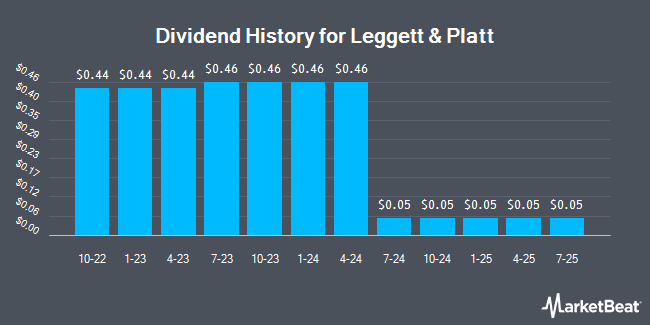

Leggett & Platt, Incorporated (NYSE:LEG - Get Free Report) declared a quarterly dividend on Thursday, November 7th,RTT News reports. Shareholders of record on Friday, December 13th will be paid a dividend of 0.05 per share on Monday, January 15th. This represents a $0.20 dividend on an annualized basis and a yield of 1.66%.

Leggett & Platt has increased its dividend by an average of 4.4% per year over the last three years. Leggett & Platt has a payout ratio of 16.8% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Leggett & Platt to earn $1.19 per share next year, which means the company should continue to be able to cover its $0.20 annual dividend with an expected future payout ratio of 16.8%.

Leggett & Platt Stock Performance

Shares of LEG stock traded down $0.17 on Thursday, reaching $12.05. The stock had a trading volume of 798,865 shares, compared to its average volume of 2,295,161. Leggett & Platt has a 1 year low of $10.11 and a 1 year high of $27.58. The stock has a market cap of $1.62 billion, a P/E ratio of -2.03 and a beta of 1.07. The company has a debt-to-equity ratio of 2.13, a quick ratio of 0.84 and a current ratio of 1.48. The company has a 50 day simple moving average of $12.75 and a 200 day simple moving average of $12.63.

Leggett & Platt (NYSE:LEG - Get Free Report) last issued its quarterly earnings data on Monday, October 28th. The company reported $0.32 EPS for the quarter, missing analysts' consensus estimates of $0.33 by ($0.01). The business had revenue of $1.10 billion during the quarter, compared to analysts' expectations of $1.10 billion. Leggett & Platt had a positive return on equity of 14.99% and a negative net margin of 18.53%. The business's quarterly revenue was down 6.3% on a year-over-year basis. During the same period in the previous year, the business earned $0.36 earnings per share. Equities research analysts expect that Leggett & Platt will post 1.04 EPS for the current year.

Analyst Ratings Changes

Several analysts have recently commented on LEG shares. Truist Financial upped their price objective on shares of Leggett & Platt from $11.00 to $13.00 and gave the company a "hold" rating in a report on Monday, August 5th. StockNews.com raised shares of Leggett & Platt from a "sell" rating to a "hold" rating in a research note on Wednesday, August 28th. Piper Sandler raised Leggett & Platt from an "underweight" rating to a "neutral" rating and boosted their target price for the stock from $11.00 to $13.00 in a research note on Wednesday, October 30th. Finally, The Goldman Sachs Group cut their target price on shares of Leggett & Platt from $14.00 to $12.00 and set a "neutral" rating on the stock in a research note on Wednesday, July 10th. Four research analysts have rated the stock with a hold rating, Based on data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $12.67.

Get Our Latest Stock Report on Leggett & Platt

Leggett & Platt Company Profile

(

Get Free Report)

Leggett & Platt, Incorporated designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally. It operates through three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products. The company offers steel rods, drawn wires, specialty foam chemicals and additives, innersprings, specialty foam for use in bedding and furniture, private label finished mattresses, ready-to-assemble mattress foundations, static foundations, and adjustable beds, as well as machines for producing innersprings; industrial sewing and quilting machines; mattress-packaging; and glue-drying equipment for various industrial users of steel rod and wire, manufacturers of finished bedding, bedding brands and mattress retailers, E-commerce retailers, big box retailers, department stores, and home improvement centers.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Leggett & Platt, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leggett & Platt wasn't on the list.

While Leggett & Platt currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.