Lancaster Investment Management lowered its stake in Liberty Global Ltd. (NASDAQ:LBTYA - Free Report) by 17.0% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 2,473,000 shares of the company's stock after selling 508,000 shares during the quarter. Liberty Global makes up 32.7% of Lancaster Investment Management's investment portfolio, making the stock its largest position. Lancaster Investment Management owned about 0.68% of Liberty Global worth $52,205,000 as of its most recent filing with the Securities & Exchange Commission.

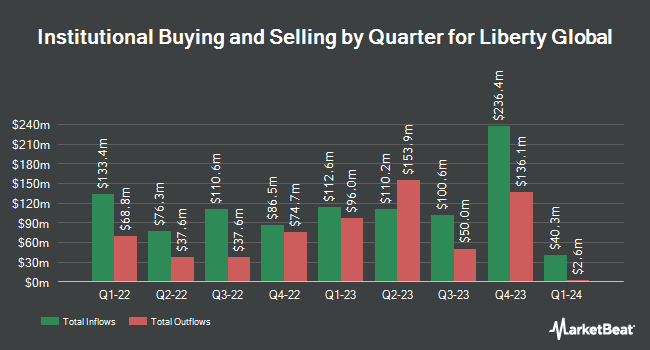

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. EverSource Wealth Advisors LLC increased its stake in Liberty Global by 63.7% in the second quarter. EverSource Wealth Advisors LLC now owns 1,545 shares of the company's stock valued at $27,000 after acquiring an additional 601 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in Liberty Global by 2.2% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 28,188 shares of the company's stock worth $595,000 after buying an additional 606 shares during the last quarter. Private Advisor Group LLC raised its stake in shares of Liberty Global by 8.1% during the third quarter. Private Advisor Group LLC now owns 11,113 shares of the company's stock worth $235,000 after acquiring an additional 835 shares in the last quarter. Blue Trust Inc. raised its position in Liberty Global by 110.3% in the 3rd quarter. Blue Trust Inc. now owns 1,859 shares of the company's stock worth $39,000 after purchasing an additional 975 shares during the period. Finally, Stratos Wealth Advisors LLC grew its stake in shares of Liberty Global by 4.1% during the third quarter. Stratos Wealth Advisors LLC now owns 29,611 shares of the company's stock valued at $625,000 after buying an additional 1,162 shares during the last quarter. 37.20% of the stock is owned by hedge funds and other institutional investors.

Liberty Global Stock Performance

Shares of Liberty Global stock traded up $0.23 during trading on Friday, hitting $20.06. 2,377,507 shares of the company's stock were exchanged, compared to its average volume of 1,763,934. Liberty Global Ltd. has a 52-week low of $15.32 and a 52-week high of $21.56. The company has a debt-to-equity ratio of 0.80, a quick ratio of 1.19 and a current ratio of 1.19. The stock has a market capitalization of $7.17 billion, a price-to-earnings ratio of -1.98 and a beta of 1.18. The business has a 50-day simple moving average of $20.51 and a 200-day simple moving average of $18.76.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on LBTYA shares. Deutsche Bank Aktiengesellschaft boosted their price target on Liberty Global from $33.00 to $34.00 and gave the company a "buy" rating in a report on Friday, July 12th. Bank of America raised Liberty Global from an "underperform" rating to a "neutral" rating and increased their target price for the stock from $15.50 to $21.30 in a research report on Monday, August 12th. Citigroup assumed coverage on Liberty Global in a research note on Friday, August 9th. They issued a "buy" rating and a $25.00 price target on the stock. Finally, Benchmark restated a "buy" rating and issued a $27.00 price objective on shares of Liberty Global in a report on Tuesday, October 29th. Four research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $24.26.

Get Our Latest Stock Report on LBTYA

Liberty Global Company Profile

(

Free Report)

Liberty Global Ltd., together with its subsidiaries, provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers. It offers value-added broadband services, such as WiFi features, security, anti-virus, firewall, spam protection, smart home services, online storage solutions, and web spaces; and Connect Box that delivers in-home Wi-Fi service.

See Also

Before you consider Liberty Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Global wasn't on the list.

While Liberty Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.