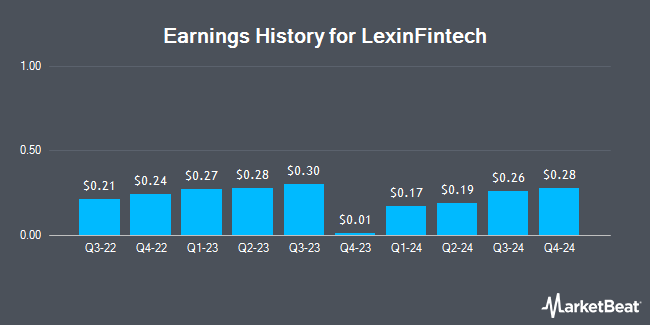

LexinFintech (NASDAQ:LX - Get Free Report) announced its quarterly earnings data on Tuesday. The company reported $0.28 EPS for the quarter, Zacks reports. The business had revenue of $501.26 million for the quarter. LexinFintech had a return on equity of 7.47% and a net margin of 5.34%.

LexinFintech Trading Up 2.4 %

LX traded up $0.25 during trading on Friday, reaching $10.77. The company had a trading volume of 9,345,453 shares, compared to its average volume of 2,489,946. The company has a quick ratio of 1.66, a current ratio of 1.66 and a debt-to-equity ratio of 0.10. LexinFintech has a 52 week low of $1.56 and a 52 week high of $11.46. The stock has a market cap of $1.77 billion, a P/E ratio of 17.10 and a beta of 0.60. The business has a 50 day simple moving average of $8.35 and a 200-day simple moving average of $5.42.

LexinFintech Increases Dividend

The business also recently declared a semi-annual dividend, which will be paid on Friday, May 16th. Investors of record on Thursday, April 17th will be issued a dividend of $0.11 per share. This represents a yield of 1.2%. The ex-dividend date of this dividend is Thursday, April 17th. This is a positive change from LexinFintech's previous semi-annual dividend of $0.07. LexinFintech's dividend payout ratio is presently 19.05%.

Analyst Upgrades and Downgrades

Separately, Citigroup raised shares of LexinFintech from a "neutral" rating to a "buy" rating in a report on Tuesday, November 26th.

Check Out Our Latest Report on LX

About LexinFintech

(

Get Free Report)

LexinFintech Holdings Ltd., through its subsidiaries, provides online consumer finance services in the People's Republic of China. The company operates Fenqile.com, an online consumption and consumer finance platform that offers installment purchase and personal installment loans, as well as online direct sales with installment payment terms; and Le Hua Card, a scenario-based lending.

See Also

Before you consider LexinFintech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LexinFintech wasn't on the list.

While LexinFintech currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.