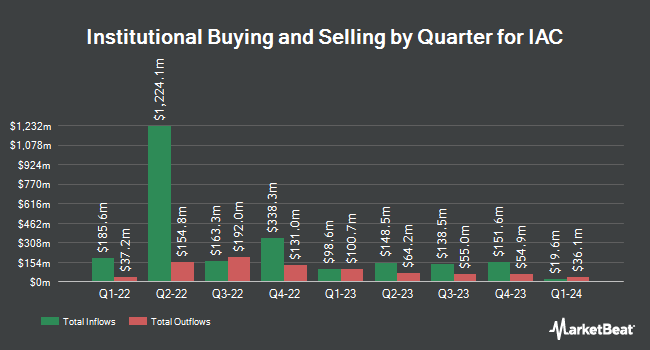

Levin Capital Strategies L.P. lifted its holdings in shares of IAC Inc. (NASDAQ:IAC - Free Report) by 139.1% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 97,251 shares of the company's stock after purchasing an additional 56,583 shares during the period. Levin Capital Strategies L.P. owned 0.12% of IAC worth $4,195,000 as of its most recent filing with the SEC.

Other institutional investors also recently modified their holdings of the company. Quarry LP raised its holdings in IAC by 408.9% during the 3rd quarter. Quarry LP now owns 977 shares of the company's stock worth $53,000 after purchasing an additional 785 shares during the last quarter. MassMutual Private Wealth & Trust FSB increased its position in shares of IAC by 1,398.5% during the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 2,053 shares of the company's stock worth $89,000 after buying an additional 1,916 shares during the period. Allworth Financial LP lifted its holdings in IAC by 1,193.4% in the fourth quarter. Allworth Financial LP now owns 3,337 shares of the company's stock valued at $139,000 after buying an additional 3,079 shares during the period. KBC Group NV boosted its position in IAC by 22.8% during the fourth quarter. KBC Group NV now owns 3,278 shares of the company's stock valued at $141,000 after acquiring an additional 608 shares during the last quarter. Finally, NJ State Employees Deferred Compensation Plan acquired a new stake in IAC during the 3rd quarter worth about $209,000. Institutional investors own 88.90% of the company's stock.

Wall Street Analysts Forecast Growth

IAC has been the topic of several research analyst reports. Piper Sandler lowered IAC from an "overweight" rating to a "neutral" rating and cut their target price for the company from $68.00 to $54.00 in a research report on Tuesday, December 10th. Macquarie reaffirmed an "outperform" rating and set a $14.00 price objective on shares of IAC in a research report on Thursday, November 14th. JMP Securities dropped their target price on shares of IAC from $70.00 to $64.00 and set a "market outperform" rating on the stock in a research report on Thursday, February 13th. UBS Group cut their target price on shares of IAC from $55.00 to $54.00 and set a "neutral" rating on the stock in a research note on Thursday, February 13th. Finally, Benchmark decreased their price target on shares of IAC from $105.00 to $100.00 and set a "buy" rating for the company in a research note on Thursday, February 13th. Three research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $64.67.

Check Out Our Latest Stock Analysis on IAC

IAC Stock Down 1.6 %

IAC stock traded down $0.72 during mid-day trading on Monday, reaching $45.50. 1,050,513 shares of the company traded hands, compared to its average volume of 907,655. The company has a quick ratio of 2.75, a current ratio of 2.80 and a debt-to-equity ratio of 0.31. The firm's 50 day moving average price is $43.45 and its 200 day moving average price is $47.92. The stock has a market cap of $3.66 billion, a price-to-earnings ratio of -6.98 and a beta of 1.32. IAC Inc. has a fifty-two week low of $39.61 and a fifty-two week high of $58.29.

About IAC

(

Free Report)

IAC Inc, together with its subsidiaries, operates as a media and internet company worldwide. The company publishes original and engaging digital content in the form of articles, illustrations, and videos and images across entertainment, food, home, beauty, travel, health, family, luxury, and fashion areas; and magazines related to women and lifestyle.

Featured Stories

Before you consider IAC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAC wasn't on the list.

While IAC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.