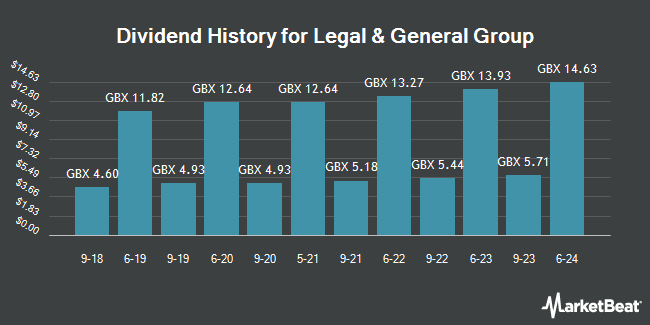

Legal & General Group Plc (LON:LGEN - Get Free Report) declared a dividend on Wednesday, March 12th, DividendData.Co.Uk reports. Stockholders of record on Thursday, April 24th will be paid a dividend of GBX 15.36 ($0.20) per share by the financial services provider on Thursday, June 5th. This represents a dividend yield of 6.18%. The ex-dividend date of this dividend is Thursday, April 24th. This is a 156.0% increase from Legal & General Group's previous dividend of $6.00. The official announcement can be accessed at this link.

Legal & General Group Price Performance

Shares of LGEN stock traded up GBX 0.18 ($0.00) during trading on Friday, hitting GBX 237.57 ($3.16). The company had a trading volume of 50,727,898 shares, compared to its average volume of 21,148,395. The company has a debt-to-equity ratio of 155.18, a quick ratio of 0.50 and a current ratio of 1.50. The firm has a market capitalization of £13.92 billion, a P/E ratio of 43.86, a price-to-earnings-growth ratio of 2.34 and a beta of 1.31. The stock's 50-day moving average price is GBX 240.13 and its 200 day moving average price is GBX 232.37. Legal & General Group has a one year low of GBX 206.80 ($2.75) and a one year high of GBX 266.20 ($3.54).

Legal & General Group (LON:LGEN - Get Free Report) last released its earnings results on Wednesday, March 12th. The financial services provider reported GBX 2.89 ($0.04) earnings per share for the quarter. Legal & General Group had a return on equity of 7.79% and a net margin of 0.67%. Equities analysts expect that Legal & General Group will post 24.2376446 EPS for the current fiscal year.

Legal & General Group declared that its board has approved a stock repurchase plan on Wednesday, March 12th that permits the company to repurchase 0 outstanding shares. This repurchase authorization permits the financial services provider to purchase shares of its stock through open market purchases. Shares repurchase plans are generally an indication that the company's leadership believes its shares are undervalued.

Insiders Place Their Bets

In related news, insider Henrietta Baldock bought 1,016 shares of the company's stock in a transaction on Monday, March 3rd. The shares were purchased at an average cost of GBX 243 ($3.24) per share, for a total transaction of £2,468.88 ($3,287.46). Also, insider Jeff Davies sold 94,803 shares of the company's stock in a transaction that occurred on Saturday, April 19th. The shares were sold at an average price of GBX 248 ($3.30), for a total value of £235,111.44 ($313,064.50). Insiders have bought 43,188 shares of company stock valued at $10,467,891 in the last three months. 0.88% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

Separately, Berenberg Bank reissued a "buy" rating and issued a GBX 265 ($3.53) target price on shares of Legal & General Group in a report on Monday, February 24th. Two investment analysts have rated the stock with a hold rating, two have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of GBX 267 ($3.56).

Check Out Our Latest Stock Analysis on Legal & General Group

About Legal & General Group

(

Get Free Report)

Legal & General Group Plc provides various insurance products and services in the United Kingdom, the United States, and internationally. It operates in Legal & General Retirement Institutional (LGRI), Legal & General Investment Management (LGIM), Legal & General Capital (LGC), and Retail segments.

See Also

Before you consider Legal & General Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legal & General Group wasn't on the list.

While Legal & General Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.