Lennar (NYSE:LEN - Free Report) had its target price decreased by Royal Bank of Canada from $160.00 to $130.00 in a report released on Friday,Benzinga reports. Royal Bank of Canada currently has an underperform rating on the construction company's stock.

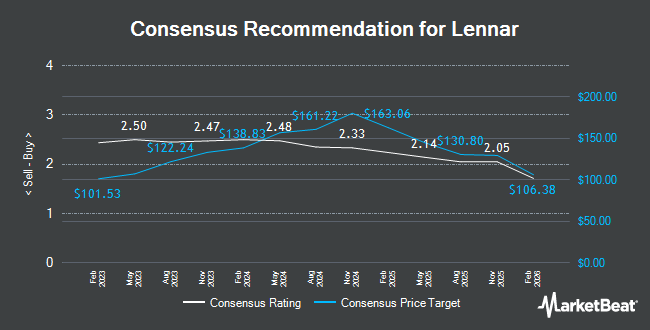

Several other analysts have also recently issued reports on the company. BTIG Research cut Lennar from a "buy" rating to a "neutral" rating in a research note on Friday. Barclays dropped their price target on Lennar from $181.00 to $135.00 and set an "equal weight" rating on the stock in a research report on Friday. Wells Fargo & Company decreased their price objective on shares of Lennar from $180.00 to $165.00 and set an "equal weight" rating for the company in a report on Tuesday. JPMorgan Chase & Co. dropped their target price on shares of Lennar from $192.00 to $173.00 and set a "neutral" rating on the stock in a report on Friday, December 13th. Finally, Citigroup lifted their price target on shares of Lennar from $164.00 to $196.00 and gave the company a "neutral" rating in a report on Monday, September 23rd. Two analysts have rated the stock with a sell rating, twelve have given a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, Lennar presently has an average rating of "Hold" and an average target price of $175.94.

View Our Latest Analysis on LEN

Lennar Stock Down 0.2 %

Shares of Lennar stock traded down $0.32 on Friday, hitting $138.08. 9,057,424 shares of the company's stock traded hands, compared to its average volume of 2,106,758. The company has a quick ratio of 0.98, a current ratio of 4.90 and a debt-to-equity ratio of 0.08. The firm's 50-day moving average is $168.98 and its 200 day moving average is $169.43. The stock has a market cap of $37.45 billion, a P/E ratio of 9.14, a PEG ratio of 1.31 and a beta of 1.61. Lennar has a 52-week low of $135.21 and a 52-week high of $193.80.

Lennar (NYSE:LEN - Get Free Report) last announced its quarterly earnings data on Wednesday, December 18th. The construction company reported $4.03 earnings per share for the quarter, missing the consensus estimate of $4.15 by ($0.12). Lennar had a return on equity of 15.47% and a net margin of 11.51%. The company had revenue of $9.95 billion for the quarter, compared to analyst estimates of $10.06 billion. During the same period in the prior year, the business earned $4.82 earnings per share. Lennar's revenue was down 9.3% on a year-over-year basis. Equities analysts anticipate that Lennar will post 14.11 earnings per share for the current year.

Lennar Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, October 24th. Stockholders of record on Wednesday, October 9th were given a dividend of $0.50 per share. The ex-dividend date was Wednesday, October 9th. This represents a $2.00 annualized dividend and a dividend yield of 1.45%. Lennar's dividend payout ratio is presently 13.25%.

Insider Activity at Lennar

In related news, Director Jeffrey Sonnenfeld sold 17,500 shares of the company's stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $175.13, for a total value of $3,064,775.00. Following the completion of the sale, the director now owns 23,689 shares of the company's stock, valued at $4,148,654.57. This represents a 42.49 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 9.36% of the stock is owned by insiders.

Institutional Trading of Lennar

A number of hedge funds and other institutional investors have recently made changes to their positions in LEN. Oddo BHF Asset Management Sas bought a new stake in shares of Lennar in the 3rd quarter worth $2,543,000. Synovus Financial Corp grew its holdings in Lennar by 1.3% during the third quarter. Synovus Financial Corp now owns 47,348 shares of the construction company's stock worth $8,877,000 after acquiring an additional 627 shares during the period. Wilmington Savings Fund Society FSB bought a new stake in Lennar in the third quarter worth about $241,000. World Investment Advisors LLC acquired a new stake in Lennar in the 3rd quarter valued at about $251,000. Finally, Sanctuary Advisors LLC boosted its position in shares of Lennar by 9.4% during the 3rd quarter. Sanctuary Advisors LLC now owns 43,049 shares of the construction company's stock valued at $8,071,000 after purchasing an additional 3,712 shares in the last quarter. 81.10% of the stock is currently owned by institutional investors.

About Lennar

(

Get Free Report)

Lennar Corporation, together with its subsidiaries, operates as a homebuilder primarily under the Lennar brand in the United States. It operates through Homebuilding East, Homebuilding Central, Homebuilding Texas, Homebuilding West, Financial Services, Multifamily, and Lennar Other segments. The company's homebuilding operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development, and sale of residential land; and development, construction, and management of multifamily rental properties.

Further Reading

Before you consider Lennar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennar wasn't on the list.

While Lennar currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.