Legal & General Group Plc lowered its position in Eastman Chemical (NYSE:EMN - Free Report) by 2.9% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,098,183 shares of the basic materials company's stock after selling 32,237 shares during the period. Legal & General Group Plc owned approximately 0.95% of Eastman Chemical worth $100,286,000 as of its most recent filing with the Securities & Exchange Commission.

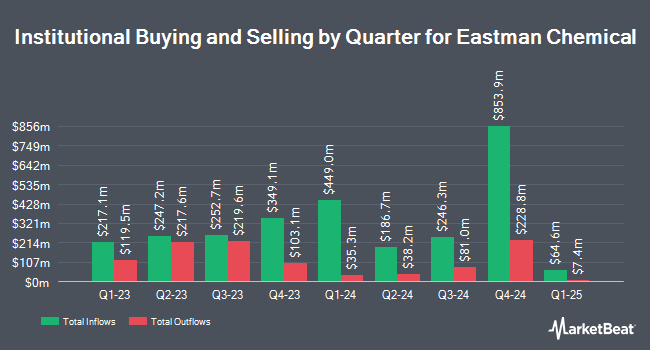

Several other institutional investors and hedge funds have also bought and sold shares of EMN. Private Trust Co. NA lifted its position in Eastman Chemical by 14.0% during the fourth quarter. Private Trust Co. NA now owns 837 shares of the basic materials company's stock valued at $76,000 after purchasing an additional 103 shares during the period. Blue Trust Inc. grew its holdings in Eastman Chemical by 2.2% during the fourth quarter. Blue Trust Inc. now owns 5,505 shares of the basic materials company's stock worth $503,000 after acquiring an additional 116 shares during the period. Picton Mahoney Asset Management boosted its position in Eastman Chemical by 62.3% in the 4th quarter. Picton Mahoney Asset Management now owns 323 shares of the basic materials company's stock worth $29,000 after purchasing an additional 124 shares in the last quarter. Caprock Group LLC increased its holdings in shares of Eastman Chemical by 4.2% during the 4th quarter. Caprock Group LLC now owns 3,196 shares of the basic materials company's stock valued at $295,000 after purchasing an additional 128 shares in the last quarter. Finally, Global Retirement Partners LLC grew its position in Eastman Chemical by 1.4% during the fourth quarter. Global Retirement Partners LLC now owns 9,268 shares of the basic materials company's stock valued at $846,000 after buying an additional 132 shares during the period. 83.65% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on EMN shares. Barclays lowered their price target on Eastman Chemical from $111.00 to $108.00 and set an "equal weight" rating on the stock in a research report on Monday, February 3rd. Mizuho upgraded Eastman Chemical from a "neutral" rating to an "outperform" rating and set a $105.00 price objective on the stock in a report on Thursday, April 3rd. JPMorgan Chase & Co. raised their target price on Eastman Chemical from $110.00 to $112.00 and gave the company an "overweight" rating in a research report on Monday, February 3rd. UBS Group decreased their price objective on Eastman Chemical from $123.00 to $115.00 and set a "buy" rating on the stock in a report on Monday, April 7th. Finally, Royal Bank of Canada upgraded shares of Eastman Chemical from a "sector perform" rating to an "outperform" rating and set a $91.00 price target on the stock in a research report on Wednesday, April 9th. Three investment analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $107.08.

Read Our Latest Stock Analysis on Eastman Chemical

Eastman Chemical Stock Up 0.3 %

NYSE:EMN traded up $0.20 during mid-day trading on Wednesday, hitting $77.88. The stock had a trading volume of 130,178 shares, compared to its average volume of 1,231,444. The company has a current ratio of 1.51, a quick ratio of 0.78 and a debt-to-equity ratio of 0.78. Eastman Chemical has a twelve month low of $70.90 and a twelve month high of $114.50. The company has a market capitalization of $8.97 billion, a PE ratio of 10.14, a PEG ratio of 1.22 and a beta of 1.38. The stock has a 50-day simple moving average of $91.09 and a two-hundred day simple moving average of $96.76.

Eastman Chemical (NYSE:EMN - Get Free Report) last released its quarterly earnings data on Thursday, January 30th. The basic materials company reported $1.87 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.60 by $0.27. Eastman Chemical had a net margin of 9.65% and a return on equity of 16.27%. On average, equities research analysts anticipate that Eastman Chemical will post 8.55 EPS for the current year.

Eastman Chemical Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, April 7th. Stockholders of record on Friday, March 14th were issued a $0.83 dividend. The ex-dividend date was Friday, March 14th. This represents a $3.32 dividend on an annualized basis and a dividend yield of 4.26%. Eastman Chemical's payout ratio is currently 43.23%.

About Eastman Chemical

(

Free Report)

Eastman Chemical Company operates as a specialty materials company in the United States, China, and internationally. The company's Additives & Functional Products segment offers amine derivative-based building blocks, intermediates for surfactants, metam-based soil fumigants, and organic acid-based solutions; specialty coalescent and solvents, paint additives, and specialty polymers; and heat transfer and aviation fluids.

Featured Articles

Before you consider Eastman Chemical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eastman Chemical wasn't on the list.

While Eastman Chemical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.