Leslie's (NASDAQ:LESL - Free Report) had its price target decreased by Telsey Advisory Group from $4.00 to $3.75 in a research report released on Tuesday morning, MarketBeat reports. Telsey Advisory Group currently has a market perform rating on the stock.

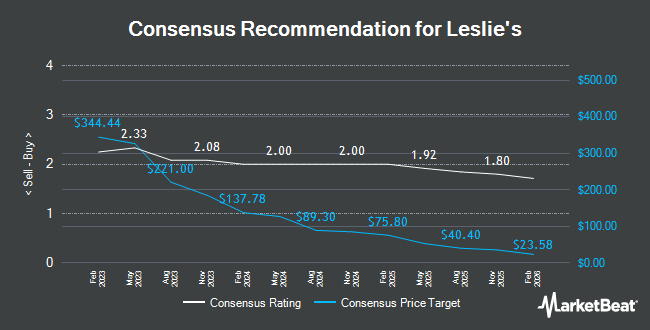

Separately, Mizuho dropped their price objective on shares of Leslie's from $6.00 to $4.00 and set a "neutral" rating for the company in a research note on Tuesday, August 6th. One investment analyst has rated the stock with a sell rating, nine have given a hold rating and one has issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $3.89.

Check Out Our Latest Report on Leslie's

Leslie's Price Performance

Shares of NASDAQ LESL traded down $1.09 during trading hours on Tuesday, reaching $2.42. The stock had a trading volume of 22,790,674 shares, compared to its average volume of 4,372,041. The company has a market cap of $447.48 million, a price-to-earnings ratio of 121.00, a PEG ratio of 2.16 and a beta of 1.19. Leslie's has a twelve month low of $2.31 and a twelve month high of $8.21. The business's fifty day moving average is $2.86 and its two-hundred day moving average is $3.50.

Institutional Trading of Leslie's

Several hedge funds have recently modified their holdings of LESL. nVerses Capital LLC acquired a new position in shares of Leslie's in the 2nd quarter worth approximately $26,000. Wealth Enhancement Advisory Services LLC bought a new position in Leslie's in the 3rd quarter valued at $32,000. Blue Trust Inc. boosted its stake in Leslie's by 1,089.6% in the third quarter. Blue Trust Inc. now owns 11,075 shares of the company's stock worth $35,000 after purchasing an additional 10,144 shares in the last quarter. IHT Wealth Management LLC grew its holdings in shares of Leslie's by 52.6% during the third quarter. IHT Wealth Management LLC now owns 16,760 shares of the company's stock worth $51,000 after purchasing an additional 5,776 shares during the last quarter. Finally, Patriot Financial Group Insurance Agency LLC acquired a new stake in shares of Leslie's in the second quarter valued at $55,000.

About Leslie's

(

Get Free Report)

Leslie's, Inc operates as a direct-to-consumer pool and spa care brand in the United States. The company markets and sells pool and spa supplies and related products and services. It also offers various pool and spa maintenance items, such as chemicals, equipment and parts, cleaning and maintenance equipment, safety, recreational, and fitness related products.

Featured Articles

Before you consider Leslie's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leslie's wasn't on the list.

While Leslie's currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.