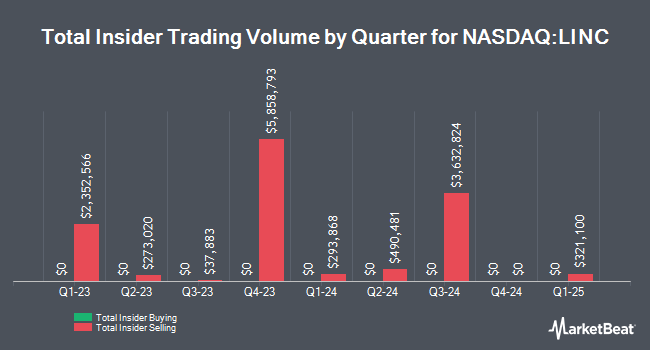

Lincoln Educational Services Co. (NASDAQ:LINC - Get Free Report) major shareholder Juniper Investment Company, Ll sold 7,123 shares of the firm's stock in a transaction dated Wednesday, November 13th. The stock was sold at an average price of $16.86, for a total transaction of $120,093.78. Following the sale, the insider now owns 867,017 shares of the company's stock, valued at $14,617,906.62. This trade represents a 0.81 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Large shareholders that own 10% or more of a company's stock are required to disclose their sales and purchases with the SEC.

Juniper Investment Company, Ll also recently made the following trade(s):

- On Monday, August 19th, Juniper Investment Company, Ll sold 2,270 shares of Lincoln Educational Services stock. The stock was sold at an average price of $12.04, for a total transaction of $27,330.80.

Lincoln Educational Services Trading Down 1.5 %

NASDAQ:LINC traded down $0.23 during trading hours on Friday, hitting $15.19. The company had a trading volume of 90,241 shares, compared to its average volume of 109,696. The company has a market capitalization of $478.18 million, a PE ratio of 47.47, a price-to-earnings-growth ratio of 2.01 and a beta of 1.41. The stock has a 50-day moving average price of $12.79 and a 200 day moving average price of $12.26. Lincoln Educational Services Co. has a 52 week low of $8.78 and a 52 week high of $18.74. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.57 and a quick ratio of 1.75.

Lincoln Educational Services (NASDAQ:LINC - Get Free Report) last released its quarterly earnings results on Monday, November 11th. The company reported $0.13 earnings per share for the quarter, missing the consensus estimate of $0.14 by ($0.01). The company had revenue of $114.41 million during the quarter, compared to the consensus estimate of $111.05 million. Lincoln Educational Services had a net margin of 2.33% and a return on equity of 10.60%. During the same quarter last year, the firm earned $0.11 EPS. On average, equities research analysts predict that Lincoln Educational Services Co. will post 0.54 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on the stock. B. Riley raised their price objective on shares of Lincoln Educational Services from $15.00 to $20.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Barrington Research raised their target price on shares of Lincoln Educational Services from $16.00 to $20.00 and gave the company an "outperform" rating in a research note on Monday. Rosenblatt Securities raised their target price on shares of Lincoln Educational Services from $15.00 to $17.00 and gave the company a "buy" rating in a research note on Friday, August 9th. Finally, StockNews.com downgraded shares of Lincoln Educational Services from a "buy" rating to a "hold" rating in a research note on Wednesday, October 9th. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $18.00.

Read Our Latest Analysis on Lincoln Educational Services

Institutional Trading of Lincoln Educational Services

A number of hedge funds have recently modified their holdings of LINC. BNP Paribas Financial Markets boosted its holdings in shares of Lincoln Educational Services by 60.2% during the 1st quarter. BNP Paribas Financial Markets now owns 11,218 shares of the company's stock valued at $116,000 after buying an additional 4,217 shares in the last quarter. First Eagle Investment Management LLC boosted its holdings in shares of Lincoln Educational Services by 13.6% during the 1st quarter. First Eagle Investment Management LLC now owns 613,097 shares of the company's stock valued at $6,333,000 after buying an additional 73,321 shares in the last quarter. Vanguard Group Inc. boosted its holdings in shares of Lincoln Educational Services by 11.3% during the 1st quarter. Vanguard Group Inc. now owns 1,343,181 shares of the company's stock valued at $13,875,000 after buying an additional 136,334 shares in the last quarter. Herr Investment Group LLC boosted its holdings in shares of Lincoln Educational Services by 3.9% during the 1st quarter. Herr Investment Group LLC now owns 2,355,737 shares of the company's stock valued at $24,335,000 after buying an additional 88,335 shares in the last quarter. Finally, Gladius Capital Management LP bought a new position in Lincoln Educational Services in the 2nd quarter worth about $33,000. Institutional investors own 72.23% of the company's stock.

Lincoln Educational Services Company Profile

(

Get Free Report)

Lincoln Educational Services Corporation, together with its subsidiaries, provides various career-oriented post-secondary education services to high school graduates and working adults in the United States. The company operates in two segments, Campus Operations and Transitional. It offers associate's degree, and diploma and certificate programs in automotive technology; skilled trades programs, including electrical, heating and air conditioning repair, welding, computerized numerical control, and electrical and electronic systems technology; health science programs comprising licensed practical nurse, registered nurse, dental assistant, medical assistant, medical administrative assistant, and claims examiner; hospitality service and information technology programs, such as culinary, therapeutic massage, cosmetology, aesthetics, and computer systems support technicians.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lincoln Educational Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lincoln Educational Services wasn't on the list.

While Lincoln Educational Services currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.