Legal & General Group Plc cut its holdings in shares of YETI Holdings, Inc. (NYSE:YETI - Free Report) by 9.2% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 135,654 shares of the company's stock after selling 13,738 shares during the period. Legal & General Group Plc owned 0.16% of YETI worth $5,224,000 at the end of the most recent quarter.

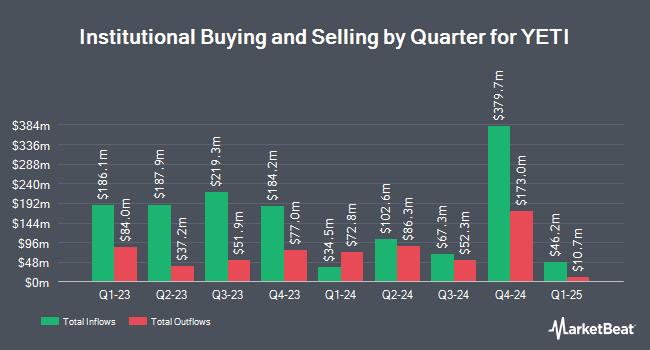

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Norges Bank purchased a new stake in YETI in the fourth quarter valued at approximately $36,778,000. Wellington Management Group LLP boosted its holdings in shares of YETI by 15.9% in the 4th quarter. Wellington Management Group LLP now owns 3,560,485 shares of the company's stock valued at $137,114,000 after acquiring an additional 489,063 shares during the last quarter. Clearbridge Investments LLC acquired a new stake in shares of YETI in the fourth quarter worth $10,767,000. Loomis Sayles & Co. L P purchased a new position in shares of YETI during the fourth quarter worth $9,060,000. Finally, Swedbank AB acquired a new position in YETI during the fourth quarter valued at $7,702,000.

YETI Price Performance

YETI traded up $0.21 on Wednesday, reaching $28.26. 1,838,043 shares of the company's stock were exchanged, compared to its average volume of 1,686,465. The stock has a market cap of $2.34 billion, a PE ratio of 13.72, a P/E/G ratio of 1.05 and a beta of 2.04. The company has a debt-to-equity ratio of 0.10, a current ratio of 2.18 and a quick ratio of 1.36. YETI Holdings, Inc. has a twelve month low of $26.61 and a twelve month high of $45.25. The stock's fifty day moving average price is $33.00 and its 200-day moving average price is $36.88.

YETI (NYSE:YETI - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The company reported $0.87 EPS for the quarter, missing the consensus estimate of $0.93 by ($0.06). The company had revenue of $555.37 million during the quarter, compared to analyst estimates of $554.08 million. YETI had a net margin of 9.60% and a return on equity of 28.23%. Sell-side analysts expect that YETI Holdings, Inc. will post 2.57 EPS for the current year.

Analyst Upgrades and Downgrades

YETI has been the subject of a number of recent research reports. Morgan Stanley reduced their price objective on YETI from $48.00 to $45.00 and set an "equal weight" rating for the company in a research note on Friday, February 14th. Stifel Nicolaus decreased their price target on YETI from $40.00 to $34.00 and set a "hold" rating for the company in a report on Thursday, April 10th. UBS Group dropped their price objective on shares of YETI from $43.00 to $31.00 and set a "neutral" rating on the stock in a research note on Thursday, April 17th. KeyCorp upgraded shares of YETI from an "underweight" rating to a "sector weight" rating in a research report on Thursday, April 17th. Finally, Canaccord Genuity Group decreased their price objective on shares of YETI from $44.00 to $42.00 and set a "hold" rating for the company in a research report on Friday, February 14th. Ten investment analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $42.20.

Check Out Our Latest Report on YETI

YETI Profile

(

Free Report)

YETI Holdings, Inc designs, retails, and distributes products for the outdoor and recreation market under the YETI brand. It offers coolers and equipment, including hard and soft coolers, cargo, bags, outdoor living, and associated accessories, as well as backpacks, duffel bags, luggage, packing cubes, carryalls, camp chairs, blankets, dog beds, dog bowls, and gear cases under the LoadOut, Panga, Crossroads, Camino, Hondo Base, Trailhead, Lowlands, Boomer, and SideKick Dry brands.

Featured Stories

Before you consider YETI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YETI wasn't on the list.

While YETI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.