Legal & General Group Plc reduced its holdings in Global-E Online Ltd. (NASDAQ:GLBE - Free Report) by 12.9% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 452,029 shares of the company's stock after selling 67,052 shares during the quarter. Legal & General Group Plc owned about 0.28% of Global-E Online worth $24,649,000 at the end of the most recent quarter.

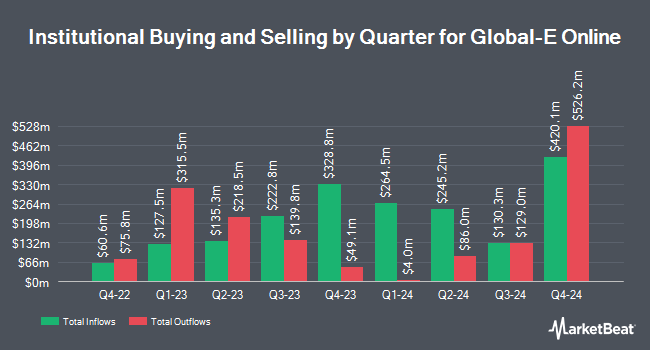

A number of other institutional investors have also recently modified their holdings of GLBE. Fifth Third Bancorp lifted its holdings in Global-E Online by 69.1% in the fourth quarter. Fifth Third Bancorp now owns 482 shares of the company's stock valued at $26,000 after acquiring an additional 197 shares during the period. Geneos Wealth Management Inc. increased its holdings in shares of Global-E Online by 1,968.4% in the 4th quarter. Geneos Wealth Management Inc. now owns 786 shares of the company's stock valued at $43,000 after purchasing an additional 748 shares in the last quarter. Arcadia Investment Management Corp MI purchased a new stake in Global-E Online during the fourth quarter worth about $59,000. Whipplewood Advisors LLC acquired a new position in Global-E Online during the fourth quarter worth about $65,000. Finally, SBI Securities Co. Ltd. purchased a new position in Global-E Online in the fourth quarter valued at about $99,000. 94.60% of the stock is currently owned by hedge funds and other institutional investors.

Global-E Online Price Performance

NASDAQ GLBE traded up $0.44 on Friday, reaching $32.44. The company had a trading volume of 2,902,584 shares, compared to its average volume of 1,380,445. The firm has a market capitalization of $5.49 billion, a PE ratio of -73.73, a P/E/G ratio of 4.61 and a beta of 1.36. The firm has a 50-day moving average of $40.41 and a 200-day moving average of $46.00. Global-E Online Ltd. has a 1 year low of $26.64 and a 1 year high of $63.69.

Global-E Online (NASDAQ:GLBE - Get Free Report) last announced its earnings results on Wednesday, February 19th. The company reported $0.01 earnings per share for the quarter, beating the consensus estimate of ($0.01) by $0.02. Global-E Online had a negative return on equity of 8.56% and a negative net margin of 10.04%. The company had revenue of $262.91 million during the quarter, compared to the consensus estimate of $250.96 million. During the same period last year, the firm earned $0.22 earnings per share. The company's revenue was up 41.8% on a year-over-year basis. As a group, sell-side analysts expect that Global-E Online Ltd. will post 0.25 EPS for the current fiscal year.

Analyst Ratings Changes

Several analysts have weighed in on GLBE shares. Wells Fargo & Company lowered their target price on Global-E Online from $60.00 to $54.00 and set an "overweight" rating on the stock in a report on Wednesday, March 5th. Piper Sandler increased their target price on Global-E Online from $63.00 to $66.00 and gave the stock an "overweight" rating in a research report on Monday, January 6th. The Goldman Sachs Group decreased their price target on shares of Global-E Online from $59.00 to $47.00 and set a "buy" rating on the stock in a report on Wednesday, April 2nd. Benchmark dropped their price objective on Global-E Online from $68.00 to $64.00 and set a "buy" rating for the company in a report on Thursday, February 20th. Finally, KeyCorp increased their target price on Global-E Online from $55.00 to $65.00 and gave the stock an "overweight" rating in a research report on Monday, February 10th. Twelve research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $57.00.

Check Out Our Latest Report on Global-E Online

About Global-E Online

(

Free Report)

Global-E Online Ltd., together with its subsidiaries, provides a platform to enable and accelerate direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally. Its platform enables international shoppers to buy online and merchants to sell from, and to, worldwide.

Featured Articles

Before you consider Global-E Online, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global-E Online wasn't on the list.

While Global-E Online currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.