Lisanti Capital Growth LLC trimmed its position in Commvault Systems, Inc. (NASDAQ:CVLT - Free Report) by 21.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 47,480 shares of the software maker's stock after selling 13,235 shares during the period. Commvault Systems makes up approximately 1.8% of Lisanti Capital Growth LLC's portfolio, making the stock its 7th biggest position. Lisanti Capital Growth LLC owned approximately 0.11% of Commvault Systems worth $7,305,000 at the end of the most recent reporting period.

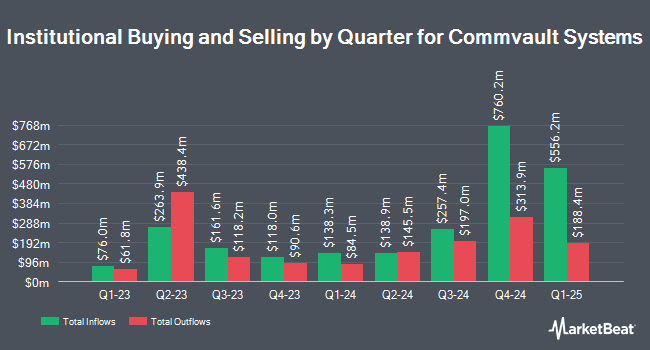

A number of other institutional investors have also added to or reduced their stakes in the company. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Commvault Systems by 7.8% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 21,379 shares of the software maker's stock valued at $2,168,000 after purchasing an additional 1,540 shares in the last quarter. Daiwa Securities Group Inc. lifted its position in shares of Commvault Systems by 700.0% during the 1st quarter. Daiwa Securities Group Inc. now owns 800 shares of the software maker's stock worth $81,000 after buying an additional 700 shares in the last quarter. Texas Permanent School Fund Corp boosted its stake in shares of Commvault Systems by 1.0% in the 1st quarter. Texas Permanent School Fund Corp now owns 38,213 shares of the software maker's stock worth $3,876,000 after buying an additional 383 shares during the last quarter. Swiss National Bank increased its position in shares of Commvault Systems by 5.1% during the first quarter. Swiss National Bank now owns 86,400 shares of the software maker's stock valued at $8,764,000 after acquiring an additional 4,200 shares during the last quarter. Finally, Sei Investments Co. boosted its position in Commvault Systems by 0.4% in the first quarter. Sei Investments Co. now owns 89,427 shares of the software maker's stock worth $9,071,000 after purchasing an additional 323 shares during the last quarter. 93.50% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several brokerages have issued reports on CVLT. Royal Bank of Canada boosted their target price on Commvault Systems from $164.00 to $182.00 and gave the company a "sector perform" rating in a research note on Wednesday, October 30th. KeyCorp lifted their price target on Commvault Systems from $140.00 to $170.00 and gave the company an "overweight" rating in a research report on Wednesday, July 31st. Guggenheim downgraded Commvault Systems from a "buy" rating to a "neutral" rating in a research note on Tuesday, October 15th. DA Davidson raised their price objective on shares of Commvault Systems from $170.00 to $175.00 and gave the company a "buy" rating in a research report on Friday, September 6th. Finally, StockNews.com lowered shares of Commvault Systems from a "strong-buy" rating to a "buy" rating in a report on Friday, November 1st. Four investment analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $144.29.

Read Our Latest Analysis on CVLT

Insider Buying and Selling

In other Commvault Systems news, insider Gary Merrill sold 17,388 shares of the business's stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $150.76, for a total transaction of $2,621,414.88. Following the completion of the sale, the insider now directly owns 94,530 shares in the company, valued at approximately $14,251,342.80. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, insider Gary Merrill sold 17,388 shares of the business's stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $150.76, for a total value of $2,621,414.88. Following the transaction, the insider now owns 94,530 shares of the company's stock, valued at approximately $14,251,342.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Allison Pickens sold 1,232 shares of the business's stock in a transaction on Friday, August 30th. The stock was sold at an average price of $153.89, for a total transaction of $189,592.48. Following the completion of the sale, the director now owns 7,131 shares in the company, valued at $1,097,389.59. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 1.00% of the stock is currently owned by corporate insiders.

Commvault Systems Stock Performance

Shares of NASDAQ CVLT traded up $1.38 during trading hours on Monday, hitting $172.95. The company's stock had a trading volume of 263,693 shares, compared to its average volume of 356,150. The stock has a market cap of $7.56 billion, a price-to-earnings ratio of 43.69 and a beta of 0.59. Commvault Systems, Inc. has a 12 month low of $68.02 and a 12 month high of $173.80. The business has a 50-day simple moving average of $151.33 and a 200-day simple moving average of $133.56.

Commvault Systems (NASDAQ:CVLT - Get Free Report) last released its earnings results on Tuesday, October 29th. The software maker reported $0.83 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.76 by $0.07. Commvault Systems had a net margin of 19.75% and a return on equity of 31.62%. The firm had revenue of $233.28 million during the quarter, compared to analyst estimates of $220.76 million. The business's revenue was up 16.1% on a year-over-year basis. During the same period last year, the business earned $0.30 earnings per share. On average, equities research analysts forecast that Commvault Systems, Inc. will post 1.65 EPS for the current year.

About Commvault Systems

(

Free Report)

Commvault Systems, Inc provides data protection platform that helps customers to secure, defend, and recover their data in the United States and internationally. The company offers Commvault Backup and Recovery, a backup and recovery solution; Commvault Disaster Recovery, a replication and disaster recovery solution; Commvault Complete Data Protection, a data protection solution; and Metallic Data Protection as-a-service, which delivers enterprise-grade data protection as a service on a cloud platform, with advanced built-in security controls.

See Also

Before you consider Commvault Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commvault Systems wasn't on the list.

While Commvault Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.