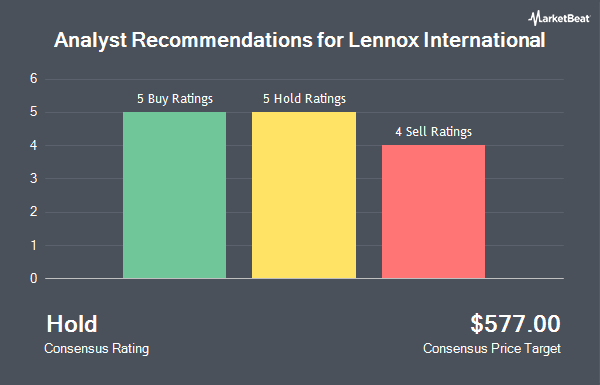

Lennox International Inc. (NYSE:LII - Get Free Report) has been assigned an average recommendation of "Hold" from the thirteen analysts that are covering the company, Marketbeat Ratings reports. Two analysts have rated the stock with a sell rating, six have given a hold rating and five have assigned a buy rating to the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $575.54.

Several research analysts have recently weighed in on the company. Robert W. Baird lifted their price objective on Lennox International from $648.00 to $656.00 and gave the stock a "neutral" rating in a research report on Thursday, October 24th. Barclays lifted their target price on Lennox International from $575.00 to $624.00 and gave the stock an "equal weight" rating in a report on Thursday, October 24th. Wells Fargo & Company increased their price target on Lennox International from $570.00 to $615.00 and gave the stock an "equal weight" rating in a report on Monday, October 7th. KeyCorp lowered shares of Lennox International from an "overweight" rating to a "sector weight" rating in a research note on Tuesday, October 15th. Finally, Northcoast Research started coverage on shares of Lennox International in a research note on Friday, November 22nd. They set a "sell" rating and a $475.00 target price on the stock.

View Our Latest Stock Report on Lennox International

Insiders Place Their Bets

In other news, Director Sherry Buck sold 500 shares of Lennox International stock in a transaction on Wednesday, November 27th. The stock was sold at an average price of $660.74, for a total transaction of $330,370.00. Following the sale, the director now directly owns 1,693 shares in the company, valued at $1,118,632.82. The trade was a 22.80 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, EVP John D. Torres sold 581 shares of the business's stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $620.98, for a total transaction of $360,789.38. Following the completion of the transaction, the executive vice president now directly owns 4,668 shares in the company, valued at $2,898,734.64. This trade represents a 11.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 2,106 shares of company stock valued at $1,353,233 in the last three months. 10.40% of the stock is currently owned by insiders.

Institutional Trading of Lennox International

Hedge funds have recently added to or reduced their stakes in the stock. GAMMA Investing LLC boosted its position in Lennox International by 38.6% during the second quarter. GAMMA Investing LLC now owns 255 shares of the construction company's stock worth $136,000 after purchasing an additional 71 shares during the period. Massmutual Trust Co. FSB ADV boosted its position in shares of Lennox International by 38.8% in the second quarter. Massmutual Trust Co. FSB ADV now owns 68 shares of the construction company's stock valued at $36,000 after acquiring an additional 19 shares during the period. DNB Asset Management AS boosted its position in shares of Lennox International by 2.6% in the second quarter. DNB Asset Management AS now owns 7,848 shares of the construction company's stock valued at $4,199,000 after acquiring an additional 196 shares during the period. Valeo Financial Advisors LLC purchased a new position in Lennox International during the second quarter valued at approximately $208,000. Finally, Tilia Fiduciary Partners Inc. increased its holdings in Lennox International by 2.8% during the 2nd quarter. Tilia Fiduciary Partners Inc. now owns 4,632 shares of the construction company's stock worth $2,478,000 after acquiring an additional 125 shares during the period. Institutional investors own 67.07% of the company's stock.

Lennox International Trading Up 1.1 %

LII traded up $7.09 during midday trading on Friday, hitting $667.13. 110,363 shares of the company were exchanged, compared to its average volume of 251,886. The firm's 50 day moving average price is $616.77 and its 200-day moving average price is $571.83. Lennox International has a 1-year low of $397.34 and a 1-year high of $682.50. The firm has a market capitalization of $23.76 billion, a P/E ratio of 31.68, a P/E/G ratio of 2.05 and a beta of 1.07. The company has a quick ratio of 0.87, a current ratio of 1.39 and a debt-to-equity ratio of 1.10.

Lennox International (NYSE:LII - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The construction company reported $6.68 EPS for the quarter, beating the consensus estimate of $5.95 by $0.73. Lennox International had a return on equity of 148.52% and a net margin of 14.63%. The business had revenue of $1.50 billion for the quarter, compared to analysts' expectations of $1.42 billion. During the same period in the prior year, the business posted $5.37 earnings per share. The firm's revenue was up 9.6% on a year-over-year basis. As a group, equities analysts forecast that Lennox International will post 21.1 EPS for the current fiscal year.

Lennox International Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were given a $1.15 dividend. This represents a $4.60 dividend on an annualized basis and a yield of 0.69%. The ex-dividend date was Monday, September 30th. Lennox International's payout ratio is currently 21.84%.

Lennox International Company Profile

(

Get Free ReportLennox International Inc, together with its subsidiaries, designs, manufactures, and markets a range of products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally. The Home Comfort Solutions segment provides furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, comfort control products, and replacement parts and supplies; residential heating, ventilation, cooling equipment, and air conditioning; and evaporator coils and unit heaters under Lennox, Dave Lennox Signature Collection, Armstrong Air, Ducane, AirEase, Concord, MagicPak, Advanced Distributor Products, Allied, Elite Series, Merit Series, Comfort Sync, Healthy Climate, iComfort, ComfortSense, and Lennox Stores name.

Featured Articles

Before you consider Lennox International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennox International wasn't on the list.

While Lennox International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report