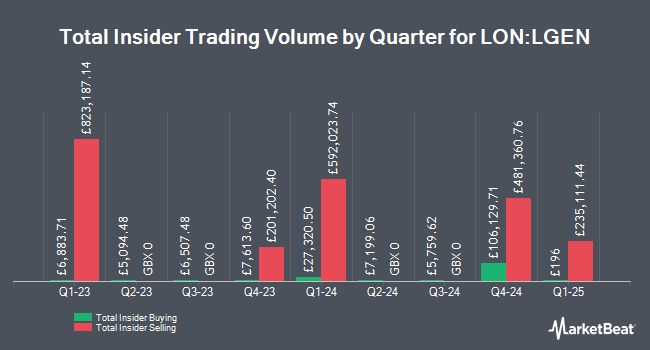

Legal & General Group Plc (LON:LGEN - Get Free Report) insider António Simões sold 197,279 shares of the business's stock in a transaction dated Thursday, March 20th. The shares were sold at an average price of GBX 244 ($3.16), for a total transaction of £481,360.76 ($623,040.07).

Legal & General Group Stock Performance

Shares of LGEN traded down GBX 0.30 ($0.00) during trading hours on Friday, reaching GBX 243.60 ($3.15). 26,439,117 shares of the company traded hands, compared to its average volume of 18,190,848. The stock has a market capitalization of £14.28 billion, a P/E ratio of 44.97, a P/E/G ratio of 2.34 and a beta of 1.31. The company has a quick ratio of 0.50, a current ratio of 1.50 and a debt-to-equity ratio of 155.18. The business has a fifty day moving average price of GBX 241.20 and a 200-day moving average price of GBX 230.60. Legal & General Group Plc has a 12-month low of GBX 211.40 ($2.74) and a 12-month high of GBX 266.20 ($3.45).

Legal & General Group (LON:LGEN - Get Free Report) last announced its quarterly earnings data on Wednesday, March 12th. The financial services provider reported GBX 2.89 ($0.04) earnings per share (EPS) for the quarter. Legal & General Group had a return on equity of 7.79% and a net margin of 0.67%. Equities analysts anticipate that Legal & General Group Plc will post 24.2376446 EPS for the current fiscal year.

Legal & General Group Increases Dividend

The firm also recently disclosed a dividend, which will be paid on Thursday, June 5th. Shareholders of record on Thursday, April 24th will be paid a dividend of GBX 15.36 ($0.20) per share. This represents a yield of 6.18%. This is a boost from Legal & General Group's previous dividend of $6.00. The ex-dividend date is Thursday, April 24th. Legal & General Group's payout ratio is presently 387.68%.

Legal & General Group declared that its Board of Directors has initiated a stock buyback program on Wednesday, March 12th that allows the company to buyback 0 shares. This buyback authorization allows the financial services provider to reacquire shares of its stock through open market purchases. Shares buyback programs are usually an indication that the company's board of directors believes its stock is undervalued.

Wall Street Analyst Weigh In

Several research firms have recently commented on LGEN. Deutsche Bank Aktiengesellschaft reissued a "top pick" rating on shares of Legal & General Group in a research report on Friday, December 6th. JPMorgan Chase & Co. boosted their target price on shares of Legal & General Group from GBX 290 ($3.75) to GBX 295 ($3.82) and gave the stock an "overweight" rating in a report on Friday, December 6th. Finally, Berenberg Bank reissued a "buy" rating and set a GBX 265 ($3.43) price target on shares of Legal & General Group in a research report on Monday, February 24th. Two research analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of GBX 267 ($3.46).

View Our Latest Analysis on LGEN

About Legal & General Group

(

Get Free Report)

Legal & General Group Plc provides various insurance products and services in the United Kingdom, the United States, and internationally. It operates in Legal & General Retirement Institutional (LGRI), Legal & General Investment Management (LGIM), Legal & General Capital (LGC), and Retail segments.

Further Reading

Before you consider Legal & General Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legal & General Group wasn't on the list.

While Legal & General Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.