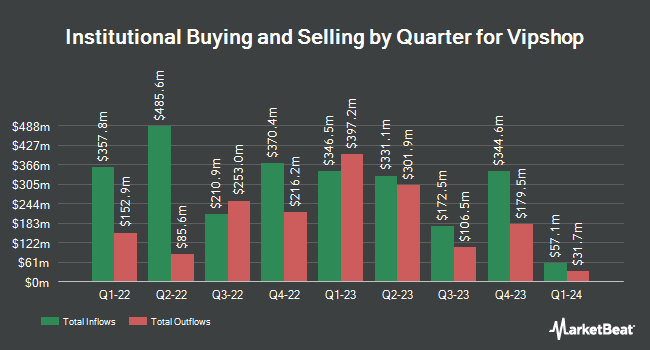

Lingohr Asset Management GmbH bought a new position in shares of Vipshop Holdings Limited (NYSE:VIPS - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 58,575 shares of the technology company's stock, valued at approximately $921,000. Vipshop makes up about 2.2% of Lingohr Asset Management GmbH's portfolio, making the stock its 12th biggest position.

A number of other institutional investors and hedge funds have also recently made changes to their positions in VIPS. Blue Trust Inc. increased its holdings in Vipshop by 1,904.0% in the 2nd quarter. Blue Trust Inc. now owns 3,527 shares of the technology company's stock worth $46,000 after purchasing an additional 3,351 shares in the last quarter. Venturi Wealth Management LLC bought a new stake in shares of Vipshop during the third quarter worth about $56,000. Employees Retirement System of Texas increased its stake in shares of Vipshop by 143.2% in the second quarter. Employees Retirement System of Texas now owns 4,614 shares of the technology company's stock valued at $60,000 after buying an additional 2,717 shares during the period. National Bank of Canada FI bought a new position in Vipshop in the 2nd quarter valued at approximately $136,000. Finally, Atomi Financial Group Inc. boosted its position in Vipshop by 6.8% during the 3rd quarter. Atomi Financial Group Inc. now owns 11,050 shares of the technology company's stock worth $174,000 after buying an additional 702 shares during the period. Institutional investors own 48.82% of the company's stock.

Vipshop Stock Down 4.5 %

VIPS stock traded down $0.63 during mid-day trading on Tuesday, hitting $13.25. The company had a trading volume of 3,423,907 shares, compared to its average volume of 3,923,229. The company has a 50-day moving average price of $14.62 and a 200 day moving average price of $14.45. Vipshop Holdings Limited has a 12-month low of $11.50 and a 12-month high of $20.19. The company has a market capitalization of $7.19 billion, a price-to-earnings ratio of 6.58, a P/E/G ratio of 1.56 and a beta of 0.34.

Vipshop (NYSE:VIPS - Get Free Report) last issued its earnings results on Tuesday, August 20th. The technology company reported $3.91 EPS for the quarter, topping analysts' consensus estimates of $0.48 by $3.43. The business had revenue of $25.08 billion for the quarter, compared to analyst estimates of $26.61 billion. Vipshop had a net margin of 7.52% and a return on equity of 22.51%. The company's quarterly revenue was down 4.1% compared to the same quarter last year. During the same period last year, the company posted $0.51 earnings per share. As a group, analysts expect that Vipshop Holdings Limited will post 1.97 EPS for the current year.

Analysts Set New Price Targets

Several research firms have recently issued reports on VIPS. StockNews.com downgraded shares of Vipshop from a "buy" rating to a "hold" rating in a research note on Tuesday, November 12th. Citigroup upped their price objective on shares of Vipshop from $15.00 to $18.00 and gave the company a "buy" rating in a research note on Friday, September 27th. CLSA lowered shares of Vipshop from an "outperform" rating to a "hold" rating and reduced their price target for the company from $15.80 to $12.00 in a research report on Wednesday, August 21st. UBS Group downgraded shares of Vipshop from a "buy" rating to a "neutral" rating and reduced their target price for the company from $20.00 to $12.50 in a research report on Wednesday, August 21st. Finally, Barclays started coverage on Vipshop in a report on Wednesday, November 6th. They set an "overweight" rating and a $19.00 price objective for the company. Six research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $17.64.

Read Our Latest Stock Analysis on Vipshop

Vipshop Company Profile

(

Free Report)

Vipshop Holdings Limited operates online platforms in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers womenswear, menswear, sportswear and sporting goods, shoes and bags, accessories, baby and children products, skincare and cosmetics, home goods and other lifestyle products, and supermarket products.

Read More

Before you consider Vipshop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vipshop wasn't on the list.

While Vipshop currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.