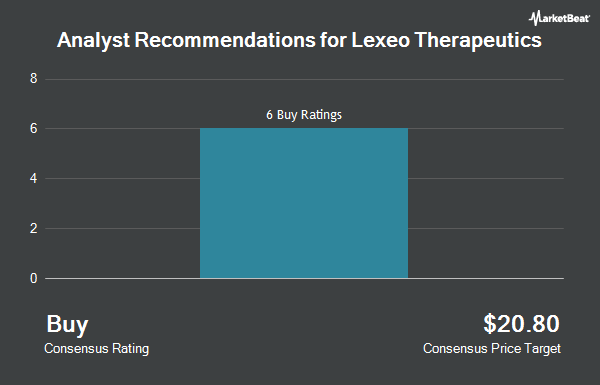

Shares of Lexeo Therapeutics, Inc. (NASDAQ:LXEO - Get Free Report) have been assigned an average recommendation of "Buy" from the six brokerages that are presently covering the firm, MarketBeat.com reports. Five investment analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $23.80.

A number of analysts recently commented on LXEO shares. Leerink Partners decreased their price objective on shares of Lexeo Therapeutics from $20.00 to $19.00 and set an "outperform" rating on the stock in a report on Wednesday, November 13th. HC Wainwright boosted their price objective on shares of Lexeo Therapeutics from $21.00 to $23.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Finally, Chardan Capital boosted their price objective on shares of Lexeo Therapeutics from $23.00 to $25.00 and gave the stock a "buy" rating in a report on Wednesday, November 13th.

Check Out Our Latest Research Report on Lexeo Therapeutics

Lexeo Therapeutics Price Performance

LXEO stock traded down $0.12 during trading on Friday, reaching $5.07. 274,728 shares of the company were exchanged, compared to its average volume of 233,584. The company has a market cap of $167.66 million, a P/E ratio of -1.60 and a beta of 3.08. Lexeo Therapeutics has a 52-week low of $4.78 and a 52-week high of $22.33. The stock's 50 day moving average price is $6.93 and its 200 day moving average price is $9.62. The company has a debt-to-equity ratio of 0.01, a quick ratio of 5.95 and a current ratio of 5.95.

Hedge Funds Weigh In On Lexeo Therapeutics

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in LXEO. BNP Paribas Financial Markets raised its position in Lexeo Therapeutics by 184.2% during the third quarter. BNP Paribas Financial Markets now owns 5,541 shares of the company's stock worth $50,000 after acquiring an additional 3,591 shares during the last quarter. Values First Advisors Inc. acquired a new position in Lexeo Therapeutics during the third quarter worth about $67,000. SG Americas Securities LLC acquired a new position in Lexeo Therapeutics during the fourth quarter worth about $72,000. JPMorgan Chase & Co. raised its position in Lexeo Therapeutics by 135.6% during the third quarter. JPMorgan Chase & Co. now owns 10,278 shares of the company's stock worth $93,000 after acquiring an additional 5,915 shares during the last quarter. Finally, MetLife Investment Management LLC raised its position in Lexeo Therapeutics by 121.5% during the third quarter. MetLife Investment Management LLC now owns 14,223 shares of the company's stock worth $129,000 after acquiring an additional 7,803 shares during the last quarter. Institutional investors and hedge funds own 60.67% of the company's stock.

Lexeo Therapeutics Company Profile

(

Get Free ReportLexeo Therapeutics, Inc operates as a clinical stage genetic medicine company that focuses on hereditary and acquired diseases. The company develops LX2006, which is an AAVrh10-based gene therapy candidate for the treatment of Friedreich's ataxia (FA) cardiomyopathy; LX2020, an AAVrh10-based gene therapy candidate for the treatment of plakophilin-2 arrhythmogenic cardiomyopathy; LX2021, a gene therapy candidate for the treatment of DSP cardiomyopathy associated with it; and LX2022, a gene therapy candidate for the treatment of hypertrophic cardiomyopathy, or HCM caused by TNNI3 gene.

Further Reading

Before you consider Lexeo Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lexeo Therapeutics wasn't on the list.

While Lexeo Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.