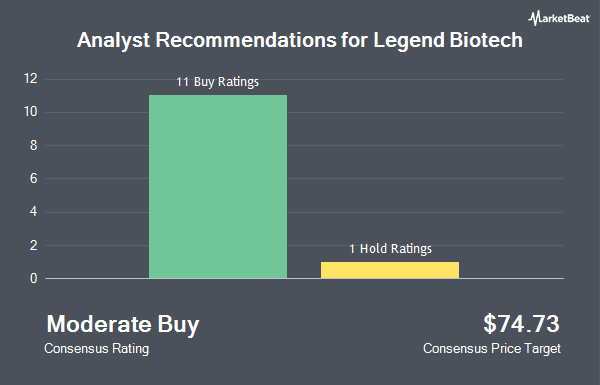

Legend Biotech Co. (NASDAQ:LEGN - Get Free Report) has been assigned an average recommendation of "Buy" from the thirteen research firms that are covering the firm, Marketbeat.com reports. Thirteen equities research analysts have rated the stock with a buy rating. The average 12-month target price among brokerages that have issued ratings on the stock in the last year is $81.54.

Several research firms have issued reports on LEGN. HC Wainwright restated a "buy" rating and set a $73.00 price objective on shares of Legend Biotech in a report on Tuesday, December 10th. Royal Bank of Canada restated an "outperform" rating and set a $86.00 price target on shares of Legend Biotech in a report on Monday, December 9th. Cantor Fitzgerald restated an "overweight" rating and issued a $83.00 price target on shares of Legend Biotech in a research report on Monday, December 9th. Finally, Redburn Atlantic began coverage on shares of Legend Biotech in a research report on Tuesday, October 8th. They set a "buy" rating and a $86.00 price objective on the stock.

View Our Latest Stock Report on LEGN

Legend Biotech Price Performance

Legend Biotech stock traded down $0.37 during mid-day trading on Friday, hitting $35.12. The company's stock had a trading volume of 893,610 shares, compared to its average volume of 1,128,587. The stock has a market capitalization of $6.41 billion, a P/E ratio of -36.97 and a beta of 0.08. Legend Biotech has a twelve month low of $34.95 and a twelve month high of $70.13. The stock's fifty day moving average price is $42.68 and its two-hundred day moving average price is $47.80. The company has a quick ratio of 4.90, a current ratio of 4.98 and a debt-to-equity ratio of 0.27.

Legend Biotech (NASDAQ:LEGN - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported ($0.34) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.56) by $0.22. Legend Biotech had a negative return on equity of 29.69% and a negative net margin of 66.92%. The business had revenue of $160.20 million for the quarter, compared to analysts' expectations of $143.91 million. During the same period in the previous year, the firm posted ($0.17) EPS. The company's quarterly revenue was up 66.9% on a year-over-year basis. Research analysts forecast that Legend Biotech will post -1.23 earnings per share for the current year.

Hedge Funds Weigh In On Legend Biotech

A number of hedge funds have recently modified their holdings of the stock. Westfield Capital Management Co. LP grew its stake in Legend Biotech by 5.6% in the third quarter. Westfield Capital Management Co. LP now owns 5,038,505 shares of the company's stock valued at $245,526,000 after purchasing an additional 266,296 shares in the last quarter. Hsbc Holdings PLC lifted its holdings in shares of Legend Biotech by 9.9% during the 2nd quarter. Hsbc Holdings PLC now owns 232,560 shares of the company's stock valued at $10,296,000 after buying an additional 20,910 shares during the last quarter. Empire Life Investments Inc. grew its stake in shares of Legend Biotech by 75.2% in the 3rd quarter. Empire Life Investments Inc. now owns 98,688 shares of the company's stock valued at $4,809,000 after buying an additional 42,368 shares in the last quarter. Vestal Point Capital LP bought a new stake in shares of Legend Biotech in the 3rd quarter valued at approximately $6,091,000. Finally, XTX Topco Ltd acquired a new position in Legend Biotech in the third quarter worth approximately $1,840,000. 70.89% of the stock is owned by institutional investors and hedge funds.

Legend Biotech Company Profile

(

Get Free ReportLegend Biotech Corporation, a clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally. Its lead product candidate, LCAR- B38M, is a chimeric antigen receptor for the treatment of multiple myeloma (MM).

Further Reading

Before you consider Legend Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legend Biotech wasn't on the list.

While Legend Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.