Leuthold Group LLC purchased a new stake in Virtu Financial, Inc. (NASDAQ:VIRT - Free Report) in the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 80,478 shares of the financial services provider's stock, valued at approximately $2,871,000. Leuthold Group LLC owned about 0.05% of Virtu Financial at the end of the most recent reporting period.

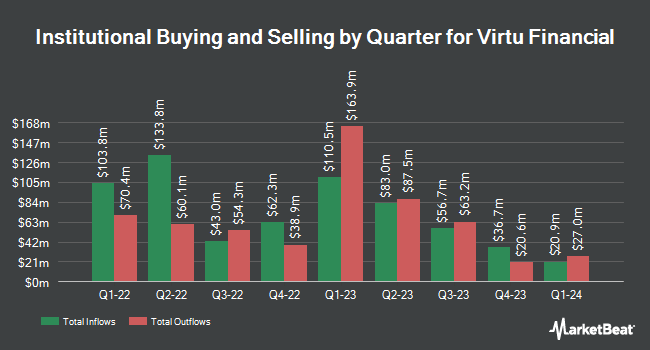

A number of other large investors have also recently bought and sold shares of the business. Sanctuary Advisors LLC purchased a new stake in shares of Virtu Financial in the third quarter valued at about $1,081,000. State of New Jersey Common Pension Fund D purchased a new stake in Virtu Financial in the 3rd quarter valued at approximately $1,971,000. Barclays PLC raised its stake in shares of Virtu Financial by 60.2% during the 3rd quarter. Barclays PLC now owns 55,486 shares of the financial services provider's stock worth $1,691,000 after buying an additional 20,843 shares in the last quarter. Bridgewater Associates LP grew its holdings in Virtu Financial by 124.7% during the third quarter. Bridgewater Associates LP now owns 53,785 shares of the financial services provider's stock worth $1,638,000 after acquiring an additional 29,844 shares during the period. Finally, JPMorgan Chase & Co. raised its position in Virtu Financial by 48.6% in the third quarter. JPMorgan Chase & Co. now owns 358,065 shares of the financial services provider's stock worth $10,907,000 after acquiring an additional 117,062 shares in the last quarter. Institutional investors and hedge funds own 45.78% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on VIRT shares. Morgan Stanley increased their price target on shares of Virtu Financial from $31.00 to $33.00 and gave the company an "equal weight" rating in a report on Thursday, February 6th. Piper Sandler boosted their price objective on shares of Virtu Financial from $35.00 to $40.00 and gave the stock an "overweight" rating in a research report on Tuesday, January 7th. Five investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, Virtu Financial presently has a consensus rating of "Hold" and an average target price of $31.36.

Get Our Latest Stock Report on Virtu Financial

Virtu Financial Price Performance

VIRT stock traded up $0.45 during trading on Wednesday, hitting $35.55. The stock had a trading volume of 1,154,351 shares, compared to its average volume of 968,142. The company has a debt-to-equity ratio of 1.17, a quick ratio of 0.46 and a current ratio of 1.13. The stock has a market cap of $5.50 billion, a price-to-earnings ratio of 11.97, a price-to-earnings-growth ratio of 1.43 and a beta of 0.46. The company's 50 day moving average price is $37.11 and its two-hundred day moving average price is $34.36. Virtu Financial, Inc. has a 1-year low of $17.08 and a 1-year high of $41.38.

Virtu Financial (NASDAQ:VIRT - Get Free Report) last issued its quarterly earnings results on Wednesday, January 29th. The financial services provider reported $1.09 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.77 by $0.32. Virtu Financial had a return on equity of 27.39% and a net margin of 9.61%. On average, sell-side analysts forecast that Virtu Financial, Inc. will post 3.13 EPS for the current fiscal year.

Virtu Financial Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, March 17th. Shareholders of record on Friday, February 28th will be issued a $0.24 dividend. The ex-dividend date is Friday, February 28th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 2.70%. Virtu Financial's dividend payout ratio (DPR) is presently 32.32%.

Insider Activity

In related news, EVP Stephen Cavoli sold 34,000 shares of Virtu Financial stock in a transaction on Friday, February 14th. The stock was sold at an average price of $36.88, for a total value of $1,253,920.00. Following the transaction, the executive vice president now owns 191,703 shares in the company, valued at approximately $7,070,006.64. This trade represents a 15.06 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, COO Brett Fairclough sold 72,967 shares of the company's stock in a transaction dated Wednesday, February 12th. The stock was sold at an average price of $36.84, for a total value of $2,688,104.28. Following the sale, the chief operating officer now owns 90,749 shares of the company's stock, valued at $3,343,193.16. This represents a 44.57 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 140,967 shares of company stock valued at $5,213,964 in the last ninety days. Company insiders own 46.70% of the company's stock.

Virtu Financial Profile

(

Free Report)

Virtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

See Also

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report