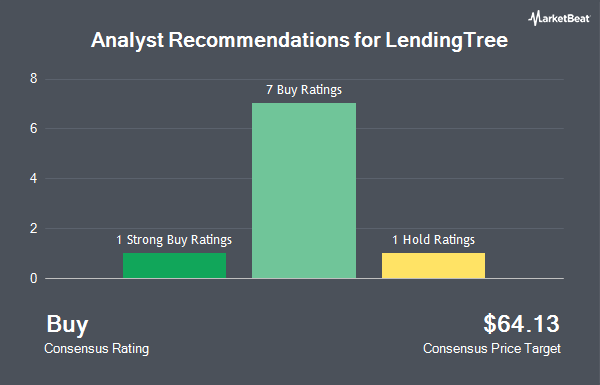

LendingTree, Inc. (NASDAQ:TREE - Get Free Report) has been given an average rating of "Buy" by the nine brokerages that are currently covering the company, MarketBeat Ratings reports. One research analyst has rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company. The average 12 month target price among analysts that have updated their coverage on the stock in the last year is $65.75.

Several brokerages recently issued reports on TREE. Northland Securities upgraded LendingTree from a "market perform" rating to an "outperform" rating and set a $60.00 price target on the stock in a research report on Tuesday, January 21st. JPMorgan Chase & Co. lifted their price objective on shares of LendingTree from $65.00 to $68.00 and gave the company an "overweight" rating in a research report on Thursday, March 6th. Stephens restated an "overweight" rating and issued a $69.00 target price on shares of LendingTree in a research note on Thursday, March 6th. StockNews.com cut shares of LendingTree from a "strong-buy" rating to a "buy" rating in a report on Tuesday, April 8th. Finally, Northland Capmk raised LendingTree from a "hold" rating to a "strong-buy" rating in a report on Tuesday, January 21st.

View Our Latest Stock Report on TREE

Insider Buying and Selling

In other news, COO Scott Peyree bought 9,794 shares of the stock in a transaction on Thursday, March 13th. The shares were bought at an average price of $46.13 per share, with a total value of $451,797.22. Following the completion of the acquisition, the chief operating officer now owns 97,566 shares of the company's stock, valued at approximately $4,500,719.58. This trade represents a 11.16 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 23.40% of the company's stock.

Institutional Investors Weigh In On LendingTree

Several institutional investors and hedge funds have recently made changes to their positions in the business. Emerald Advisers LLC increased its holdings in LendingTree by 1.4% during the 4th quarter. Emerald Advisers LLC now owns 361,220 shares of the financial services provider's stock valued at $13,997,000 after acquiring an additional 4,831 shares in the last quarter. Blue Grotto Capital LLC raised its position in shares of LendingTree by 4.1% during the 4th quarter. Blue Grotto Capital LLC now owns 301,784 shares of the financial services provider's stock worth $11,694,000 after purchasing an additional 11,784 shares during the last quarter. Geode Capital Management LLC grew its holdings in LendingTree by 1.0% during the 3rd quarter. Geode Capital Management LLC now owns 253,208 shares of the financial services provider's stock valued at $14,697,000 after buying an additional 2,595 shares during the last quarter. Hennessy Advisors Inc. grew its holdings in LendingTree by 6.8% during the 4th quarter. Hennessy Advisors Inc. now owns 242,400 shares of the financial services provider's stock valued at $9,393,000 after buying an additional 15,400 shares during the last quarter. Finally, Dimensional Fund Advisors LP raised its holdings in shares of LendingTree by 15.8% in the fourth quarter. Dimensional Fund Advisors LP now owns 204,896 shares of the financial services provider's stock worth $7,940,000 after acquiring an additional 27,887 shares during the last quarter. 68.26% of the stock is currently owned by hedge funds and other institutional investors.

LendingTree Stock Performance

NASDAQ TREE traded up $2.14 during trading on Friday, reaching $45.15. The company's stock had a trading volume of 189,867 shares, compared to its average volume of 237,761. The business's fifty day moving average price is $45.95 and its 200-day moving average price is $46.07. LendingTree has a twelve month low of $33.58 and a twelve month high of $62.49. The company has a debt-to-equity ratio of 3.67, a quick ratio of 0.92 and a current ratio of 0.92. The firm has a market cap of $604.74 million, a price-to-earnings ratio of -16.72 and a beta of 1.90.

LendingTree Company Profile

(

Get Free ReportLendingTree, Inc, through its subsidiary, operates online consumer platform in the United States. It operates through three segments: Home, Consumer, and Insurance. The Home segment offers purchase mortgage, refinance mortgage, and home equity loans and lines of credit; and real estate brokerage services.

Read More

Before you consider LendingTree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingTree wasn't on the list.

While LendingTree currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.