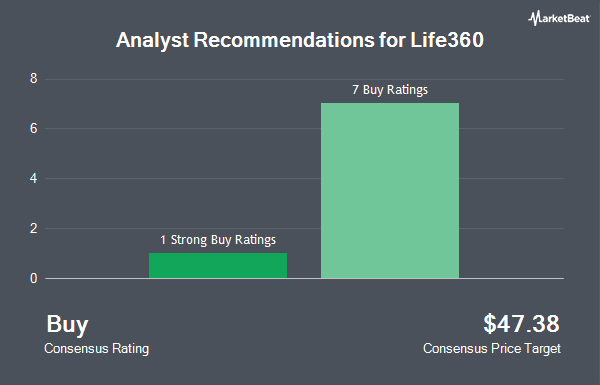

Shares of Life360, Inc. (NASDAQ:LIF - Get Free Report) have been given an average recommendation of "Buy" by the eight analysts that are currently covering the company, Marketbeat Ratings reports. One investment analyst has rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the company. The average 1 year target price among analysts that have issued a report on the stock in the last year is $47.00.

Several analysts recently weighed in on the company. UBS Group boosted their price objective on Life360 from $35.00 to $50.00 and gave the company a "neutral" rating in a report on Thursday, November 7th. Stifel Nicolaus boosted their price objective on Life360 from $40.00 to $50.00 and gave the stock a "buy" rating in a research report on Monday, October 28th. Canaccord Genuity Group raised their target price on Life360 from $54.00 to $58.00 and gave the company a "buy" rating in a research report on Monday, December 2nd. JMP Securities boosted their price target on Life360 from $40.00 to $55.00 and gave the stock a "market outperform" rating in a research report on Thursday, November 14th. Finally, Loop Capital raised their price target on Life360 from $36.00 to $43.00 and gave the company a "buy" rating in a report on Wednesday, August 21st.

View Our Latest Analysis on LIF

Insider Transactions at Life360

In other news, CFO Russell John Burke sold 3,104 shares of the company's stock in a transaction dated Tuesday, December 10th. The stock was sold at an average price of $43.97, for a total transaction of $136,482.88. Following the completion of the sale, the chief financial officer now owns 158,066 shares in the company, valued at approximately $6,950,162.02. This represents a 1.93 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CEO Chris Hulls sold 556,569 shares of the firm's stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $41.02, for a total value of $22,830,460.38. Following the completion of the transaction, the chief executive officer now directly owns 952,696 shares in the company, valued at $39,079,589.92. The trade was a 36.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 629,673 shares of company stock valued at $25,855,843 over the last three months.

Institutional Investors Weigh In On Life360

Several hedge funds and other institutional investors have recently modified their holdings of LIF. FMR LLC raised its position in Life360 by 6.1% in the third quarter. FMR LLC now owns 1,520,135 shares of the company's stock worth $59,817,000 after purchasing an additional 86,917 shares in the last quarter. Wealthstream Advisors Inc. acquired a new position in Life360 during the third quarter worth $35,538,000. Regal Partners Ltd acquired a new stake in shares of Life360 in the 2nd quarter valued at $23,635,000. Millennium Management LLC bought a new stake in shares of Life360 in the 2nd quarter worth about $11,861,000. Finally, Ghisallo Capital Management LLC acquired a new stake in shares of Life360 during the 2nd quarter worth about $8,098,000. Institutional investors and hedge funds own 20.00% of the company's stock.

Life360 Price Performance

NASDAQ LIF traded down $0.02 during trading hours on Thursday, reaching $43.50. 228,750 shares of the company traded hands, compared to its average volume of 316,461. The stock has a 50 day simple moving average of $44.72. Life360 has a 12 month low of $26.00 and a 12 month high of $52.76.

About Life360

(

Get Free ReportLife360 Inc is a family connection and safety company. Its business category includes mobile app and Tile tracking devices with a range of services, including location sharing, safe driver reports and crash detection with emergency dispatch. Life360 Inc is based in SAN FRANCISCO.

Featured Articles

Before you consider Life360, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Life360 wasn't on the list.

While Life360 currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.