Lightspeed Commerce (NYSE:LSPD - Get Free Report) had its target price boosted by equities research analysts at TD Securities from $15.00 to $19.00 in a research report issued to clients and investors on Friday,BayStreet.CA reports. The brokerage currently has a "hold" rating on the stock. TD Securities' price objective points to a potential upside of 10.47% from the company's current price.

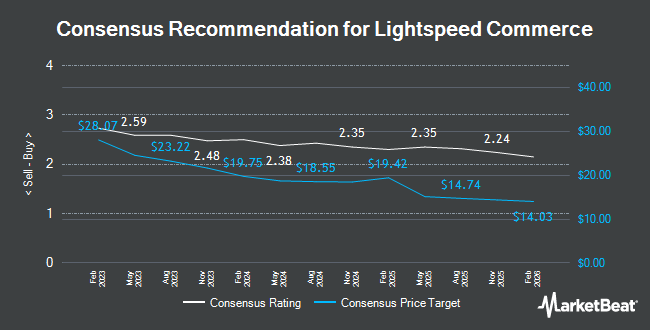

Several other analysts also recently weighed in on LSPD. Piper Sandler cut their price objective on shares of Lightspeed Commerce from $17.00 to $15.00 and set a "neutral" rating on the stock in a research report on Friday, August 2nd. Benchmark upped their price objective on Lightspeed Commerce from $20.00 to $21.00 and gave the company a "buy" rating in a report on Friday. Jefferies Financial Group dropped their price target on shares of Lightspeed Commerce from $22.00 to $20.00 and set a "hold" rating on the stock in a research report on Wednesday, August 21st. Wells Fargo & Company lowered their price objective on shares of Lightspeed Commerce from $17.00 to $15.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 31st. Finally, BMO Capital Markets raised their target price on shares of Lightspeed Commerce from $18.00 to $20.00 and gave the stock an "outperform" rating in a report on Thursday, September 26th. One investment analyst has rated the stock with a sell rating, nine have assigned a hold rating, six have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $19.75.

View Our Latest Stock Analysis on LSPD

Lightspeed Commerce Stock Up 1.5 %

Shares of LSPD stock traded up $0.25 on Friday, hitting $17.20. The stock had a trading volume of 636,457 shares, compared to its average volume of 1,107,032. Lightspeed Commerce has a 52-week low of $11.01 and a 52-week high of $21.71. The firm has a market capitalization of $2.61 billion, a price-to-earnings ratio of -17.46, a P/E/G ratio of 9.52 and a beta of 2.35. The company has a debt-to-equity ratio of 0.01, a quick ratio of 6.06 and a current ratio of 6.19. The stock's 50 day moving average is $14.73 and its 200-day moving average is $14.06.

Lightspeed Commerce (NYSE:LSPD - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported $0.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.02 by $0.01. Lightspeed Commerce had a negative net margin of 15.55% and a negative return on equity of 0.99%. The business had revenue of $277.18 million during the quarter, compared to analyst estimates of $273.90 million. As a group, research analysts expect that Lightspeed Commerce will post 0.05 earnings per share for the current year.

Institutional Investors Weigh In On Lightspeed Commerce

A number of institutional investors have recently added to or reduced their stakes in the company. Toronto Dominion Bank raised its holdings in shares of Lightspeed Commerce by 102.8% in the 2nd quarter. Toronto Dominion Bank now owns 6,870 shares of the company's stock worth $94,000 after buying an additional 3,482 shares in the last quarter. Headlands Technologies LLC bought a new stake in shares of Lightspeed Commerce in the 2nd quarter worth about $181,000. Aigen Investment Management LP acquired a new stake in shares of Lightspeed Commerce during the 3rd quarter worth about $225,000. Duality Advisers LP lifted its holdings in Lightspeed Commerce by 160.8% during the 1st quarter. Duality Advisers LP now owns 34,337 shares of the company's stock valued at $483,000 after purchasing an additional 21,172 shares during the last quarter. Finally, Addenda Capital Inc. boosted its position in Lightspeed Commerce by 10.5% in the second quarter. Addenda Capital Inc. now owns 44,041 shares of the company's stock valued at $603,000 after buying an additional 4,196 shares in the last quarter. 68.68% of the stock is owned by institutional investors and hedge funds.

Lightspeed Commerce Company Profile

(

Get Free Report)

Lightspeed Commerce Inc engages in sale of cloud-based software subscriptions and payments solutions for small and midsize businesses, retailers, restaurants, and golf course operators in North America, Europe, the United Kingdom, Australia, New Zealand, and internationally. Its Software as a Service platform enables customers to engage with consumers, manage operations, accept payments, etc.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lightspeed Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lightspeed Commerce wasn't on the list.

While Lightspeed Commerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.