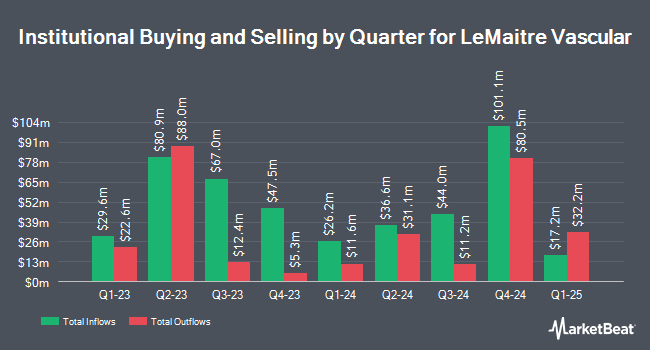

DF Dent & Co. Inc. lowered its position in shares of LeMaitre Vascular, Inc. (NASDAQ:LMAT - Free Report) by 26.4% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 190,362 shares of the medical instruments supplier's stock after selling 68,405 shares during the quarter. DF Dent & Co. Inc. owned approximately 0.85% of LeMaitre Vascular worth $17,540,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also made changes to their positions in the company. Raymond James Financial Inc. acquired a new position in shares of LeMaitre Vascular during the 4th quarter worth approximately $14,900,000. Segall Bryant & Hamill LLC acquired a new position in shares of LeMaitre Vascular during the 4th quarter valued at about $5,446,000. JPMorgan Chase & Co. raised its stake in LeMaitre Vascular by 45.9% during the fourth quarter. JPMorgan Chase & Co. now owns 147,489 shares of the medical instruments supplier's stock worth $13,590,000 after purchasing an additional 46,430 shares during the period. Barclays PLC boosted its holdings in LeMaitre Vascular by 394.5% in the 3rd quarter. Barclays PLC now owns 36,577 shares of the medical instruments supplier's stock valued at $3,396,000 after purchasing an additional 29,180 shares during the last quarter. Finally, State Street Corp raised its position in shares of LeMaitre Vascular by 3.6% during the 3rd quarter. State Street Corp now owns 822,085 shares of the medical instruments supplier's stock valued at $76,363,000 after buying an additional 28,525 shares during the period. Hedge funds and other institutional investors own 84.64% of the company's stock.

LeMaitre Vascular Trading Up 0.5 %

Shares of NASDAQ LMAT traded up $0.39 during midday trading on Tuesday, reaching $79.78. 51,221 shares of the company were exchanged, compared to its average volume of 156,922. The stock has a fifty day simple moving average of $91.22 and a 200 day simple moving average of $94.15. The stock has a market cap of $1.80 billion, a P/E ratio of 43.62, a PEG ratio of 2.22 and a beta of 0.89. LeMaitre Vascular, Inc. has a 1 year low of $62.39 and a 1 year high of $109.58.

LeMaitre Vascular (NASDAQ:LMAT - Get Free Report) last released its quarterly earnings results on Thursday, February 27th. The medical instruments supplier reported $0.49 EPS for the quarter, hitting the consensus estimate of $0.49. LeMaitre Vascular had a return on equity of 13.15% and a net margin of 19.40%. The business had revenue of $55.81 million during the quarter, compared to analysts' expectations of $55.99 million. As a group, analysts forecast that LeMaitre Vascular, Inc. will post 1.94 earnings per share for the current year.

LeMaitre Vascular Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, March 27th. Investors of record on Thursday, March 13th were given a $0.20 dividend. The ex-dividend date was Thursday, March 13th. This represents a $0.80 dividend on an annualized basis and a yield of 1.00%. This is an increase from LeMaitre Vascular's previous quarterly dividend of $0.16. LeMaitre Vascular's dividend payout ratio (DPR) is presently 41.24%.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on LMAT. Wells Fargo & Company started coverage on LeMaitre Vascular in a research note on Thursday, February 13th. They issued an "equal weight" rating and a $95.00 price target on the stock. StockNews.com downgraded shares of LeMaitre Vascular from a "buy" rating to a "hold" rating in a research note on Friday, December 13th. Barrington Research downgraded shares of LeMaitre Vascular from an "outperform" rating to a "market perform" rating in a report on Friday, February 28th. Lake Street Capital raised their price target on LeMaitre Vascular from $105.00 to $110.00 and gave the stock a "buy" rating in a research report on Friday, February 28th. Finally, Oppenheimer cut LeMaitre Vascular from an "outperform" rating to a "market perform" rating in a report on Friday, February 28th. Five investment analysts have rated the stock with a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $95.25.

Check Out Our Latest Research Report on LMAT

Insider Buying and Selling at LeMaitre Vascular

In other news, insider Trent G. Kamke sold 2,009 shares of the stock in a transaction dated Wednesday, March 12th. The shares were sold at an average price of $82.12, for a total value of $164,979.08. Following the completion of the transaction, the insider now owns 5,564 shares in the company, valued at $456,915.68. This trade represents a 26.53 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 10.79% of the stock is owned by corporate insiders.

LeMaitre Vascular Company Profile

(

Free Report)

LeMaitre Vascular, Inc develops, manufactures, and markets medical devices and implants used in the field of vascular surgery worldwide. It offers human cadaver tissue cryopreservation services; angioscope, a fiberoptic catheter used for viewing the lumen of a blood vessel; embolectomy catheters to remove blood clots from arteries; thrombectomy catheters for removing thrombi in the venous system; occlusion catheters that temporarily occlude the blood flow; and perfusion catheters to perfuse the blood and other fluids into the vasculature.

See Also

Before you consider LeMaitre Vascular, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LeMaitre Vascular wasn't on the list.

While LeMaitre Vascular currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.