock was sold at an average price of $380.24, for a total transaction of $1,140,720.00. Following the completion of the transaction, the insider now owns 9,044 shares in the company, valued at approximately $3,438,890.56. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other Casey's General Stores news, CEO Darren M. Rebelez sold 13,500 shares of the business's stock in a transaction on Friday, September 6th. The shares were sold at an average price of $374.54, for a total transaction of $5,056,290.00. Following the sale, the chief executive officer now owns 73,838 shares of the company's stock, valued at $27,655,284.52. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Thomas P. Brennan, Jr. sold 3,000 shares of the stock in a transaction on Friday, September 6th. The stock was sold at an average price of $380.24, for a total value of $1,140,720.00. Following the sale, the insider now owns 9,044 shares in the company, valued at approximately $3,438,890.56. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.56% of the stock is owned by company insiders.

Casey's General Stores Stock Performance

CASY stock traded up $3.83 during midday trading on Friday, hitting $417.20. The company's stock had a trading volume of 72,999 shares, compared to its average volume of 269,190. Casey's General Stores, Inc. has a 1 year low of $266.56 and a 1 year high of $420.27. The stock has a market cap of $15.49 billion, a price-to-earnings ratio of 30.09 and a beta of 0.79. The stock's 50-day moving average price is $381.07 and its 200 day moving average price is $365.32. The company has a quick ratio of 0.44, a current ratio of 0.84 and a debt-to-equity ratio of 0.44.

Casey's General Stores (NASDAQ:CASY - Get Free Report) last posted its quarterly earnings results on Wednesday, September 4th. The company reported $4.83 earnings per share for the quarter, beating the consensus estimate of $4.54 by $0.29. The company had revenue of $4.10 billion during the quarter, compared to analyst estimates of $4.15 billion. Casey's General Stores had a net margin of 3.40% and a return on equity of 17.07%. The firm's revenue for the quarter was up 5.9% on a year-over-year basis. During the same quarter in the prior year, the business earned $4.52 earnings per share. On average, equities analysts forecast that Casey's General Stores, Inc. will post 14.01 EPS for the current year.

Casey's General Stores Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, November 15th. Investors of record on Friday, November 1st will be issued a $0.50 dividend. The ex-dividend date is Friday, November 1st. This represents a $2.00 dividend on an annualized basis and a dividend yield of 0.48%. Casey's General Stores's dividend payout ratio (DPR) is presently 14.56%.

Analysts Set New Price Targets

Several equities research analysts have weighed in on CASY shares. JPMorgan Chase & Co. downgraded shares of Casey's General Stores from a "neutral" rating to an "underweight" rating and lifted their price target for the company from $300.00 to $337.00 in a research note on Thursday, September 19th. Wells Fargo & Company increased their price target on Casey's General Stores from $415.00 to $425.00 and gave the stock an "overweight" rating in a report on Friday, September 6th. StockNews.com downgraded Casey's General Stores from a "strong-buy" rating to a "buy" rating in a report on Saturday, August 3rd. Gordon Haskett began coverage on Casey's General Stores in a report on Monday. They issued a "hold" rating and a $400.00 target price on the stock. Finally, Benchmark restated a "buy" rating and set a $410.00 price objective on shares of Casey's General Stores in a report on Tuesday, September 10th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $408.25.

Get Our Latest Research Report on Casey's General Stores

About Casey's General Stores

(

Free Report)

Casey's General Stores, Inc, together with its subsidiaries, operates convenience stores under the Casey's and Casey's General Store names. Its stores offer pizza, donuts, breakfast items, and sandwiches; and tobacco and nicotine products. The company's stores provide soft drinks, energy, water, sports drinks, juices, coffee, and tea and dairy products; beer, wine, and spirits; snacks, candy, packaged bakery, and other food items; ice, ice cream, meals, and appetizers; health and beauty aids, automotive products, electronic accessories, housewares, and pet supplies; and ATM, lotto/lottery, and prepaid cards.

See Also

Before you consider Casey's General Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Casey's General Stores wasn't on the list.

While Casey's General Stores currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report