Legal & General Group Plc cut its position in shares of Zoom Video Communications, Inc. (NASDAQ:ZM - Free Report) by 22.5% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 1,785,358 shares of the company's stock after selling 517,519 shares during the period. Legal & General Group Plc owned approximately 0.58% of Zoom Video Communications worth $145,703,000 at the end of the most recent quarter.

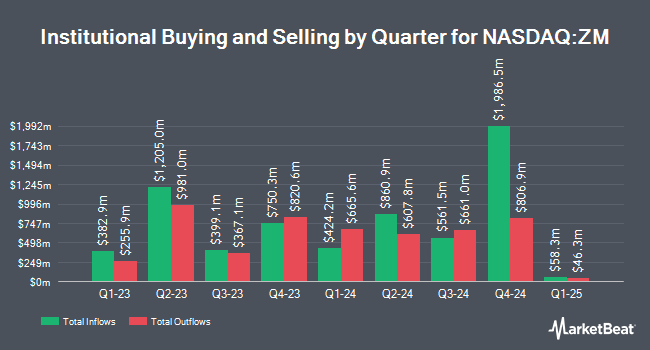

Several other hedge funds also recently added to or reduced their stakes in ZM. HighTower Advisors LLC grew its stake in shares of Zoom Video Communications by 449.4% during the third quarter. HighTower Advisors LLC now owns 63,618 shares of the company's stock valued at $4,429,000 after buying an additional 52,039 shares during the last quarter. Merit Financial Group LLC bought a new position in Zoom Video Communications in the 4th quarter valued at $1,072,000. Nordea Investment Management AB increased its stake in Zoom Video Communications by 202.8% in the fourth quarter. Nordea Investment Management AB now owns 779,051 shares of the company's stock worth $64,054,000 after purchasing an additional 521,778 shares during the period. Tri Ri Asset Management Corp purchased a new position in shares of Zoom Video Communications during the third quarter worth approximately $2,676,000. Finally, Retirement Systems of Alabama grew its position in shares of Zoom Video Communications by 48.1% during the 3rd quarter. Retirement Systems of Alabama now owns 903,797 shares of the company's stock worth $63,031,000 after buying an additional 293,375 shares in the last quarter. 66.54% of the stock is currently owned by institutional investors.

Zoom Video Communications Stock Performance

Shares of ZM stock traded up $0.97 during midday trading on Monday, reaching $72.31. 1,158,829 shares of the company were exchanged, compared to its average volume of 3,096,871. The company's 50 day moving average price is $76.77 and its two-hundred day moving average price is $78.49. The company has a market cap of $22.07 billion, a P/E ratio of 24.10, a PEG ratio of 5.48 and a beta of 0.67. Zoom Video Communications, Inc. has a 12 month low of $55.06 and a 12 month high of $92.80.

Insider Buying and Selling

In other Zoom Video Communications news, Director Santiago Subotovsky sold 2,475 shares of the company's stock in a transaction dated Monday, March 24th. The stock was sold at an average price of $77.86, for a total value of $192,703.50. Following the transaction, the director now directly owns 169,452 shares of the company's stock, valued at $13,193,532.72. This represents a 1.44 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Eric S. Yuan sold 83,332 shares of the firm's stock in a transaction dated Tuesday, February 4th. The stock was sold at an average price of $86.28, for a total value of $7,189,884.96. The disclosure for this sale can be found here. Insiders have sold a total of 198,413 shares of company stock valued at $16,009,889 over the last three months. Company insiders own 10.78% of the company's stock.

Analysts Set New Price Targets

ZM has been the topic of a number of recent analyst reports. Morgan Stanley raised their price target on shares of Zoom Video Communications from $86.00 to $96.00 and gave the company an "equal weight" rating in a report on Wednesday, December 18th. Benchmark reissued a "buy" rating and issued a $97.00 price objective on shares of Zoom Video Communications in a report on Tuesday, February 25th. Scotiabank cut their price objective on shares of Zoom Video Communications from $85.00 to $75.00 and set a "sector perform" rating for the company in a report on Monday, March 17th. Stifel Nicolaus lowered their price target on Zoom Video Communications from $90.00 to $85.00 and set a "hold" rating for the company in a report on Tuesday, February 25th. Finally, Cantor Fitzgerald reissued a "neutral" rating and set a $87.00 price target on shares of Zoom Video Communications in a research report on Tuesday, February 25th. Fifteen equities research analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $89.33.

Check Out Our Latest Analysis on Zoom Video Communications

Zoom Video Communications Profile

(

Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Featured Articles

Before you consider Zoom Video Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Video Communications wasn't on the list.

While Zoom Video Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.