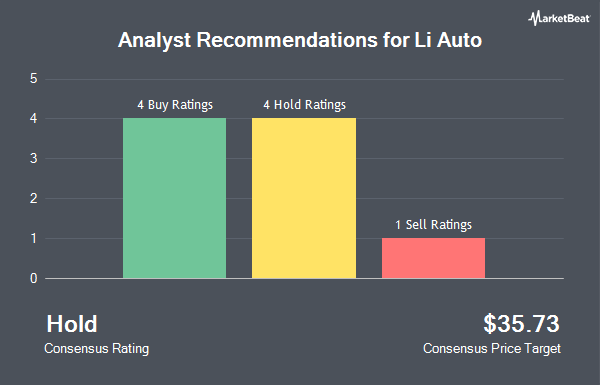

Shares of Li Auto Inc. (NASDAQ:LI - Get Free Report) have earned an average recommendation of "Moderate Buy" from the eight ratings firms that are currently covering the stock, Marketbeat Ratings reports. Four research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average twelve-month price target among analysts that have issued ratings on the stock in the last year is $33.94.

Several analysts recently issued reports on the company. Citigroup increased their target price on Li Auto from $25.50 to $29.60 and gave the stock a "neutral" rating in a research report on Monday, September 30th. Bank of America lifted their target price on shares of Li Auto from $30.00 to $31.00 and gave the stock a "buy" rating in a research note on Thursday, August 29th. JPMorgan Chase & Co. dropped their price objective on shares of Li Auto from $21.00 to $19.00 and set a "neutral" rating on the stock in a research note on Thursday, August 29th. Macquarie reaffirmed a "neutral" rating and set a $33.00 target price (up previously from $25.00) on shares of Li Auto in a report on Friday, October 4th. Finally, Barclays raised their price objective on Li Auto from $22.00 to $31.00 and gave the stock an "equal weight" rating in a research report on Monday, November 4th.

Get Our Latest Stock Analysis on Li Auto

Li Auto Price Performance

Shares of NASDAQ:LI traded down $1.72 on Tuesday, hitting $22.61. The company's stock had a trading volume of 6,668,872 shares, compared to its average volume of 8,056,945. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.76 and a quick ratio of 1.64. The company has a market capitalization of $23.99 billion, a PE ratio of 16.80, a PEG ratio of 2.26 and a beta of 0.99. The company has a 50-day simple moving average of $24.50 and a 200 day simple moving average of $22.23. Li Auto has a 1 year low of $17.44 and a 1 year high of $46.44.

Li Auto (NASDAQ:LI - Get Free Report) last released its quarterly earnings results on Wednesday, August 28th. The company reported $0.14 earnings per share for the quarter. Li Auto had a net margin of 7.20% and a return on equity of 13.03%. The business had revenue of $4.36 billion for the quarter. Sell-side analysts forecast that Li Auto will post 1.04 EPS for the current fiscal year.

Institutional Trading of Li Auto

Several institutional investors and hedge funds have recently modified their holdings of LI. Allspring Global Investments Holdings LLC purchased a new stake in Li Auto during the third quarter worth approximately $39,000. Harel Insurance Investments & Financial Services Ltd. lifted its holdings in Li Auto by 58.7% in the second quarter. Harel Insurance Investments & Financial Services Ltd. now owns 1,549 shares of the company's stock worth $28,000 after purchasing an additional 573 shares during the period. Venturi Wealth Management LLC acquired a new position in shares of Li Auto during the 3rd quarter valued at $50,000. Blue Trust Inc. boosted its stake in shares of Li Auto by 1,707.4% during the 2nd quarter. Blue Trust Inc. now owns 1,952 shares of the company's stock worth $35,000 after acquiring an additional 1,844 shares in the last quarter. Finally, Avior Wealth Management LLC lifted its position in shares of Li Auto by 708.5% in the 3rd quarter. Avior Wealth Management LLC now owns 2,385 shares of the company's stock valued at $61,000 after acquiring an additional 2,090 shares in the last quarter. Hedge funds and other institutional investors own 9.88% of the company's stock.

About Li Auto

(

Get Free ReportLi Auto Inc operates in the energy vehicle market in the People's Republic of China. It designs, develops, manufactures, and sells premium smart electric vehicles. The company's product line comprises MPVs and sport utility vehicles. It offers sales and after sales management, and technology development and corporate management services, as well as purchases manufacturing equipment.

Further Reading

Before you consider Li Auto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Li Auto wasn't on the list.

While Li Auto currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.