Legato Capital Management LLC acquired a new position in shares of BILL Holdings, Inc. (NYSE:BILL - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 9,780 shares of the company's stock, valued at approximately $828,000.

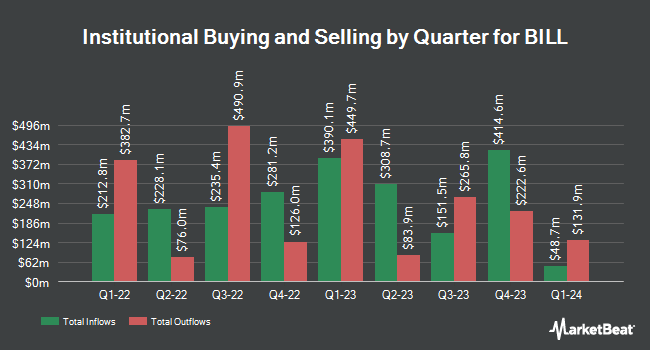

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Abdiel Capital Advisors LP grew its holdings in shares of BILL by 48.2% during the 3rd quarter. Abdiel Capital Advisors LP now owns 5,121,139 shares of the company's stock worth $270,191,000 after purchasing an additional 1,666,316 shares during the period. Charles Schwab Investment Management Inc. lifted its holdings in shares of BILL by 45.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 895,833 shares of the company's stock valued at $47,264,000 after acquiring an additional 279,256 shares in the last quarter. Two Sigma Advisers LP boosted its position in BILL by 87.0% during the 3rd quarter. Two Sigma Advisers LP now owns 690,800 shares of the company's stock worth $36,447,000 after purchasing an additional 321,400 shares during the period. Assenagon Asset Management S.A. raised its position in BILL by 297.7% in the third quarter. Assenagon Asset Management S.A. now owns 380,640 shares of the company's stock valued at $20,083,000 after purchasing an additional 284,935 shares during the period. Finally, Iridian Asset Management LLC CT lifted its stake in shares of BILL by 26.9% during the third quarter. Iridian Asset Management LLC CT now owns 294,668 shares of the company's stock worth $15,547,000 after purchasing an additional 62,499 shares in the last quarter. Hedge funds and other institutional investors own 97.99% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on BILL shares. Robert W. Baird increased their price objective on shares of BILL from $74.00 to $100.00 and gave the company a "neutral" rating in a research report on Tuesday, December 3rd. Susquehanna raised their price target on shares of BILL from $91.00 to $100.00 and gave the company a "positive" rating in a report on Tuesday, January 7th. Mizuho boosted their price objective on shares of BILL from $64.00 to $75.00 and gave the stock a "neutral" rating in a report on Friday, December 13th. Piper Sandler reissued an "overweight" rating and issued a $85.00 price objective on shares of BILL in a research report on Friday, February 7th. Finally, Oppenheimer dropped their target price on BILL from $110.00 to $90.00 and set an "outperform" rating on the stock in a research report on Friday, February 7th. One analyst has rated the stock with a sell rating, seven have given a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $81.72.

Read Our Latest Stock Report on BILL

BILL Stock Performance

BILL stock traded down $1.08 during trading on Monday, hitting $59.80. 4,694,181 shares of the company's stock traded hands, compared to its average volume of 2,205,951. The stock has a market capitalization of $6.19 billion, a price-to-earnings ratio of -5,980.20, a price-to-earnings-growth ratio of 157.98 and a beta of 1.76. BILL Holdings, Inc. has a 52 week low of $43.11 and a 52 week high of $100.19. The stock has a fifty day moving average price of $85.18 and a two-hundred day moving average price of $70.06. The company has a quick ratio of 1.53, a current ratio of 1.53 and a debt-to-equity ratio of 0.23.

BILL (NYSE:BILL - Get Free Report) last released its quarterly earnings data on Thursday, February 6th. The company reported $0.05 earnings per share for the quarter, missing the consensus estimate of $0.43 by ($0.38). BILL had a return on equity of 1.50% and a net margin of 5.90%. As a group, equities analysts anticipate that BILL Holdings, Inc. will post 0.04 EPS for the current fiscal year.

About BILL

(

Free Report)

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.

Read More

Before you consider BILL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BILL wasn't on the list.

While BILL currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.