Lisanti Capital Growth LLC decreased its holdings in Sweetgreen, Inc. (NYSE:SG - Free Report) by 32.2% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 100,205 shares of the company's stock after selling 47,595 shares during the quarter. Lisanti Capital Growth LLC owned approximately 0.09% of Sweetgreen worth $3,552,000 as of its most recent SEC filing.

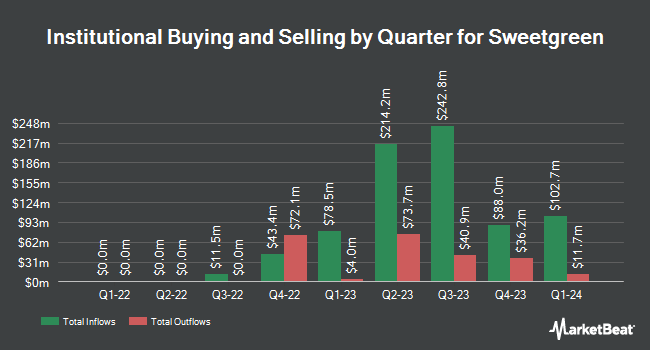

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Driehaus Capital Management LLC lifted its position in Sweetgreen by 231.8% in the 2nd quarter. Driehaus Capital Management LLC now owns 2,688,403 shares of the company's stock valued at $81,028,000 after acquiring an additional 1,878,216 shares in the last quarter. Hood River Capital Management LLC bought a new position in shares of Sweetgreen during the first quarter worth approximately $29,105,000. Allspring Global Investments Holdings LLC bought a new stake in shares of Sweetgreen during the 2nd quarter valued at $33,449,000. Renaissance Technologies LLC bought a new stake in shares of Sweetgreen during the 2nd quarter worth $29,109,000. Finally, Baillie Gifford & Co. lifted its stake in shares of Sweetgreen by 6.2% in the 2nd quarter. Baillie Gifford & Co. now owns 12,326,336 shares of the company's stock valued at $371,516,000 after acquiring an additional 721,740 shares during the last quarter. Institutional investors and hedge funds own 95.75% of the company's stock.

Insider Transactions at Sweetgreen

In related news, insider Adrienne Gemperle sold 3,868 shares of Sweetgreen stock in a transaction on Friday, August 16th. The shares were sold at an average price of $36.31, for a total transaction of $140,447.08. Following the sale, the insider now owns 114,842 shares of the company's stock, valued at $4,169,913.02. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. In other Sweetgreen news, insider Adrienne Gemperle sold 3,868 shares of the business's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $36.31, for a total value of $140,447.08. Following the sale, the insider now directly owns 114,842 shares in the company, valued at approximately $4,169,913.02. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Nicolas Jammet sold 16,751 shares of Sweetgreen stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $40.04, for a total transaction of $670,710.04. Following the transaction, the insider now owns 1,930,233 shares in the company, valued at approximately $77,286,529.32. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 466,022 shares of company stock worth $16,671,481 in the last three months. 21.52% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

SG has been the topic of several research analyst reports. Oppenheimer increased their target price on shares of Sweetgreen from $40.00 to $45.00 and gave the stock an "outperform" rating in a research note on Friday. UBS Group upped their price target on Sweetgreen from $37.00 to $45.00 and gave the company a "buy" rating in a research report on Friday. Morgan Stanley boosted their price target on shares of Sweetgreen from $25.00 to $27.00 and gave the stock an "equal weight" rating in a research note on Friday, August 9th. Bank of America raised their price target on Sweetgreen from $39.00 to $43.00 and gave the stock a "buy" rating in a research report on Monday, August 19th. Finally, TD Cowen lifted their price target on Sweetgreen from $43.00 to $45.00 and gave the company a "buy" rating in a research report on Friday. Four research analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $39.80.

Get Our Latest Stock Analysis on SG

Sweetgreen Trading Down 0.8 %

Shares of NYSE SG traded down $0.31 during mid-day trading on Monday, reaching $39.38. The company had a trading volume of 3,269,594 shares, compared to its average volume of 2,873,613. Sweetgreen, Inc. has a 52-week low of $8.83 and a 52-week high of $42.77. The firm has a 50 day simple moving average of $35.59 and a two-hundred day simple moving average of $31.47. The stock has a market cap of $4.49 billion, a P/E ratio of -52.51 and a beta of 2.32.

Sweetgreen (NYSE:SG - Get Free Report) last issued its earnings results on Thursday, August 8th. The company reported ($0.13) earnings per share for the quarter, missing the consensus estimate of ($0.11) by ($0.02). Sweetgreen had a negative return on equity of 18.71% and a negative net margin of 13.27%. The company had revenue of $184.60 million for the quarter, compared to analyst estimates of $180.79 million. The company's quarterly revenue was up 21.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted ($0.20) earnings per share. On average, equities analysts expect that Sweetgreen, Inc. will post -0.75 EPS for the current year.

Sweetgreen Company Profile

(

Free Report)

Sweetgreen, Inc, together with its subsidiaries, operates fast food restaurants serving healthy foods at scale in the United States. The company also accepts orders through its online and mobile ordering platforms, as well as sells gift cards that do not have an expiration date and can be redeemed. The company was founded in 2006 and is headquartered in Los Angeles, California.

Further Reading

Before you consider Sweetgreen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sweetgreen wasn't on the list.

While Sweetgreen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.