Legal & General Group Plc lessened its position in Imperial Oil Limited (NYSEAMERICAN:IMO - Free Report) TSE: IMO by 32.0% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 806,794 shares of the energy company's stock after selling 379,707 shares during the quarter. Legal & General Group Plc owned 0.16% of Imperial Oil worth $49,697,000 at the end of the most recent reporting period.

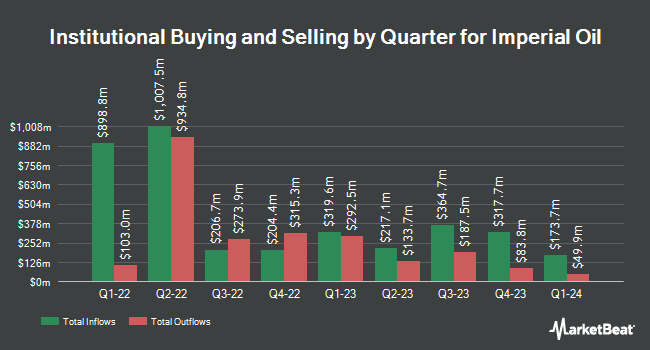

Other large investors have also recently made changes to their positions in the company. FMR LLC increased its stake in Imperial Oil by 16.9% in the fourth quarter. FMR LLC now owns 43,162,088 shares of the energy company's stock worth $2,659,965,000 after purchasing an additional 6,228,461 shares during the period. Geode Capital Management LLC increased its stake in Imperial Oil by 29.0% in the 4th quarter. Geode Capital Management LLC now owns 1,086,840 shares of the energy company's stock worth $67,634,000 after buying an additional 244,176 shares during the period. JPMorgan Chase & Co. lifted its holdings in Imperial Oil by 29.0% during the 4th quarter. JPMorgan Chase & Co. now owns 945,002 shares of the energy company's stock valued at $58,212,000 after buying an additional 212,707 shares in the last quarter. Guardian Partners Inc. purchased a new stake in Imperial Oil in the 4th quarter valued at about $10,890,000. Finally, Raymond James Financial Inc. bought a new position in Imperial Oil in the 4th quarter worth about $7,982,000. 20.74% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on the stock. The Goldman Sachs Group downgraded shares of Imperial Oil from a "neutral" rating to a "sell" rating in a research note on Thursday, March 27th. JPMorgan Chase & Co. lowered Imperial Oil from a "neutral" rating to an "underweight" rating in a research report on Thursday, December 19th. Wolfe Research downgraded Imperial Oil from an "outperform" rating to a "peer perform" rating in a research report on Friday, January 3rd. Royal Bank of Canada restated a "sector perform" rating and set a $101.00 price target on shares of Imperial Oil in a research note on Thursday, April 3rd. Finally, Raymond James raised shares of Imperial Oil from a "market perform" rating to an "outperform" rating in a research note on Wednesday, April 9th. Two investment analysts have rated the stock with a sell rating, four have given a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat, Imperial Oil has an average rating of "Hold" and a consensus target price of $106.33.

View Our Latest Stock Analysis on IMO

Imperial Oil Stock Down 2.0 %

Shares of NYSEAMERICAN IMO traded down $1.25 during mid-day trading on Tuesday, reaching $60.95. 378,728 shares of the company were exchanged, compared to its average volume of 442,340. The firm has a 50-day moving average of $68.04 and a 200 day moving average of $69.93. Imperial Oil Limited has a 1 year low of $58.76 and a 1 year high of $80.17. The company has a quick ratio of 1.23, a current ratio of 1.34 and a debt-to-equity ratio of 0.17. The stock has a market cap of $31.03 billion, a price-to-earnings ratio of 9.25 and a beta of 1.44.

Imperial Oil Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, April 1st. Stockholders of record on Wednesday, March 5th were issued a $0.4972 dividend. This is a boost from Imperial Oil's previous quarterly dividend of $0.43. This represents a $1.99 dividend on an annualized basis and a dividend yield of 3.26%. The ex-dividend date of this dividend was Wednesday, March 5th. Imperial Oil's dividend payout ratio (DPR) is currently 25.80%.

Imperial Oil Profile

(

Free Report)

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

Further Reading

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.