Legato Capital Management LLC lifted its stake in Texas Roadhouse, Inc. (NASDAQ:TXRH - Free Report) by 230.4% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 8,009 shares of the restaurant operator's stock after acquiring an additional 5,585 shares during the quarter. Legato Capital Management LLC's holdings in Texas Roadhouse were worth $1,445,000 as of its most recent filing with the Securities and Exchange Commission.

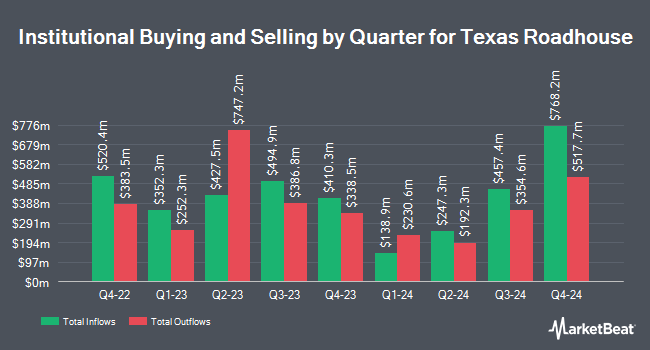

A number of other hedge funds have also modified their holdings of TXRH. True Wealth Design LLC acquired a new position in shares of Texas Roadhouse in the third quarter worth $30,000. Mirae Asset Global Investments Co. Ltd. bought a new stake in Texas Roadhouse in the fourth quarter worth $30,000. PSI Advisors LLC boosted its holdings in Texas Roadhouse by 70.8% in the third quarter. PSI Advisors LLC now owns 181 shares of the restaurant operator's stock worth $32,000 after purchasing an additional 75 shares in the last quarter. MassMutual Private Wealth & Trust FSB boosted its holdings in Texas Roadhouse by 32.2% in the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 267 shares of the restaurant operator's stock worth $48,000 after purchasing an additional 65 shares in the last quarter. Finally, First Horizon Advisors Inc. boosted its holdings in Texas Roadhouse by 158.1% in the third quarter. First Horizon Advisors Inc. now owns 302 shares of the restaurant operator's stock worth $53,000 after purchasing an additional 185 shares in the last quarter. 94.82% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other news, insider Christopher C. Colson sold 1,370 shares of the company's stock in a transaction dated Friday, January 10th. The shares were sold at an average price of $179.46, for a total value of $245,860.20. Following the sale, the insider now directly owns 10,000 shares of the company's stock, valued at approximately $1,794,600. This represents a 12.05 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 0.50% of the company's stock.

Analysts Set New Price Targets

TXRH has been the subject of a number of recent research reports. Robert W. Baird upped their price objective on shares of Texas Roadhouse from $190.00 to $205.00 and gave the stock an "outperform" rating in a report on Friday, October 25th. Bank of America upped their price objective on shares of Texas Roadhouse from $206.00 to $234.00 and gave the stock a "buy" rating in a report on Tuesday, October 22nd. Royal Bank of Canada reiterated a "sector perform" rating and issued a $200.00 price objective on shares of Texas Roadhouse in a report on Thursday, January 16th. Morgan Stanley upgraded shares of Texas Roadhouse from an "equal weight" rating to an "overweight" rating and upped their price objective for the stock from $205.00 to $213.00 in a report on Tuesday, January 21st. Finally, Wedbush restated an "outperform" rating and set a $200.00 price target on shares of Texas Roadhouse in a report on Thursday, December 19th. Thirteen investment analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $190.83.

Read Our Latest Stock Report on Texas Roadhouse

Texas Roadhouse Stock Performance

TXRH traded up $0.27 during trading on Friday, reaching $171.70. 1,059,207 shares of the company's stock were exchanged, compared to its average volume of 885,523. The company's fifty day moving average price is $181.04 and its 200-day moving average price is $180.02. Texas Roadhouse, Inc. has a fifty-two week low of $132.28 and a fifty-two week high of $206.04. The firm has a market capitalization of $11.45 billion, a PE ratio of 29.50, a P/E/G ratio of 1.28 and a beta of 1.02.

Texas Roadhouse Profile

(

Free Report)

Texas Roadhouse, Inc, together with its subsidiaries, operates casual dining restaurants in the United States and internationally. It also operates and franchises restaurants under the Texas Roadhouse, Bubba's 33, and Jaggers names in 49 states and ten internationally. Texas Roadhouse, Inc was founded in 1993 and is based in Louisville, Kentucky.

Featured Articles

Before you consider Texas Roadhouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Roadhouse wasn't on the list.

While Texas Roadhouse currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.