LendingTree (NASDAQ:TREE - Get Free Report) was downgraded by research analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a research report issued to clients and investors on Tuesday.

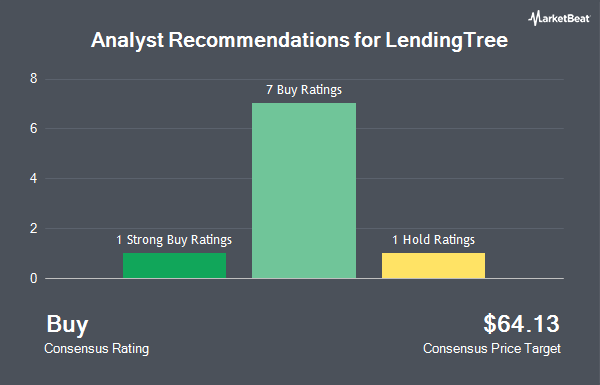

Other equities research analysts have also issued research reports about the stock. JPMorgan Chase & Co. lifted their target price on shares of LendingTree from $65.00 to $68.00 and gave the company an "overweight" rating in a research note on Thursday, March 6th. Keefe, Bruyette & Woods reduced their price objective on LendingTree from $73.00 to $66.00 and set an "outperform" rating for the company in a research report on Thursday, March 6th. Northland Securities upgraded LendingTree from a "market perform" rating to an "outperform" rating and set a $60.00 target price on the stock in a research note on Tuesday, January 21st. Northland Capmk raised LendingTree from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, January 21st. Finally, Stephens reiterated an "overweight" rating and set a $69.00 price target on shares of LendingTree in a report on Thursday, March 6th. One equities research analyst has rated the stock with a hold rating, eight have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Buy" and a consensus target price of $65.75.

Read Our Latest Analysis on TREE

LendingTree Stock Down 3.0 %

Shares of NASDAQ TREE traded down $1.27 during mid-day trading on Tuesday, reaching $41.02. The company had a trading volume of 277,335 shares, compared to its average volume of 238,198. The stock has a fifty day moving average of $45.98 and a two-hundred day moving average of $46.16. LendingTree has a 12-month low of $33.58 and a 12-month high of $62.49. The company has a market capitalization of $549.42 million, a price-to-earnings ratio of -15.19 and a beta of 1.90. The company has a debt-to-equity ratio of 3.67, a quick ratio of 0.92 and a current ratio of 0.92.

Insider Activity at LendingTree

In related news, COO Scott Peyree purchased 9,794 shares of the stock in a transaction on Thursday, March 13th. The shares were bought at an average price of $46.13 per share, for a total transaction of $451,797.22. Following the completion of the acquisition, the chief operating officer now directly owns 97,566 shares in the company, valued at approximately $4,500,719.58. This trade represents a 11.16 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. 23.40% of the stock is owned by company insiders.

Institutional Trading of LendingTree

Large investors have recently modified their holdings of the company. National Bank of Canada FI acquired a new position in LendingTree during the 3rd quarter worth $32,000. New Age Alpha Advisors LLC bought a new stake in LendingTree during the 4th quarter valued at approximately $36,000. Tower Research Capital LLC TRC grew its holdings in LendingTree by 248.0% in the 4th quarter. Tower Research Capital LLC TRC now owns 1,190 shares of the financial services provider's stock valued at $46,000 after buying an additional 848 shares during the last quarter. Wealthfront Advisers LLC bought a new position in LendingTree in the 4th quarter worth approximately $54,000. Finally, CANADA LIFE ASSURANCE Co bought a new position in LendingTree in the 4th quarter worth approximately $56,000. 68.26% of the stock is owned by institutional investors.

About LendingTree

(

Get Free Report)

LendingTree, Inc, through its subsidiary, operates online consumer platform in the United States. It operates through three segments: Home, Consumer, and Insurance. The Home segment offers purchase mortgage, refinance mortgage, and home equity loans and lines of credit; and real estate brokerage services.

Featured Articles

Before you consider LendingTree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingTree wasn't on the list.

While LendingTree currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.