Legacy Housing (NASDAQ:LEGH - Get Free Report) is projected to post its quarterly earnings results after the market closes on Friday, March 21st. Analysts expect Legacy Housing to post earnings of $0.58 per share for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

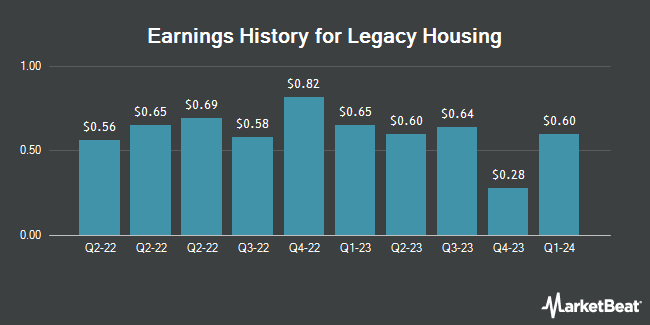

Legacy Housing (NASDAQ:LEGH - Get Free Report) last issued its earnings results on Wednesday, March 12th. The company reported $0.59 EPS for the quarter, beating analysts' consensus estimates of $0.52 by $0.07. The business had revenue of $54.19 million during the quarter, compared to analysts' expectations of $44.59 million. Legacy Housing had a net margin of 33.11% and a return on equity of 11.85%.

Legacy Housing Trading Up 2.2 %

LEGH traded up $0.55 on Friday, hitting $25.96. The company had a trading volume of 104,068 shares, compared to its average volume of 71,728. Legacy Housing has a 1 year low of $19.42 and a 1 year high of $29.31. The firm has a market cap of $627.14 million, a P/E ratio of 11.96 and a beta of 1.16. The company's fifty day moving average price is $25.33 and its 200 day moving average price is $25.87.

Insider Buying and Selling

In other Legacy Housing news, Director Curtis Drew Hodgson sold 17,300 shares of the business's stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $25.20, for a total transaction of $435,960.00. Following the transaction, the director now owns 439,322 shares in the company, valued at approximately $11,070,914.40. The trade was a 3.79 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Insiders have sold a total of 54,252 shares of company stock valued at $1,332,489 in the last ninety days. Company insiders own 30.60% of the company's stock.

Legacy Housing Company Profile

(

Get Free Report)

Legacy Housing Corporation engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States. It manufactures and provides for the transport of mobile homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms; and provides wholesale financing to dealers and mobile home parks, as well as retail financing to consumers.

Featured Stories

Before you consider Legacy Housing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legacy Housing wasn't on the list.

While Legacy Housing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.