Legal & General Group Plc lessened its position in shares of CBRE Group, Inc. (NYSE:CBRE - Free Report) by 21.2% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 1,989,129 shares of the financial services provider's stock after selling 534,736 shares during the quarter. Legal & General Group Plc owned about 0.65% of CBRE Group worth $261,153,000 at the end of the most recent reporting period.

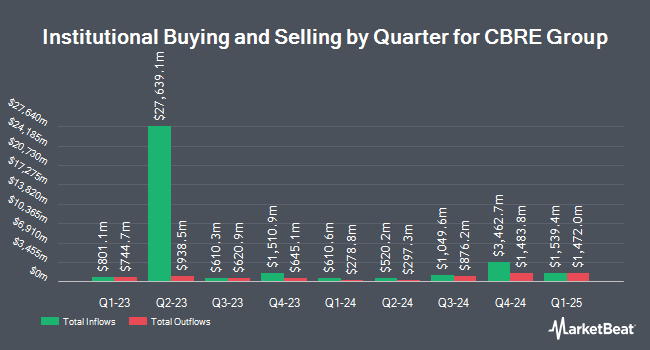

Other large investors have also modified their holdings of the company. Geode Capital Management LLC boosted its stake in CBRE Group by 3.2% during the fourth quarter. Geode Capital Management LLC now owns 7,904,316 shares of the financial services provider's stock worth $1,035,229,000 after buying an additional 245,821 shares during the period. Principal Financial Group Inc. increased its holdings in CBRE Group by 2.4% in the 4th quarter. Principal Financial Group Inc. now owns 7,601,790 shares of the financial services provider's stock valued at $998,039,000 after purchasing an additional 177,119 shares during the last quarter. Cantillon Capital Management LLC increased its holdings in CBRE Group by 0.5% in the 4th quarter. Cantillon Capital Management LLC now owns 4,748,386 shares of the financial services provider's stock valued at $623,416,000 after purchasing an additional 25,142 shares during the last quarter. Franklin Resources Inc. lifted its stake in CBRE Group by 17.3% during the fourth quarter. Franklin Resources Inc. now owns 4,100,770 shares of the financial services provider's stock worth $538,390,000 after purchasing an additional 605,403 shares in the last quarter. Finally, Artisan Partners Limited Partnership boosted its position in shares of CBRE Group by 290.0% during the fourth quarter. Artisan Partners Limited Partnership now owns 4,050,089 shares of the financial services provider's stock worth $531,736,000 after buying an additional 3,011,566 shares during the period. Institutional investors and hedge funds own 98.41% of the company's stock.

CBRE Group Stock Up 1.9 %

Shares of CBRE traded up $2.26 during mid-day trading on Monday, reaching $118.21. The company's stock had a trading volume of 535,253 shares, compared to its average volume of 1,804,306. The company's 50 day moving average is $132.59 and its 200 day moving average is $132.32. The stock has a market cap of $35.45 billion, a PE ratio of 37.65 and a beta of 1.26. CBRE Group, Inc. has a 12-month low of $84.24 and a 12-month high of $147.75. The company has a debt-to-equity ratio of 0.35, a current ratio of 1.07 and a quick ratio of 1.13.

CBRE Group (NYSE:CBRE - Get Free Report) last released its quarterly earnings data on Thursday, February 13th. The financial services provider reported $2.32 earnings per share for the quarter, topping analysts' consensus estimates of $2.20 by $0.12. CBRE Group had a net margin of 2.71% and a return on equity of 16.96%. Equities analysts anticipate that CBRE Group, Inc. will post 5.99 EPS for the current fiscal year.

Insider Activity at CBRE Group

In related news, CFO Emma E. Giamartino sold 2,000 shares of the stock in a transaction on Monday, March 17th. The shares were sold at an average price of $125.69, for a total transaction of $251,380.00. Following the completion of the sale, the chief financial officer now owns 107,343 shares in the company, valued at $13,491,941.67. This represents a 1.83 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Chad J. Doellinger sold 797 shares of the firm's stock in a transaction on Tuesday, March 11th. The stock was sold at an average price of $126.31, for a total transaction of $100,669.07. Following the transaction, the insider now directly owns 28,735 shares in the company, valued at $3,629,517.85. The trade was a 2.70 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.54% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on the company. Morgan Stanley boosted their price objective on CBRE Group from $160.00 to $165.00 and gave the company an "overweight" rating in a report on Wednesday, February 19th. JPMorgan Chase & Co. reduced their price target on shares of CBRE Group from $163.00 to $141.00 and set an "overweight" rating on the stock in a research report on Thursday. Evercore ISI dropped their price objective on shares of CBRE Group from $147.00 to $141.00 and set an "outperform" rating for the company in a report on Monday, January 13th. UBS Group reduced their target price on shares of CBRE Group from $146.00 to $130.00 and set a "neutral" rating on the stock in a report on Friday. Finally, Keefe, Bruyette & Woods boosted their price target on shares of CBRE Group from $142.00 to $145.00 and gave the stock a "market perform" rating in a research note on Friday, February 14th. Three analysts have rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $151.33.

Get Our Latest Stock Analysis on CBRE

About CBRE Group

(

Free Report)

CBRE Group, Inc operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally. The Advisory Services segment offers strategic advice and execution to owners, investors, and occupiers of real estate in connection with leasing of offices, and industrial and retail space; clients fully integrated property sales services under the CBRE Capital Markets brand; clients commercial mortgage and structured financing services; originates and sells commercial mortgage loans; property management services, such as marketing, building engineering, accounting, and financial services on a contractual basis for owners of and investors in office, industrial, and retail properties; and valuation services that include market value appraisals, litigation support, discounted cash flow analyses, and feasibility studies, as well as consulting services, such as property condition reports, hotel advisory, and environmental consulting.

Further Reading

Before you consider CBRE Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBRE Group wasn't on the list.

While CBRE Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report