HC Wainwright restated their buy rating on shares of Legend Biotech (NASDAQ:LEGN - Free Report) in a report issued on Tuesday,Benzinga reports. HC Wainwright currently has a $73.00 price target on the stock.

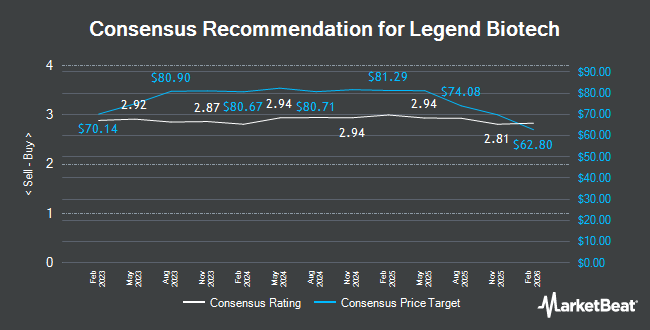

LEGN has been the topic of several other reports. Cantor Fitzgerald reiterated an "overweight" rating and set a $83.00 price objective on shares of Legend Biotech in a report on Monday. Scotiabank increased their price objective on shares of Legend Biotech from $70.00 to $76.00 and gave the stock a "sector outperform" rating in a report on Monday, August 12th. Redburn Atlantic started coverage on shares of Legend Biotech in a report on Tuesday, October 8th. They issued a "buy" rating and a $86.00 price target on the stock. Finally, Royal Bank of Canada restated an "outperform" rating and issued a $86.00 price target on shares of Legend Biotech in a report on Monday. Thirteen investment analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $81.54.

Read Our Latest Stock Analysis on LEGN

Legend Biotech Trading Down 9.0 %

Shares of Legend Biotech stock traded down $3.73 during mid-day trading on Tuesday, hitting $37.90. 2,312,725 shares of the stock were exchanged, compared to its average volume of 1,124,300. Legend Biotech has a twelve month low of $36.92 and a twelve month high of $70.13. The stock has a market capitalization of $6.95 billion, a price-to-earnings ratio of -40.97 and a beta of 0.08. The company has a 50-day simple moving average of $43.65 and a 200 day simple moving average of $47.96. The company has a current ratio of 4.98, a quick ratio of 4.90 and a debt-to-equity ratio of 0.27.

Legend Biotech (NASDAQ:LEGN - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported ($0.34) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.56) by $0.22. The company had revenue of $160.20 million for the quarter, compared to analysts' expectations of $143.91 million. Legend Biotech had a negative net margin of 66.92% and a negative return on equity of 29.69%. The firm's revenue for the quarter was up 66.9% compared to the same quarter last year. During the same period last year, the company earned ($0.17) EPS. Research analysts forecast that Legend Biotech will post -1.23 EPS for the current year.

Institutional Trading of Legend Biotech

Hedge funds have recently made changes to their positions in the stock. Franklin Resources Inc. acquired a new position in Legend Biotech in the third quarter worth $12,837,000. Geode Capital Management LLC boosted its holdings in Legend Biotech by 3.6% in the third quarter. Geode Capital Management LLC now owns 494,864 shares of the company's stock worth $23,933,000 after purchasing an additional 17,337 shares during the period. Public Employees Retirement System of Ohio acquired a new position in Legend Biotech in the third quarter worth $229,000. Groupama Asset Managment boosted its holdings in Legend Biotech by 20.2% in the third quarter. Groupama Asset Managment now owns 27,374 shares of the company's stock worth $1,329,000 after purchasing an additional 4,592 shares during the period. Finally, Y Intercept Hong Kong Ltd acquired a new position in Legend Biotech in the third quarter worth $458,000. Institutional investors and hedge funds own 70.89% of the company's stock.

Legend Biotech Company Profile

(

Get Free Report)

Legend Biotech Corporation, a clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally. Its lead product candidate, LCAR- B38M, is a chimeric antigen receptor for the treatment of multiple myeloma (MM).

Featured Articles

Before you consider Legend Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legend Biotech wasn't on the list.

While Legend Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.